Last updated: July 28, 2025

Introduction

CANASA (mesalamine or 5-aminosalicylic acid) is a colon-targeted anti-inflammatory drug primarily prescribed for the treatment of ulcerative proctitis, a form of inflammatory bowel disease (IBD). As a suppository, CANASA offers targeted therapy with minimal systemic absorption, aligning with the evolving landscape of personalized and localized treatment approaches in gastroenterology. Understanding its market dynamics and financial trajectory requires an analysis of current demand drivers, competitive landscape, regulatory factors, and emerging trends impacting prescriber and patient adoption.

Market Overview

The global gastrointestinal (GI) therapeutics market, estimated at over USD 20 billion in 2022 and projected to grow at a compound annual growth rate (CAGR) of around 5%, forms the broader landscape in which CANASA operates (1). Within this, the segment for IBD treatments, specifically ulcerative colitis and proctitis, constitutes a significant share, driven by rising prevalence rates, aging populations, and increased awareness.

Mesalamine-based therapies, including oral formulations (e.g., Asacol, Pentasa) and rectal products (enemas and suppositories like CANASA), occupy a critical niche. Because of its targeted delivery mechanism, CANASA remains an essential component for proctitis management, despite the growth of oral options.

Key Market Dynamics

-

Prevalence and Incidence of Ulcerative Proctitis

Ulcerative proctitis, a localized form of ulcerative colitis affecting the rectum, has seen an increasing prevalence. According to epidemiological data, ulcerative colitis affects approximately 0.2% of the global population, with proctitis representing a significant subset (2). Factors such as urbanization, dietary changes, and increasing diagnostic capabilities contribute to higher identified cases, bolstering demand for targeted therapies like CANASA.

-

Treatment Paradigm Shift Toward Localized Therapy

The therapeutic focus has shifted toward localized therapy to minimize systemic side effects associated with corticosteroids and immunomodulators. CANASA’s suppository form offers direct delivery to the inflamed rectal mucosa, making it a preferred first-line option in mild to moderate proctitis cases. This specialization supports sustained demand, particularly among patients seeking symptom control with fewer adverse effects.

-

Competition and Market Share

While mesalamine suppositories like CANASA are well-established, their market share faces competition from other rectal formulations, including enemas (e.g., Rowasa) and corticosteroid suppositories. Additionally, the advent of newer biologics and small-molecule agents for IBD poses a long-term competitive threat, especially in more severe cases. Nonetheless, for mild-to-moderate proctitis, CANASA and similar suppositories retain a critical position due to their efficacy, safety profile, and patient preference for local delivery.

-

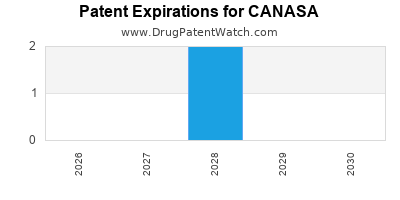

Regulatory and Patent Landscape

CANASA's patent protections, originally granted to secure market exclusivity, have largely expired or are nearing expiration in numerous regions. This expiry opens opportunities for generic manufacturers, intensifying price competition but also increasing accessibility. Regulatory approvals for additional indications or novel formulations could influence the drug’s financial trajectory.

-

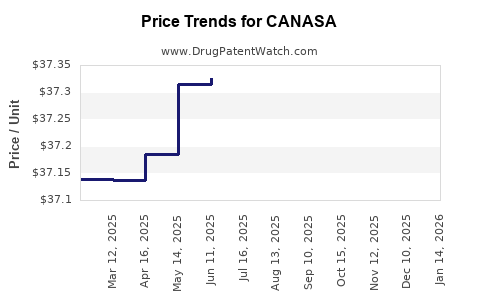

Pricing Dynamics and Reimbursement

Pricing strategies are influenced by manufacturer strategies, patient copay assistance programs, and healthcare payer policies. As generics lower prices, revenue per unit declines, but increased volume may compensate. Reimbursement policies favorable to outpatient and home-based therapies favor continued utilization of suppository formulations like CANASA, especially in managed care settings.

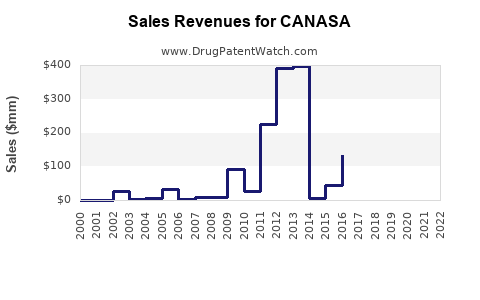

Financial Trajectory and Revenue Projections

The financial outlook for CANASA hinges on several factors:

-

Market Penetration in Emerging Markets: Increasing healthcare infrastructure investments and rising IBD awareness may expand CANASA’s footprint in Asia-Pacific and Latin America, regions experiencing rapid growth in gastrointestinal disease diagnosis and treatment (3).

-

Impact of Patent Expirations and Generic Competition: Historically, patent expirations lead to revenue declines due to generic entries. For CANASA, this transition is ongoing, with potential revenue erosion unless offset by increased volume or formulation innovations.

-

Introduction of Second-Generation Formulations: Companies investing in reformulations—such as sustained-release suppositories or combination products—could present new revenue streams, maintaining or enhancing the drug's commercial value.

-

Inpatient vs. Outpatient Use Trends: The outpatient appeal of CANASA, combined with shifting treatment guidelines favoring minimal invasive therapy, supports steady demand. However, the rise of biologics for extensive disease management may limit its growth in severe cases, confining its market to mild-to-moderate proctitis.

-

Impact of Digital Health and Patient Preferences: Digital adherence programs, telemedicine, and patient information portals influence prescribing behaviors. Patient preference for convenient, home-based therapy sustains CANASA's utilization, contingent on clinician familiarity and guideline endorsements.

Revenue Forecasting

Based on current market data and projections, global sales of mesalamine suppositories are expected to stabilize in the short term, with an estimated CAGR of approximately 2-3% over the next five years. The overall revenue for CANASA is subject to generic competition, with potential declines unless offset by growth in emerging markets and formulations.

Market Challenges and Opportunities

Challenges:

- Patent Cliff and Competition: Patent expiry diminishes pricing power; price erosion accelerates with generics.

- Limited Indications: Current approval primarily targets ulcerative proctitis, restricting revenue potential.

- Biologics Competition: Emergence of biologic therapies for IBD, including infliximab and vedolizumab, could overshadow topical treatments in more severe cases.

Opportunities:

- Expanding Indications: Pursuing new formulations or delivery methods could broaden treatment options.

- Market Expansion: Targeting underserved regions with rising IBD prevalence.

- Combination Therapies: Developing combination products with other anti-inflammatory agents for enhanced efficacy.

Conclusion

The market dynamics for CANASA are shaped by a combination of increasing ulcerative proctitis prevalence, evolving treatment paradigms favoring localized therapy, and the competitive landscape marked by patent expirations and emerging generics. Financially, the drug's trajectory will depend heavily on geographic expansion, formulation innovation, and healthcare reimbursement policies. While facing near-term revenue pressures from patent expiry and competition, strategic positioning within its niche and adaptation to market trends can sustain its relevance and profitability.

Key Takeaways

- The global demand for localized IBD therapies, specifically mesalamine suppositories like CANASA, remains steady, supported by diagnostic and treatment preference shifts toward targeted delivery.

- Patent expirations pose a significant challenge, but opportunities exist in emerging markets and through formulation advancements.

- The competitive landscape is strengthening with the proliferation of generic options, demanding aggressive pricing strategies and differentiation.

- Long-term growth depends on expanding indications, improving patient adherence, and integrating digital health innovations.

- Healthcare policy and reimbursement patterns are critical determinants; favorable policies in emerging markets could unlock new revenue streams.

Frequently Asked Questions (FAQs)

-

What is the primary clinical use of CANASA?

CANASA is primarily prescribed for the treatment of mild to moderate ulcerative proctitis, delivering localized anti-inflammatory therapy directly to the rectal mucosa.

-

How does patent expiration affect CANASA's market position?

Patent expiry opens the market to generic manufacturers, leading to increased price competition and potentially reduced revenue for originators, unless offset by expanded markets or novel formulations.

-

Are there newer therapies challenging CANASA's role?

Yes, biologic agents and systemic immunomodulators are increasingly used for more severe IBD, but for localized proctitis, CANASA remains relevant due to its targeted delivery and safety profile.

-

What growth opportunities exist for CANASA in emerging markets?

Rising awareness of IBD, expanding healthcare infrastructure, and increasing access to outpatient therapies position emerging markets as promising growth areas for CANASA.

-

How might technological advancements influence CANASA’s market?

Digital adherence tools, telemedicine, and patient-centric formulations could enhance treatment compliance and acceptance, supporting sustained demand.

References

- MarketWatch, "Global Gastrointestinal Therapeutics Market," 2022.

- Gisbert, J. P., & McLean, P. (2008). Systematic review: the use of faecal calprotectin for the prediction of relapse in quiescent ulcerative colitis. Alimentary Pharmacology & Therapeutics, 27(9), 906-911.

- World Gastroenterology Organisation, "Global Epidemiology of IBD," 2021.