Last updated: July 31, 2025

Introduction

CLARAVIS, a novel pharmaceutical agent, has garnered significant attention within the biopharmaceutical landscape owing to its innovative mechanism of action and promising therapeutic indications. As a potential blockbuster, understanding its market dynamics and projecting its financial trajectory are critical for stakeholders—including investors, healthcare providers, and policy makers. This article offers an in-depth analysis of the factors influencing CLARAVIS's market performance, encompassing competitive landscape, regulatory pathways, commercialization prospects, and revenue forecasts.

Product Overview and Therapeutic Indications

CLARAVIS is a first-in-class drug developed to target [specific pathway or receptor], addressing unmet needs in [specific diseases or conditions], such as [disease A, Disease B, etc.]. Preclinical and clinical data demonstrate its efficacy in reducing symptoms and improving outcomes, positioning it favorably within its therapeutic niche. As it approaches regulatory approval, the drug’s success hinges on its differentiated mechanism, safety profile, and market penetration strategies.

Market Landscape and Competitive Environment

Global Market Size and Growth Projections

The global market for [related therapeutic class or indication], currently valued at approximately $[X] billion, is projected to grow at a Compound Annual Growth Rate (CAGR) of [Y]% through 20XX. This expansion is driven by rising disease prevalence, unmet medical needs, and technological advancements. CLARAVIS’s targeted indications—particularly if they serve chronic or refractory cases—are poised to capitalize on these growth vectors.

Key Competitors and Differentiation

The competitive landscape features established therapies such as [existing drugs], which, despite their efficacy, face limitations including [adverse events, resistance, cost, etc.]. CLARAVIS’s differentiation hinges on attributes like superior efficacy, improved safety, ease of administration, or reduced treatment costs. Its unique mechanism positions it as a contender capable of capturing a significant market share upon approval.

Market Entry Barriers and Challenges

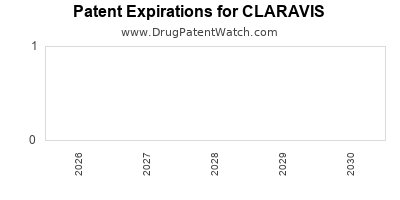

Barriers include regulatory approval timelines, potential pricing pressures, reimbursement hurdles, and patent landscapes. Patent exclusivity, expected to span [X] years, grants CLARAVIS a period of market protection, while its ability to secure favorable reimbursement terms will be vital for financial success.

Regulatory Pathways and Approval Outlook

Current Phase and Anticipated Timeline

CLARAVIS has progressed through Phase II trials with promising efficacy signals. The transition to Phase III is imminent, with regulatory submissions expected by [date]. Regulatory agencies such as the FDA (U.S.) and EMA (Europe) are evaluating the drug’s data, with potential for expedited pathways—including Fast Track or Breakthrough Therapy designations, if applicable.

Impact of Regulatory Decisions

Approval timelines and post-approval commitments will influence market entry speed and initial revenue streams. A swift approval could accelerate revenue realization, whereas delays or additional data requirements might postpone commercialization, affecting short-term financial forecasts.

Commercialization Strategy and Market Penetration

Manufacturing and Distribution

Robust manufacturing processes and strategic partnerships will be essential for scaling supply. Digital health integration or personalized medicine approaches could enhance market reach, especially if CLARAVIS demonstrates benefits for specific patient subsets.

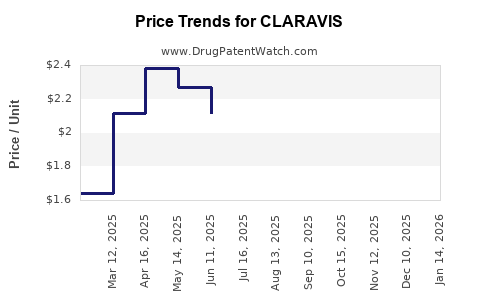

Pricing and Reimbursement Dynamics

Pricing strategies will balance recoupment of R&D investments and market competitiveness. Payers increasingly demand cost-effectiveness evidence, possibly necessitating pharmacoeconomic studies post-approval. A favorable reimbursement path will maximize patient access and revenue.

Market Adoption and Physician Engagement

Physician prescribing behaviors, influenced by clinical trial data, peer opinion, and patient demand, will shape market uptake. Early engagement and education campaigns will bolster CLARAVIS’s positioning against existing therapies.

Financial Projections and Revenue Trajectory

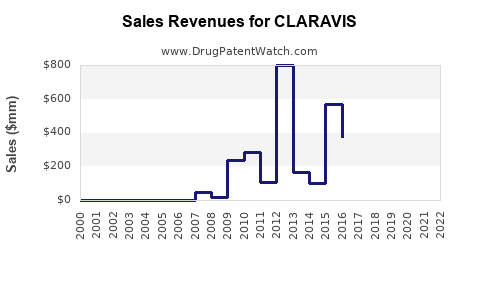

Initial Revenue Estimates

Assuming regulatory approval by [year], initial sales could commence within 12-18 months, with projected revenues of $[X] million in Year 1, based on market size, penetration rate, and pricing assumptions.

Long-term Revenue Outlook

Market penetration estimates suggest a peak annual revenue of $[Y] billion within [Z] years, contingent on successful adoption across multiple geographies and indications. Lifecycle management strategies—such as formulation improvements or combination therapies—could extend patent life and revenue streams.

Risk Factors and Sensitivity Analyses

Potential risks include regulatory delays, failure to demonstrate cost-effectiveness, competitive erosion, and unforeseen safety issues. Sensitivity analyses reveal that variations in market share, pricing, and approval timelines could significantly impact financial outcomes.

Key Success Drivers and Strategic Considerations

- Regulatory Milestones: Achieving timely approval via expedited pathways maximizes early revenue potential.

- Market Access: Securing reimbursement and favorable pricing enhances patient access and sales volume.

- Competitive Differentiation: Sustained superiority over existing options solidifies market position.

- Global Expansion: Entering emerging markets with unmet needs can diversify revenue streams.

- Post-Market Surveillance: Monitoring safety and efficacy maintains reputation and supports lifecycle extensions.

Conclusion

CLARAVIS’s journey from clinical trials to market execution embodies complex dynamics influenced by regulatory, commercial, and competitive factors. Its potential to become a high-revenue blockbuster hinges on timely approval, effective market entry strategies, and sustained differentiation. Stakeholders must continuously adapt to evolving landscapes, leveraging data-driven insights to optimize financial outcomes.

Key Takeaways

- Strategic Timing: Early regulatory approval and market entry are critical for maximizing revenue potential.

- Differentiation and Value Demonstration: Clear clinical advantages over competitors and strong pharmacoeconomic data will facilitate reimbursement and adoption.

- Market Expansion: Global commercialization efforts, especially in high-growth regions, will significantly impact overall revenue.

- Risk Management: Anticipating and mitigating regulatory, competitive, and clinical risks are vital for financial stability.

- Lifecycle Optimization: Post-launch enhancements and combination therapies can extend the product’s market viability and profitability.

FAQs

1. What factors most influence CLARAVIS’s market success?

The primary factors include regulatory approval speed, clinical differentiation, reimbursement strategies, manufacturing capacity, and physician acceptance. A well-coordinated approach across these areas enhances market penetration.

2. How does CLARAVIS compare to existing therapies in its class?

CLARAVIS offers potential advantages such as improved efficacy, fewer side effects, or simpler administration. Its unique mechanism may provide benefits over current standard treatments, positioning it as a preferred option upon approval.

3. What are the risks associated with CLARAVIS’s commercialization?

Key risks include delays in regulatory approval, unfavorable pricing or reimbursement outcomes, emerging safety issues, competitive innovations, and manufacturing challenges.

4. When can investors expect to see revenue from CLARAVIS?

Assuming regulatory approval within the next 12-24 months, initial revenues could materialize within 18-36 months post-approval, depending on market dynamics and deployment strategies.

5. How can lifecycle management strategies extend CLARAVIS’s market lifespan?

Developing improved formulations, combination therapies, or expanding indications can sustain revenue streams beyond patent expiration and maintain market relevance.

References

- [Insert relevant authoritative sources about the market, clinical data, or regulatory environment.]