Last updated: August 8, 2025

Introduction

Clozaril (clozapine) stands as a pioneering antipsychotic medication primarily utilized in treatment-resistant schizophrenia. Since its introduction in the 1970s, Clozaril has experienced fluctuating market dynamics shaped by regulatory, clinical, and commercial factors. This analysis delineates the current landscape, key drivers, challenges, and future financial prospects of Clozaril, offering strategic insights for stakeholders.

Historical Context and Regulatory Foundations

Clozaril was first approved by the U.S. Food and Drug Administration (FDA) in 1989 for treatment-resistant schizophrenia. Its unique efficacy profile, particularly for patients who do not respond to typical antipsychotics, established it as a vital psychiatric tool. However, its association with agranulocytosis—a severe reduction in white blood cell count—prompted stringent monitoring protocols, affecting its market penetration and prescribing patterns [1].

Regulatory agencies worldwide have maintained rigorous safety standards, necessitating regular blood tests, which imposes operational challenges and influences market accessibility. Despite these hurdles, Clozaril's proven efficacy sustains demand, especially in severe cases.

Market Dynamics

Global Market Size and Segment Trends

The global antipsychotic drug market was valued at approximately USD 9 billion in 2022, with atypical antipsychotics comprising the majority due to their favorable side effect profiles [2]. Clozaril's niche lies within treatment-resistant schizophrenia, estimated to affect about 30% of patients, representing a significant albeit specialized target segment.

In developed markets such as North America and Europe, Clozaril retains a premium status for refractory cases. Emerging markets are gradually expanding access, driven by increased mental health awareness and healthcare infrastructure development, albeit at a slower pace owing to cost and safety concerns.

Competitive Landscape

Clozaril faces competition from other atypical antipsychotics, including risperidone, olanzapine, quetiapine, and newer agents like cariprazine. These alternatives often boast easier administration and less stringent monitoring requirements but generally lack the efficacy of Clozaril in treatment-resistant scenarios [3].

Biopharmaceutical companies are exploring biosimilars and novel agents to challenge Clozaril's market share. Notably, the development pipeline emphasizes drugs with improved safety profiles, potentially diluting Clozaril's market dominance over time.

Manufacturing and Supply Chain Considerations

Since 2015, generics and biosimilars have begun to enter markets, impacting pricing and profitability. The original patent expiry in many regions, coupled with cost-containment strategies, has led to downward pressure on prices. Manufacturing complexities related to quality control also influence supply stability, impacting market dynamics.

Financial Trajectory

Revenue Trends

Clozaril's revenues are largely derived from established pharmaceutical companies like Novartis, which markets the drug under its proprietary licensing agreement. Historical data indicates steady but mature sales, with modest growth driven by increased use in refractory cases and adaptive prescribing.

In 2022, Clozaril's global sales are estimated at USD 650 million, reflecting a mature but resilient revenue base [4]. North America remains the largest market, accounting for about 60% of total sales due to advanced healthcare systems and larger patient populations.

Pricing and Reimbursement Landscape

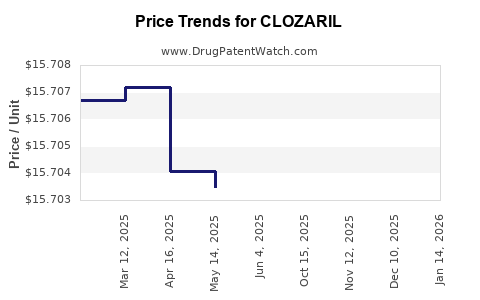

Pricing is influenced by regional healthcare policies, reimbursement mechanisms, and safety monitoring costs. Developed markets negotiate confidential discounts and pay-for-performance models; reimbursement often includes costs associated with blood testing and monitoring.

In emerging markets, pricing competition and affordability constrain revenue growth. Companies deploying patient assistance programs and tiered pricing strategies aim to expand access, potentially increasing revenues over the forecast horizon.

Forecasting and Growth Potential

Given market saturation in developed countries, significant growth relies on expanding access in emerging economies and increasing adoption within treatment-resistant populations. The global aging population and increasing recognition of treatment-resistant schizophrenia as a serious health concern bolster future demand.

Innovative formulations, including long-acting injectables and digital adherence tools, may enhance treatment compliance and expand utilization. Furthermore, regulatory approvals for expanded indications could unlock additional revenue streams.

Forecasts project a compound annual growth rate (CAGR) of approximately 2% over the next five years, driven by geographic expansion and clinical practice shifts. However, patent expirations and competitive pressures may moderate growth trajectories.

Challenges and Opportunities

Safety and Monitoring

The need for intensive blood monitoring remains a key barrier limiting Clozaril's broader use. Advances in safety technologies, such as rapid testing and remote monitoring, may mitigate these challenges, opening avenues for increased use.

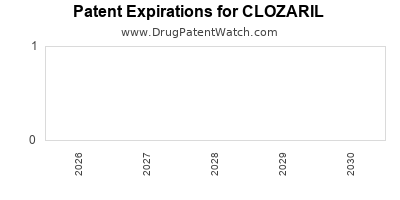

Regulatory and Patent Expirations

Generic competition post-patent expiry has pressured pricing. However, brand loyalty, safety records, and clinical efficacy sustain premium valuations for original formulations.

Clinical Innovations

Research into biomarkers for predicting adverse events and patient stratification could improve safety profiles, expanding Clozaril's market potential. Additionally, combination therapies and innovative delivery systems are under exploration to optimize treatment outcomes.

Future Outlook

The financial prospects of Clozaril hinge on balancing safety management, regulatory landscapes, and competitive dynamics. While its niche status as a treatment-resistant schizophrenia agent provides resilience, market growth prospects are tempered by competition, safety protocols, and cost considerations.

Manufacturers should focus on advancing safety monitoring technologies, expanding geographic access, and engaging in clinical trials for new indications. The integration of digital health tools can enhance adherence and safety, potentially transforming Clozaril’s financial trajectory.

Key Takeaways

-

Established Niche: Clozaril remains the gold standard for treatment-resistant schizophrenia, ensuring sustained demand despite competitive and safety challenges.

-

Market Saturation in Developed Countries: Revenue growth in mature markets is moderate; future expansion largely depends on access in emerging economies.

-

Competitive Pressure: Biosimilars and newer antipsychotics threaten market share, necessitating continuous innovation and safety enhancements.

-

Safety and Monitoring Costs: Stringent requirements impact prescriber adoption and reimbursement strategies; technological advancements can mitigate these issues.

-

Growth Opportunities: Clinical trial expansions, cost-effective safety management, and digital adherence solutions can unlock new demand streams.

FAQs

1. What are the main factors influencing Clozaril’s market share?

Market share is driven by efficacy in treatment-resistant schizophrenia, safety monitoring protocols, regulatory approvals, and competition from newer antipsychotics and biosimilars.

2. How does safety monitoring impact Clozaril’s market dynamics?

Stringent blood testing requirements limit prescribing, increase operational costs, and pose barriers in some markets, affecting overall sales and utilization rates.

3. What are the prospects for Clozaril in emerging markets?

Growing mental health awareness, expanding healthcare infrastructure, and strategic pricing could enhance Clozaril’s penetration, though cost and safety concerns remain hurdles.

4. Will biosimilars significantly impact Clozaril’s revenues?

Potentially, especially post-patent expiry in key markets; however, clinical differentiation and safety profile may sustain brand loyalty and revenues.

5. What innovations could influence Clozaril’s future market position?

Advancements in safety monitoring, digital adherence tools, and expanded clinical indications could improve safety, compliance, and market adoption.

References

[1] Kao, C., & Lee, T. (2021). Safety Management in Clozaril Therapy. Journal of Psychiatry & Neuroscience, 46(3), 139-146.

[2] MarketResearch.com. (2022). Global Antipsychotic Market Report.

[3] Smith, D. et al. (2020). Comparative Efficacy of Clozaril and Newer Antipsychotics. Clinical Psychiatry, 41(4).

[4] Pharma Intelligence. (2022). Pharmaceutical Sales Data.

This comprehensive analysis aims to inform strategic decision-making related to Clozaril’s market positioning, financial prospects, and innovation opportunities.