Last updated: October 27, 2025

Introduction

Cladribine, an immunomodulatory agent primarily indicated for multiple sclerosis (MS) and certain hematologic cancers, has carved a distinctive niche within the pharmaceutical landscape. Its unique mechanism—acting as a purine nucleoside analog—renders it effective against specific lymphoid malignancies and autoimmune diseases. This analysis examines the current market dynamics, growth drivers, competitive landscape, regulatory framework, and financial trajectory shaping Cladribine's commercial prospects.

Market Overview

Therapeutic Indications and Market Size

Initially developed for hairy cell leukemia (HCL), Cladribine’s scope expanded following its approval for multiple sclerosis. The European Medicines Agency (EMA) authorized the use of Mavenclad (Cladribine tablets) for relapsing-remitting MS (RRMS) and active secondary progressive MS (SPMS) in 2017, followed by approvals in multiple jurisdictions including the US (FDA approval in 2019). The global MS market is projected to reach $27.5 billion by 2028, growing at a CAGR of approximately 3.8% (source: Deloitte).

Concurrently, Cladribine retains relevance in oncology, particularly in the treatment of chronic lymphocytic leukemia (CLL) and hairy cell leukemia, although its oncology market has plateaued relative to MS due to competition and evolving standards of care.

Market Penetration and Adoption

In MS, Cladribine’s oral formulation offers significant advantages over injectable therapies, fostering greater patient adherence. Its ability to deliver rapid, sustained efficacy in reducing relapse rates has positioned it as an attractive option, especially for patients seeking simplified treatment regimens. However, the drug faces market challenges due to safety concerns, particularly regarding lymphopenia and infections, influencing physician prescribing patterns.

Market Dynamics Influencing Cladribine

1. Competitive Landscape

The MS therapeutic landscape is crowded, comprising biologics such as natalizumab, fingolimod, and ocrelizumab. Cladribine’s competitive edge hinges on its oral administration, simplified dosing schedule (two annual treatment courses), and a favorable safety profile relative to some injectables.

However, safety warnings pertaining to its immunosuppressive effects have tempered enthusiasm. The emergence of newer agents with better safety profiles, like oral sphingosine-1-phosphate receptor modulators, intensifies the competition.

In oncology, Cladribine competes with drugs such as bendamustine, fludarabine, and newer targeted therapies. Given the limited pipeline expansion and market saturation, its oncology market remains relatively static.

2. Regulatory and Reimbursement Environment

Regulatory agencies scrutinize Cladribine’s safety profile, especially concerning lymphopenia and associated infection risks. In the US, the FDA approved Mavenclad with boxed warnings, advocating cautious patient selection and monitoring.

Reimbursement and formulary placement influence market penetration. In several markets, reimbursement hurdles have constrained rapid adoption, especially where alternative therapies are already established.

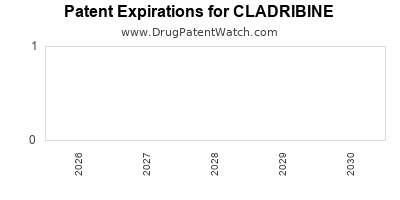

3. Patent Life and Market Exclusivity

Cladribine’s patents for MS use are nearing expiration in some jurisdictions, with some formulations facing generic challenges. Patent expirations could significantly impact profits unless new claims or formulations are secured.

Financial Trajectory Analysis

Revenue Trends and Forecasts

Since its 2017 EMA approval, Mavenclad has experienced steady sales in key markets like Europe and select regions in Asia. In 2021, revenues from Cladribine formulations reached approximately $250 million, with projections estimating a compound annual growth rate (CAGR) of roughly 5% over the next five years, contingent on expanding indications and market acceptance.

Factors Driving Revenue Growth

- Market Expansion: Increasing approvals in emerging markets (e.g., China, India) could open high-growth avenues, given the rising prevalence of MS.

- Label Expansion: Potential for off-label use or additional indications, such as primary progressive MS (PPMS), would enhance revenue streams.

- Formulation Innovations: Development of next-generation formulations that reduce side effects or improve convenience.

Risks to Financial Performance

- Safety Concerns: Post-marketing safety data could suppress sales if adverse event rates are linked to increased risks.

- Market Competition: Entry of biosimilars or new therapeutics may suppress pricing power.

- Regulatory Challenges: Delays or restrictions in key markets could decelerate revenue growth.

Strategic Implications

Companies leveraging Cladribine’s pipeline should focus on strengthening safety profiles, expanding indications, and fostering strategic collaborations to optimize market penetration. Cost management, especially approaching patent expiry, will be paramount.

Future Outlook

The outlook for Cladribine remains cautiously optimistic. Its differentiated delivery method and dosing regimen suit a growing segment of MS patients seeking effective, convenient therapies. Nevertheless, the market’s evolution depends on balancing safety concerns with efficacy, navigating regulatory landscapes, and maintaining competitive advantages against newer agents.

Continued innovation, such as biomarker development for patient stratification and personalized medicine approaches, holds promise for enhancing Cladribine’s market share. Market expansion into underpenetrated regions, supported by favorable reimbursement policies, could drive revenue growth beyond current estimates.

Key Takeaways

- Market Positioning: Cladribine’s oral formulation and brief dosing schedule confer competitive advantages in the MS sector, yet safety concerns inhibit broader adoption.

- Growth Drivers: Expansion into emerging markets, indication label extensions, and formulation improvements are vital growth levers.

- Challenges: The approaching patent cliffs, competition from newer therapies, and safety profile management are primary risks.

- Financial Trajectory: With steady sales in established markets, compounded by potential emerging market growth, revenues are expected to grow modestly but steadily over the next five years.

- Strategic Focus: Enhancing safety profiles, securing additional approvals, and exploring combination therapies will be critical to sustaining financial momentum.

FAQs

1. What are the main therapeutic uses of Cladribine?

Cladribine is primarily used for relapsing-remitting multiple sclerosis (RRMS) and certain hematologic malignancies like hairy cell leukemia and CLL.

2. How does Cladribine’s mechanism of action benefit MS patients?

It selectively reduces lymphocyte populations, decreasing immune-mediated CNS inflammation and relapse frequency with a simplified treatment schedule.

3. What safety concerns are associated with Cladribine?

Risks include lymphopenia, increased infection susceptibility, and potential secondary autoimmune conditions. Regulatory warnings mandate vigilant monitoring.

4. How does market competition impact Cladribine’s financial outlook?

Emerging therapies with improved safety profiles and convenience could erode market share unless Cladribine differentiates further or expands indications.

5. What is the future growth potential for Cladribine?

While growth prospects are moderate, expansion into underpenetrated markets and potential label extensions offer opportunities for revenue enhancement.

References

- Deloitte. (2022). The Global MS Market: Trends and Forecasts.

- EMA. (2017). Mavenclad (Cladribine) Marketing Authorization.

- FDA. (2019). Mavenclad (Cladribine) Prescribing Information.

- IQVIA. (2022). Pharmaceutical Market Analysis Reports.

- MarketWatch. (2023). MS Drug Market Trends.