Last updated: July 27, 2025

Introduction

Ceftazidime, a third-generation cephalosporin antibiotic, continues to be a critical option in the management of serious bacterial infections, including Pseudomonas aeruginosa and other Gram-negative bacteria. Its commercial and clinical significance hinges on evolving resistance patterns, regulatory pathways, manufacturing dynamics, and market competition. This analysis explores the current market landscape, forecasted financial trajectory, and key variables influencing ceftazidime’s position within the global pharmaceutical industry.

Market Overview and Current Demand

The global antibiotic market, valued at approximately $49 billion in 2022, is driven by rising infectious diseases, aging populations, and increasing antibiotic resistance [1]. Ceftazidime's segment remains robust due to its efficacy against multidrug-resistant Gram-negative pathogens. In 2022, sales of ceftazidime and related formulations reached an estimated $1.2 billion, reflecting steady demand across North America, Europe, and emerging markets.

Clinically, ceftazidime is primarily indicated for severe infections such as pneumonia, sepsis, intra-abdominal infections, and complicated urinary tract infections, particularly in hospital settings. The ongoing emergence of multidrug-resistant bacteria, especially Pseudomonas and Acinetobacter species, sustains the necessity for ceftazidime as part of combination therapies.

Market Drivers

-

Antibiotic Resistance: Escalating resistance among Gram-negative bacteria necessitates potent, broad-spectrum antibiotics like ceftazidime. The WHO has categorized multiple resistant strains, intensifying demand for effective agents [2].

-

Hospital-Acquired Infections (HAIs): Rising HAIs, exacerbated by increased hospital admissions and surgeries, amplify the need for potent antibiotics, including ceftazidime.

-

Regulatory Approvals and Line Extensions: Recent approvals for combination formulations, such as ceftazidime-avibactam (a β-lactamase inhibitor), provide expanded indications and boost sales.

-

Market Penetration in Developing Countries: Growing healthcare infrastructure and infectious disease burden propel demand in Asia-Pacific and Latin America. These regions are increasingly adopting ceftazidime due to cost advantages and established efficacy.

Challenges and Market Restraints

-

Emerging Resistance: Bacterial resistance to ceftazidime diminishes clinical utility, prompting shifts toward newer β-lactamase inhibitors or carbapenems.

-

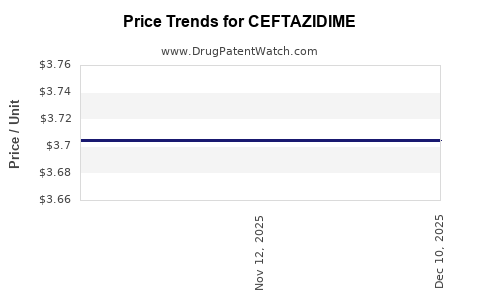

Generic Competition: Several generic manufacturers dominate the market, exerting price pressure on branded formulations and affecting profit margins.

-

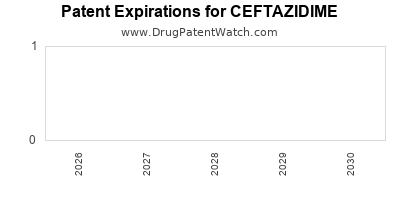

Regulatory and Patent Landscape: Patent expirations of key formulations, combined with regulatory hurdles for new indications, impact revenue streams.

-

Alternative Therapies: The development of novel antibiotics and alternative antimicrobial strategies could potentially displace ceftazidime in certain indications.

Emerging Trends and Innovations

-

Combination Therapies: The introduction of ceftazidime combined with β-lactamase inhibitors like avibactam enhances efficacy against resistant strains, providing a significant growth avenue. Ceftazidime-avibactam, approved by FDA in 2015, exemplifies this trend.

-

Formulation Developments: Innovations in sustained-release formulations and improved stability are under exploration, aiming to optimize dosing and patient adherence.

-

Diagnostics and Stewardship: Enhanced diagnostic tools facilitate targeted therapy, potentially reducing ceftazidime overuse and resistance development.

Financial Trajectory and Forecast

Historical Revenue Trends

Between 2015 and 2022, ceftazidime's global sales experienced modest growth, driven chiefly by the uptake of ceftazidime-avibactam. The initial sales boost in 2015, driven by new approvals, plateaued as generic versions entered the market.

Forecasted Growth

Analysts project a Compound Annual Growth Rate (CAGR) of approximately 4% for the ceftazidime market between 2023 and 2030. Factors including increased resistance, expanding indications for combination formulations, and rising adoption in emerging markets underpin this trajectory.

Branded formulations such as ceftazidime-avibactam are expected to lead growth, with forecasted sales surpassing $2.5 billion globally by 2030, accounting for both direct sales and combination products.

Revenue Segmentation

-

Established Markets (North America and Europe): Saturated but stable, with steady demand in hospitals. Focus remains on resistant infection management.

-

Emerging Markets: Rapid growth, driven by expanding healthcare infrastructure and infectious disease burden. Prices tend to be lower, but volume growth compensates.

-

Generic Market Share: Dominates sales volume, with branded products representing premium pricing segments.

Impact of Patent Expirations and Generics

Patent expirations for key formulations are anticipated over the next 2–3 years, with multiple generics expected to flood the market. This development may induce short-term revenue declines but can also expand access and overall volume, stabilizing long-term demand.

Competitive Landscape

-

Major Players: Pfizer (Zavicefta, the branded ceftazidime-avibactam), Sandoz, Teva, and Mylan dominate the generic market.

-

Pipeline Developments: Companies are investing in novel β-lactamase inhibitors and combination therapies to combat resistance, possibly redefining the market dynamics in coming years.

-

Pricing Strategies: Companies employ volume-based discounts and regional price differentiation to compete, especially in price-sensitive markets.

Regulatory Outlook

Ongoing regulatory vigilance is essential. The evolving resistance landscape necessitates continuous updates to prescribing guidelines, regulatory approvals for new combinations, and post-market surveillance to monitor efficacy and safety.

Conclusion

Ceftazidime's market and financial future hinges on its continued relevance in managing resistant infections, strategic development of combination agents, and navigating patent and generic competition. While resistance presents challenges, innovation and expanding indications, especially with avibactam combination formulations, underpin a cautiously optimistic outlook.

Key Takeaways

-

Growth prospects are driven by resistance-driven demand and approvals for novel combinations such as ceftazidime-avibactam, projected to surpass $2.5 billion globally by 2030.

-

Generic market competition and patent expirations will influence revenue streams, necessitating strategic positioning for branded products.

-

Emerging markets present significant growth opportunities, facilitated by healthcare infrastructure expansion and infectious disease burden.

-

Resistance remains a double-edged sword, both fueling demand and compelling innovation to sustain market relevance.

-

Continuous adaptation to regulatory environments and investment in novel formulations are critical for maintaining market share and profitability.

FAQs

1. How does bacterial resistance impact the future sales of ceftazidime?

Rising resistance diminishes ceftazidime’s clinical utility, prompting the shift toward combination therapies with β-lactamase inhibitors. While resistance challenges sales, the development and approval of newer formulations like ceftazidime-avibactam are expected to offset decline by expanding indications and maintaining therapeutic efficacy.

2. What role do generics play in the ceftazidime market?

Generics account for the majority of volume sales, exerting downward pressure on prices. Patent expirations lead to increased generic competition, which reduces revenue for branded formulations but broadens access in cost-sensitive markets.

3. Which regions are expected to drive the highest growth for ceftazidime?

Emerging markets in Asia-Pacific and Latin America are anticipated to lead growth due to increasing infectious disease burden, expanding healthcare infrastructure, and affordability of generic formulations.

4. What innovations could prolong ceftazidime’s market relevance?

Development of novel combination agents, sustained-release formulations, and enhanced diagnostic tools for targeted therapy can extend ceftazidime's clinical and commercial lifespan.

5. How might regulatory changes influence ceftazidime's market trajectory?

Regulatory approvals for new indications or combination therapies, along with post-market safety requirements, can expand sales opportunities or impose constraints, depending on approval outcomes and policy shifts.

References

[1] Global Market Insights. Antibiotics Market Size & Industry Analysis, 2022.

[2] World Health Organization. Global Priority List of Antibiotic-Resistant Bacteria, 2017.