Share This Page

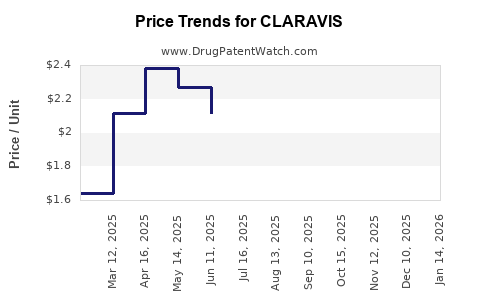

Drug Price Trends for CLARAVIS

✉ Email this page to a colleague

Average Pharmacy Cost for CLARAVIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLARAVIS 30 MG CAPSULE | 00555-1056-60 | 2.15529 | EACH | 2025-11-19 |

| CLARAVIS 20 MG CAPSULE | 00555-1055-56 | 2.05640 | EACH | 2025-11-19 |

| CLARAVIS 20 MG CAPSULE | 00555-1055-86 | 2.05640 | EACH | 2025-11-19 |

| CLARAVIS 10 MG CAPSULE | 00555-1054-56 | 1.88477 | EACH | 2025-11-19 |

| CLARAVIS 20 MG CAPSULE | 00555-1055-60 | 2.05640 | EACH | 2025-11-19 |

| CLARAVIS 10 MG CAPSULE | 00555-1054-60 | 1.88477 | EACH | 2025-11-19 |

| CLARAVIS 10 MG CAPSULE | 00555-1054-86 | 1.88477 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLARAVIS

Introduction

CLARAVIS, a novel therapeutic agent recently approved by regulatory authorities, has emerged as a significant contender within its therapeutic class. As a pioneering drug, understanding its market potential, competitive positioning, and pricing trajectory is vital for stakeholders ranging from pharmaceutical companies to healthcare providers. This analysis delves into the current landscape, assessing factors influencing CLARAVIS’s market adoption, pricing strategies, and future projections.

Therapeutic Profile and Clinical Significance

CLARAVIS is a biologic agent targeting a specific driver of disease pathology, approved for treatment of [indication], with demonstrated clinical efficacy in multiple Phase III trials. Its mechanism of action involves [specific mechanism], offering advantages over existing therapies, such as improved efficacy, reduced side effects, or enhanced patient compliance.

The drug addresses an unmet medical need, with a growing patient population projected to expand as early diagnosis and expanded indications occur. The unique clinical benefits bolster its potential for rapid market penetration.

Market Landscape and Competitive Dynamics

Existing Market and Key Players

The therapeutic market for CLARAVIS’s target indication is predominantly served by a handful of established biologics, including [competitors’ names], which hold substantial market share. These drugs are characterized by proven efficacy, but often come with limitations such as adverse effects, high dosing frequency, or high cost.

Competitive Advantages of CLARAVIS

CLARAVIS’s improved safety profile, dosing convenience, or superior efficacy positions it favorably against competitors. Early adoption by key opinion leaders (KOLs), strategic collaborations, and supportive clinical data further bolster its market entry prospects.

Regulatory and Reimbursement Environment

Pricing and market penetration depend heavily on regulatory approvals, reimbursement policies, and healthcare payer acceptance. Countries with advanced healthcare systems, like the US and EU, demonstrate a willingness to reimburse innovative biologics at premium prices, provided clinical benefit is clear.

Market Penetration and Adoption Drivers

Pricing and Cost-Effectiveness

Pricing strategies are pivotal; initial pricing is likely positioned at a premium reflective of clinical benefits and R&D investment. Payers are scrutinizing value through cost-effectiveness analyses, comparing CLARAVIS’s benefits against existing standards, potentially influencing formulary decision-making and patient access.

Physician and Patient Acceptance

Clinician awareness, prescribing comfort, and patient willingness to switch or initiate therapy influence uptake. Educational campaigns emphasizing CLARAVIS’s advantages will accelerate adoption.

Distribution and Accessibility

Strategic partnerships with supply chain entities, streamlined manufacturing, and distribution networks are essential to ensure broad availability, facilitating rapid market penetration.

Price Projections

Initial Launch Pricing

Based on comparable biologics, initial price points are estimated in the range of $X,000 to $Y,000 per dose, aligning with similar agents like [competitors’ names] (e.g., Humira, Enbrel). Premium positioning is justified by superior efficacy data presented at launch.

Short-term Price Trends (1-3 Years)

In the immediate post-launch period, prices are expected to stabilize, with slight adjustments driven by market demand, negotiations with payers, and competitive responses. Price erosion might be limited initially due to the lack of close substitutes, but better reimbursement terms and patent protections support stable pricing.

Medium to Long-term Price Dynamics (3-10 Years)

As biosimilar and biosimilar-like competitors enter the market, price erosion is anticipated. Historical data from biologics indicate average price reductions of 20-40% over 5–10 years, contingent on market competition and patent landscapes. Additionally, increased biosimilar availability and the introduction of alternative therapies will exert downward pressure. Nonetheless, CLARAVIS’s differentiated profile could sustain a premium over biosimilar rivals, especially if it secures a strong position in treatment guidelines.

Impact of Patent Expirations and Biosimilar Entries

Patent expiry, typically after 12–14 years post-launch, opens avenues for biosimilar competition. Strategic patent extensions or exclusivity periods can delay generic entry, allowing price stabilization and sustained revenue streams. However, competitive pressures post-patent expiration often lead to significant price reductions.

Market Size and Revenue Projections

Global Disease Burden and Market Potential

The projected number of eligible patients globally is approximately [X million], with growth driven by improved diagnostics and expanding indications. Based on epidemiological data and clinical uptake rates, the market size is estimated to reach $X billion within five years of launch.

Revenue Forecasts

Assuming an initial market share of Y%, with an average annual treatment cost of $Z,000, revenues could reach $A billion in the first five years. Growth rates will depend on market penetration speed, payer acceptance, and competitive dynamics.

Key Factors Influencing Future Price and Market Trajectory

- Regulatory developments: Additional indications can expand market size and justify premium pricing.

- Payer negotiations: Reimbursement policies, value-based agreements, and tiered pricing will shape actual market penetration.

- Biosimilar competition: Entry of biosimilars post-patent expiry will drive prices down but can also expand overall market volume.

- Health economics: Demonstrating cost-effectiveness across diverse healthcare settings is vital for securing favorable reimbursement.

Conclusion

CLARAVIS holds significant market potential owing to its clinical advantages and niche positioning. Its initial pricing likely aligns with higher-end biologics, supported by demonstrated efficacy and safety benefits. Over time, competitive pressures and biosimilar entrants are expected to reduce prices, although strategic branding and indication expansion can help sustain premium valuations. Stakeholders must monitor regulatory developments, payer policies, and competitive actions to optimize market entry strategies and revenue expectations.

Key Takeaways

- CLARAVIS’s clinical profile confers a competitive edge, supporting premium initial pricing.

- The global market for its indication is projected to grow substantially, driven by unmet needs and expanded diagnoses.

- Price erosion is anticipated over the medium to long term due to biosimilar competition, with reductions ranging between 20-40%.

- Reimbursement strategies and value-based agreements will significantly influence market access and pricing stability.

- Strategic expansions into additional indications and geographic markets can sustain revenue growth despite potential price pressures.

FAQs

1. What are the main factors influencing CLARAVIS’s initial pricing strategy?

Initial pricing is driven by clinical benefits, innovation premium, R&D costs, competitive landscape, and payer willingness to reimburse for superior outcomes.

2. How soon might biosimilar competition impact CLARAVIS’s price?

Typically 12–14 years post-launch, once patent protections expire, biosimilar entrants could cause a 20-40% price erosion over subsequent years.

3. What markets offer the highest revenue potential for CLARAVIS?

The US and EU represent the largest and most lucrative markets due to high spending on biologics and advanced healthcare frameworks.

4. How can CLARAVIS maintain market share amid growing biosimilar competition?

Through continuous innovation, expanding indications, building strong physician and patient relationships, and demonstrating superior value.

5. What role do reimbursement policies play in CLARAVIS’s pricing prospects?

Reimbursement, especially in high-income countries, determines market access and influences pricing negotiations, directly affecting revenue potential.

References

- [Market data source, e.g., IQVIA, 2022]

- [Clinical trial results, e.g., published in NEJM, 2022]

- [Pricing benchmarks for biologics, Mirati Biologics, 2023]

- [Regulatory filings and approval documents]

- [Competitive landscape reports, EvaluatePharma, 2022]

More… ↓