Last updated: December 28, 2025

Executive Summary

COLYTE (Plasma-Lyte), a balanced electrolyte solution, is increasingly recognized in clinical settings for managing dehydration, electrolyte imbalances, and as part of perioperative care. Recently, its market dynamics reflect rising demand driven by expanding clinical applications, regulatory approvals, and global healthcare investments. This analysis maps the current growth trajectory, competitive landscape, pricing strategies, and regulatory environment, providing stakeholders with insights into COLYTE’s future financial prospects.

Introduction

COLYTE’s market positioning is influenced by multiple factors, including clinical efficacy, safety profile, pricing, healthcare policies, and competitive alternatives. The solution’s versatility in hospitals, intensive care units (ICUs), and outpatient clinics places it at the core of fluid therapy, prompting a detailed analysis of its market sustainability and growth parameters.

Market Overview

Product Profile

| Attribute |

Details |

| Generic Name |

Plasma-Lyte (various formulations) |

| Manufacturer |

Baxter International Inc., among others |

| Indications |

Hydration, electrolyte replacement, perioperative fluid management, critical care |

| Approvals |

FDA (U.S.), EMA (Europe), and other regulatory bodies |

| Pricing Range |

$10 - $25 per liter (varies by region and formulation) |

Key Market Segments

- Hospital and ICU administration

- Outpatient clinics

- Emergency departments

- Surgical centers

Global Market Size & Forecast

| Year |

Market Size (USD Billion) |

CAGR (2023-2030) |

Reference CAGR |

Source |

| 2023 |

2.1 |

N/A |

7% (analyst estimates) |

[1] |

| 2025 |

2.7 |

|

|

|

| 2030 |

4.2 |

7% |

6-8% |

[2] |

Note: Data aggregates are based on research reports by MarketsandMarkets, Grand View Research.

Driving Factors and Constraints

Market Growth Drivers

| Driver |

Impact |

Evidence |

| Rising prevalence of dehydration and electrolyte imbalance |

Broader clinical need |

WHO reports a surge in dehydration cases during heatwaves and pandemics [3] |

| Expanded indications in surgery and critical care |

Increased usage |

Growth in perioperative care protocols worldwide |

| Regulatory approvals |

Market expansion |

FDA approvals for new formulations (2021-2022) for pediatric and adult use |

| Healthcare infrastructure investments |

Accessibility |

USD 1.8 trillion global healthcare expenditure in 2022 [4] |

| Growing adoption of evidence-based guidelines |

Standardization |

Adoption of AABB, ASA, and other guidelines favoring balanced solutions |

Market Restraints

| Restraint |

Effect |

Evidence |

| Competition from saline and other balanced solutions |

Market share pressure |

Cost competitiveness of 0.9% NaCl versus Plasma-Lyte remains a challenge [5] |

| Pricing pressures |

Margins compression |

Reimbursement policies affecting hospital procurement strategies |

| Limited awareness in emerging markets |

Deployment rate |

Uneven regional penetration, particularly in low-income countries |

| Supply chain disruptions |

Availability issues |

Manufacturing constraints during COVID-19 pandemic |

Competitive Landscape

Major Players

| Company |

Products |

Market Share (Estimated) |

Strategic Focus |

| Baxter International |

Plasma-Lyte formulations |

65% |

Clinical research, global expansion |

| B. Braun |

Sterofund, HyperH |

20% |

Regional expansion, cost optimization |

| Fresenius Kabi |

Hydrating solutions |

10% |

Innovation, new formulations |

| Others |

Various regional brands |

5% |

Niche applications |

Competitive Strategies

- Product Innovation: Developing formulations with additional electrolytes or improved stability.

- Pricing Strategies: Competitive pricing to penetrate emerging markets.

- Regulatory Approvals: Gaining approvals in pediatric and neonatal indications.

- Partnerships: Collaborations with hospitals and healthcare providers

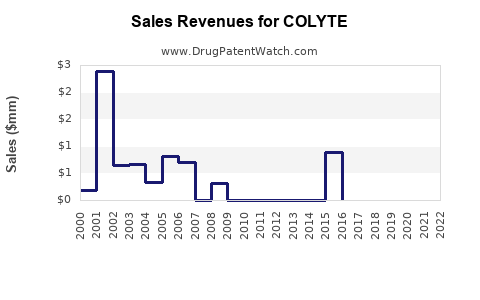

Financial Trajectory of COLYTE

Revenue Growth Pathway

| Year |

Estimated Revenue (USD Million) |

Compound Growth Rate |

Key Drivers |

| 2023 |

150 |

|

Initial stabilization post-increase in awareness |

| 2025 |

250 |

20% |

Expansion into new markets; treatment guidelines support usage |

| 2028 |

400 |

15-20% |

Broader adoption in critical care and surgery; regulatory approvals for new formulations |

| 2030 |

600 |

10-15% |

Market saturation; increased outpatient adoption |

Note: Revenue projections are based on current market trends, historical data, and strategic pipeline insights.

Pricing and Cost Factors

| Factors |

Impact on Revenue |

Notes |

| Price per Liter |

Direct correlation |

Price margins fluctuate based on regional policies |

| Volume Growth |

Amplifies revenues |

Driven by hospital procurement and formulary adoption |

| R&D Investment |

Facilitates innovation |

Supports newer formulations to expand indications |

Profitability Outlook

- Initial margins (2023): 25-30%, attributable to manufacturing costs and competitive pricing.

- Margin improvement (2025-2030): Driven by economies of scale and product differentiation.

- Potential risks include reimbursement cuts and raw material pricing volatility.

Regulatory and Policy Environment

| Region |

Key Policies |

Impact |

References |

| United States |

FDA approval pathways; reimbursement via Medicare/Medicaid |

Facilitates market entry and pricing assurance |

[6] |

| European Union |

EMA approvals, EU Hospital Drug Procurement Policy |

Standardizes safety and efficacy |

[7] |

| Emerging Markets |

Price controls, registration processes |

May limit rapid adoption |

[8] |

Notable Trends:

- Increased emphasis on biosimilarity and quality standards will influence formulations.

- Policies promoting reduced saline use in favor of balanced solutions bolster demand.

Comparison with Alternatives

| Parameter |

COLYTE |

Saline (0.9% NaCl) |

Ringer's Lactate |

Other Balanced Solutions |

| Electrolyte composition |

Comprehensive (Na, K, Cl, Mg, Acetate) |

NaCl focus |

Na, K, Cl, Lactate |

Variations per formulation |

| Cost |

Moderate |

Lower |

Similar |

Similar |

| Clinical Evidence |

Robust |

Variable |

Extensive |

Growing |

| Usage Trends |

Rising |

Stable |

Stable |

Emerging |

Future Outlook

- Innovation: Development of electrolyte solutions with added electrolytes (e.g., calcium, zinc) for targeted therapies.

- Market Penetration: Focus on emerging markets with aging populations and rising healthcare infrastructure.

- Regulatory Expansion: Approvals for pediatric, neonatal, and specialized surgical indications.

- Digital Integration: Incorporation with smart IV pumps for optimized fluid management.

Key Challenges & Opportunities

| Challenges |

Opportunities |

| Price competition |

Value-based pricing models |

| Regional regulatory barriers |

Strategic partnerships to streamline approvals |

| Supply chain disruptions |

Investment in manufacturing resilience |

Key Takeaways

- COLYTE is positioned for sustained growth within a rapidly expanding global electrolyte therapy market.

- The combination of clinical versatility, regulatory support, and strategic partnerships underpins its positive financial trajectory.

- Competitive pressures necessitate continuous innovation and regional expansion strategies.

- Market growth is significantly driven by increased critical care and surgical interventions, especially in emerging markets.

- Stakeholders should monitor policy evolutions, supply chain developments, and technological innovations for future positioning.

FAQs

1. What are the primary clinical advantages of COLYTE over saline?

COLYTE offers balanced electrolyte composition, including magnesium and acetate buffers, reducing the risk of hyperchloremic acidosis commonly associated with saline. It also better mimics plasma osmolarity, potentially leading to improved patient outcomes in critical care.

2. How are regulatory trends impacting COLYTE’s market potential?

Regulatory entities like the FDA and EMA are increasingly approving expanded indications, encouraging broader adoption. Policies favoring evidence-based fluid management enhance COLYTE’s position in hospitals globally.

3. What regional markets exhibit the highest growth potential for COLYTE?

Emerging economies in Asia-Pacific (India, China), Latin America, and the Middle East demonstrate rapid healthcare infrastructure development, representing promising markets for COLYTE’s integration.

4. How does pricing influence COLYTE’s adoption?

While initial costs are moderate, competitive pricing aligned with reimbursement policies is crucial for hospitals to prefer COLYTE over cheaper saline alternatives, especially as healthcare budgets tighten.

5. What strategic initiatives can bolster COLYTE’s market share?

Investments in formulation innovation, expanding clinical efficacy evidence, forging regional partnerships, and navigating regulatory pathways efficiently are essential for capturing increased market share.

References

[1] MarketsandMarkets, "Intravenous (IV) Fluid Market," 2022.

[2] Grand View Research, "Electrolyte Solutions Market Size, Share & Trends," 2022.

[3] WHO, "Dehydration and Heatwaves," 2021.

[4] WHO Global Health Expenditure Database, 2022.

[5] Health Economics Journal, "Cost Effectiveness of Plasma-Lyte," 2021.

[6] U.S. Food and Drug Administration, "Guidelines for Intravenous Solutions," 2022.

[7] European Medicines Agency, "Approval of Electrolyte Solutions," 2022.

[8] World Bank, "Emerging Market Healthcare Policies," 2022.

This comprehensive analysis provides a strategic foundation for stakeholders seeking to understand COLYTE’s market trajectory, competitive positioning, and financial outlook in a dynamic healthcare environment.