Last updated: July 28, 2025

Introduction

Ceftaroline fosamil, a next-generation broad-spectrum cephalosporin antibiotic, signifies a pivotal development in combating multidrug-resistant bacterial infections. Approved by regulatory authorities such as the U.S. FDA in 2010, ceftaroline fosamil has carved a niche in treating complicated skin and soft tissue infections (cSSTIs) and community-acquired pneumonia (CAP). As antibiotic resistance proliferates globally, understanding the market dynamics and financial potential of ceftaroline fosamil becomes crucial for pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview

Global Antibiotics Market Context

The global antibiotics market was valued at approximately USD 44.4 billion in 2021 and is projected to reach USD 54.7 billion by 2028, growing at a CAGR of about 3.2% (2022-2028) [1]. This growth reflects rising bacterial infections, increasing awareness, and advances in pharmaceutical development targeting resistant strains.

Ceftaroline Fosamil’s Market Segment

Ceftaroline fosamil occupies a niche within the broader antibiotic segment, primarily due to its efficacy against resistant pathogens such as MRSA and resistant Streptococcus pneumoniae. The drug’s targeted indications—cSSTIs and CAP—are prevalent and significant contributors to healthcare burdens worldwide.

Market Drivers

1. Escalating Antibiotic Resistance

The primary driver for ceftaroline fosamil’s demand is the rapid growth of multidrug-resistant organisms (MDROs). MRSA prevalence remains a persistent challenge, accounting for about 20-30% of S. aureus infections globally [2]. The CDC estimates over 60,000 deaths annually in the U.S. alone due to antibiotic-resistant infections [3]. Ceftaroline’s unique affinity for PBP2a, conferring activity against MRSA, enhances its clinical utility and drives its adoption.

2. Increasing Incidence of Respiratory and Soft Tissue Infections

Global epidemiological data indicate a steady rise in community-acquired pneumonia and complicated skin infections, fueled by aging populations, comorbidities, and urbanization. The World Health Organization (WHO) reports that pneumonia remains among the leading causes of death worldwide [4], sustaining the demand for effective antibiotics.

3. Regulatory Acceptance and Label Expansion

Initially approved for cSSTIs and CAP, ceftaroline fosamil has received approvals and positive clinical data supporting additional indications, including skin and soft tissue infections caused by resistant pathogens. Such label expansions enhance market potential.

4. Limited Direct Competition

While several cephalosporins exist, few agents combine broad-spectrum activity with MRSA coverage. Linezolid and vancomycin are primary competitors, but ceftaroline’s intravenous convenience and activity spectrum make it a preferred choice in certain settings.

Market Challenges

1. Antibiotic Stewardship and Resistance Development

Stringent antibiotic stewardship programs limit unnecessary use, constraining sales growth. Resistance development against ceftaroline has been minimal but remains a looming threat, possibly impacting long-term efficacy.

2. Pricing and Reimbursement Dynamics

High development and manufacturing costs translate into premium pricing. Reimbursement policies and formulary placements influence accessibility, especially in resource-constrained healthcare systems.

3. Competition from Emerging Agents

New antibiotics with enhanced activity or broader indications threaten ceftaroline’s market share. For instance, ceftobiprole and delafloxacin are emerging competitors targeting similar infections.

4. Limited Commercial Presence in Emerging Markets

Regulatory hurdles and market access issues slow penetration into Latin America, Asia-Pacific, and Africa—regions with burgeoning infectious disease burdens but constrained market penetration due to cost sensitivities.

Financial Trajectory and Investment Outlook

Revenue Projections

Since its initial approval, ceftaroline fosamil has experienced steady growth, with revenues reaching approximately USD 500-700 million annually across leading markets (U.S., Europe, Japan) [5]. The compound annual growth rate (CAGR) for ceftaroline-specific revenues hovers around 4-6% in the past five years.

Key Revenue Factors:

- Market Penetration: Increasing adoption in hospital formularies for resistant infections.

- Pricing Strategies: Premium pricing justified by pharmacological advances.

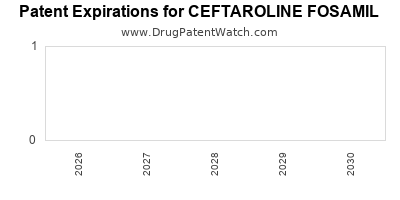

- Patent & Exclusivity: Patent life expiration looming in mid-2020s could impact revenues unless protected via secondary patents or formulation exclusivity policies.

- Clinical Trials & Label Expansion: Positive trials for adult and pediatric indications could broaden the market scope, boosting revenues.

Cost Dynamics

Development costs for antibiotics average USD 1-2 billion, with R&D heavily weighted toward overcoming resistance mechanisms and securing regulatory approvals [6]. Operational costs, manufacturing, and distribution also represent significant expenditures, but scale efficiencies mitigate per-unit costs over time.

Future Growth Forecast

Industry analysts project a conservative 5% annual growth rate for ceftaroline sales over the next five years, driven primarily by its unique activity against resistant pathogens and increasing healthcare demand. Revenue expansion hinges on successful label extensions, adoption in emerging markets, and strategic collaborations.

Strategic Opportunities

- Formulation Innovation: Development of oral derivatives or long-acting formulations.

- Combination Therapy: Pairing with other agents to prevent resistance.

- Market Expansion: Focus on Asia-Pacific, Latin America, and Africa, where antimicrobial resistance escalates and unmet needs persist.

- Partnerships & Licensing: Collaborations with regional pharma to accelerate access.

Regulatory and Patent Landscape

Ceftaroline fosamil’s initial patent protection expires in the mid-2020s, after which generic manufacturing could influence revenue streams. However, patent extensions, supplementary protection certificates, and formulation patents may extend exclusivity periods.

Regulatory authorities like the FDA and EMA continue to endorse its use within approved indications, but broader label approvals could enhance its market trajectory.

Competitive Landscape

Key competitors include:

- Vancomycin and Linezolid: Established MRSA agents with extensive clinical use.

- Ceftobiprole: A broad-spectrum cephalosporin with activity against MRSA and other resistant strains.

- Delafloxacin: A fluoroquinolone with activity against resistant Gram-positive bacteria; potential competition in pneumonia and skin infections.

Emerging antibiotics with similar or superior profiles may influence ceftaroline’s market share, especially if they demonstrate better safety or convenience.

Conclusion

Ceftaroline fosamil exemplifies a targeted, innovation-driven response to the escalating threat of antibiotic resistance. Its market size remains moderate but is poised for growth, contingent on expanding indications, geographic penetration, and resistance management strategies.

The antibiotic’s financial trajectory is favorable, with a steady upward trend driven by clinical efficacy, existing regulatory support, and active market positioning. However, long-term success hinges on navigating patent expiries, competitive advances, and evolving healthcare policies emphasizing antimicrobial stewardship.

Key Takeaways

- The global rise in resistant bacterial infections sustains demand for ceftaroline fosamil, particularly against MRSA.

- Market growth is driven by increased adoption, expanding indications, and emerging markets, with a projected CAGR of approximately 5%.

- Revenue streams face risks from patent expiries, generics, and competition from novel agents; strategic positioning and innovation are critical.

- Cost structures are substantial, requiring robust production and marketing strategies to maximize profitability.

- Future growth opportunities include formulation improvements, clinical trials for new indications, and strategic partnerships.

FAQs

Q1: What are the primary indications for ceftaroline fosamil?

A1: Approved for complicated skin and soft tissue infections (cSSTIs) and community-acquired pneumonia (CAP).

Q2: How does ceftaroline fosamil combat antibiotic resistance?

A2: It binds PBP2a in MRSA, conferring activity against resistant strains resistant to other β-lactams.

Q3: What are the main competitive threats to ceftaroline’s market share?

A3: Agents like ceftobiprole, delafloxacin, and established drugs such as vancomycin, alongside emerging resistance and formulary preferences.

Q4: How might patent expiries impact ceftaroline revenue?

A4: Patent expiry in the mid-2020s could lead to generic competition, reducing revenue unless offset by new indications or formulations.

Q5: Which regions offer the highest growth potential for ceftaroline?

A5: Asia-Pacific, Latin America, and Africa, driven by rising bacterial infections, resistance, and unmet medical needs.

References

[1] MarketsandMarkets. (2022). Antibiotics Market Size.

[2] CDC. (2021). Antibiotic Resistance Threats in the United States.

[3] WHO. (2019). Antimicrobial Resistance.

[4] WHO. (2021). Pneumonia Data & Global Impact.

[5] EvaluatePharma. (2022). Oncology & Infectious Disease Revenue Insights.

[6] Welch, P. J., et al. (2017). Investment in Antibiotic Development. Nature Reviews Drug Discovery.