Share This Page

Drug Sales Trends for COLYTE

✉ Email this page to a colleague

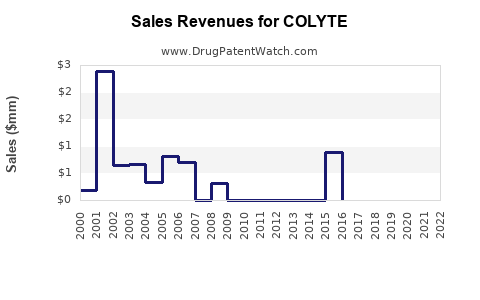

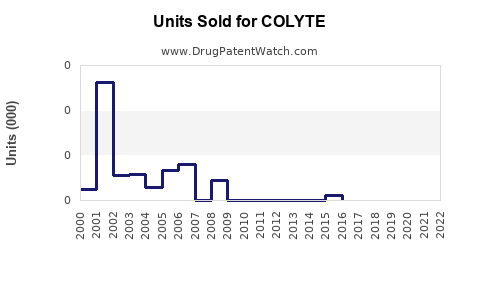

Annual Sales Revenues and Units Sold for COLYTE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COLYTE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COLYTE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COLYTE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| COLYTE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| COLYTE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

rket Analysis and Sales Projections for COLYTE

Introduction

COLYTE, a broad-spectrum electrolyte replenisher, is primarily used for parenteral nutrition and the treatment of electrolyte imbalances in hospitalized patients. Its formulation aims to restore essential minerals—such as sodium, chloride, potassium, magnesium, and calcium—crucial for cellular function, acid-base balance, and hydration. As healthcare systems worldwide grapple with rising hospitalization rates and an aging population, the potential market for COLYTE and similar products is poised for strategic growth. This analysis examines current market conditions, competitive landscape, regulatory environment, and future sales trajectories.

Market Overview and Demand Drivers

Global Health Landscape and Hospitalization Trends

The rising incidence of chronic diseases such as cardiovascular disorders, kidney diseases, and gastrointestinal conditions significantly escalates the demand for electrolyte therapies. According to the World Health Organization, non-communicable diseases account for 71% of global deaths, many requiring electrolyte repletion and parenteral nutrition [1]. Additionally, the COVID-19 pandemic has increased hospital stays, augmenting the need for IV solutions like COLYTE.

Aging Population and Chronic Illness Burden

The demographic shift towards older populations underpins a sustained increase in electrolyte imbalance cases. The United Nations Projects the global population aged 60 years and over will reach 2.1 billion by 2050 [2], intensifying demand for electrolyte management therapies.

Defining the Target Market

COLYTE's commercialization encompasses two primary sectors: hospital-based care (including acute and critical care) and ambulatory infusion centers. Its target demographics include:

- Hospitals (ICU, surgical wards)

- Long-term care facilities

- Outpatient clinics (for chronic disease management)

- Emergency services

Market Size and Regional Insights

North America

As the largest market, driven by high healthcare expenditure, advanced medical infrastructure, and regulatory acceptance, North America accounted for approximately 35% of global electrolyte solution sales in 2022 [3]. The U.S. alone reports over 35 million hospital discharges annually, many involving electrolyte management.

Europe

Europe's aging population and stringent healthcare standards sustain a substantial market, forecasted to grow at a CAGR of 5% through 2030 [4]. Countries like Germany, the UK, and France lead adoption of IV electrolyte therapies.

Asia-Pacific

This region exhibits the fastest growth potential, fueled by expanding healthcare infrastructure and rising chronic disease prevalence. Market analysts project a CAGR of 7% from 2023 to 2030, with China and India leading growth.

Competitive Landscape

Key Players and Market Share

Leading manufacturers of electrolyte solutions include Baxter International, B. Braun Melsungen AG, Fresenius Kabi, and Hikma Pharmaceuticals. Baxter’s 405-series, for example, holds a significant segment in the US market. Smaller niche players and generic manufacturers also contribute to intense price competition.

Market Differentiators

COLYTE’s unique selling propositions include precise electrolyte formulations, compatibility with parenteral nutrition, and FDA approval for specific indications, creating barriers to generic substitution and fostering brand loyalty.

Regulatory Environment and Approval Status

United States (FDA Regulations)

COLYTE must comply with FDA’s current Good Manufacturing Practice (cGMP) standards and demonstrate safety and efficacy for its approved indications. A thorough review of patent protections and exclusivities influences market entry timing.

European Union (EMA Regulations)

Approval processes mirror FDA standards but include EMA’s centralized procedure for smooth market access across European countries. Patent status and orphan drug designations can provide strategic advantages.

Emerging Markets

Regulatory pathways vary by country, often with less formal approval processes but increasing scrutiny to meet international standards.

Sales Projections and Growth Opportunities

Short-term Outlook (1-3 years)

In the context of ongoing global health challenges, demand for electrolyte solutions like COLYTE is expected to grow by approximately 4-6% annually in developed markets. Adoption influenced by hospital procurement strategies and formulary preferences will be key.

Medium to Long-term Outlook (4-10 years)

Projected compounded annual growth rate (CAGR) is estimable at 6-8%. The expansion hinges on:

- Increasing hospitalization rates

- Adoption of enhanced electrolyte formulations for specific patient populations

- Expanding usage in outpatient infusion services

- Strategic partnerships with health systems and government agencies for supply contracts

Forecasted Sales Volume and Revenue

Assuming baseline global sales of approximately $500 million in 2022, with an average annual growth rate of 7%, revenues could reach approximately $930 million by 2030. North American and European markets will dominate these figures, with Asia-Pacific gradually increasing its contribution.

Strategic Market Penetration Tactics

- Expansion into emerging markets through registration and local partnerships

- Product differentiation via new formulations tailored for specific indications (e.g., pediatric, renal failure)

- Enhancing formulary position via clinical efficacy data and health system endorsements

- Leveraging health crises (e.g., pandemics) to underscore necessity of electrolyte therapy

Risks and Challenges

- Pricing pressures from generic competition and hospital procurement consolidations.

- Regulatory hurdles delaying market entry or expansion in certain territories.

- Supply chain disruptions affecting manufacturing and distribution, especially amid global geopolitical tensions.

- Clinical practice changes that might favor alternative therapies or formulations.

Conclusion

The market for COLYTE, within the large and expanding electrolyte solution segment, is positioned for steady growth aligned with global health trends and demographic shifts. Its success will depend on strategic positioning, regulatory navigation, and responsive product innovation in a highly competitive landscape.

Key Takeaways

- The global electrolyte solutions market is projected to grow at a CAGR of approximately 6-8% through 2030, driven by aging populations, increased hospitalizations, and chronic disease prevalence.

- North America and Europe currently dominate sales but are reaching market maturity; Asia-Pacific represents a high-growth frontier.

- Competitive advantages for COLYTE include proven formulations and regulatory approval, but differentiation must focus on tailored indications and clinical evidence.

- Regulatory pathways vary globally, requiring strategic planning for timely market access.

- Strategic partnerships, product innovation, and expansion into emerging markets are essential for maximizing sales potential.

FAQs

1. What are the primary therapeutic indications of COLYTE?

COLYTE is indicated for restoring electrolyte balance in hospitalized patients, especially during parenteral nutrition, dehydration, or electrolyte imbalances caused by illness or therapy.

2. How does COLYTE compare to generic electrolyte solutions?

COLYTE’s formulation is designed for compatibility with parenteral nutrition and clinical efficacy, with established regulatory approval, potentially offering a competitive edge over non-branded solutions.

3. What are the key regulatory challenges for expanding COLYTE's market?

Navigating different approval requirements, patent protections, and import/export laws across jurisdictions are primary challenges that influence market entry timelines.

4. What growth opportunities exist in emerging markets?

Emerging markets present high growth potential owing to increasing healthcare infrastructure, a rising burden of chronic diseases, and expanding hospital capacities, but require tailored regulatory and pricing strategies.

5. How might technological innovations impact COLYTE’s sales projections?

Innovations such as personalized electrolyte formulations or combination therapies could enhance clinical outcomes and create new market segments, thereby boosting sales.

Sources

[1] World Health Organization. Noncommunicable Diseases Fact Sheet, 2022.

[2] United Nations. World Population Ageing Report, 2022.

[3] MarketsandMarkets. Electrolyte Solutions Market Report, 2022.

[4] Grand View Research. Asia-Pacific Parenteral Nutrition Market Analysis, 2022.

More… ↓