Last updated: July 28, 2025

Introduction

Calcipotriene, a synthetic vitamin D analog primarily indicated for the treatment of psoriasis, has garnered significant attention within dermatology pharmacotherapy. Its distinctive mechanism, targeting keratinocyte proliferation, positions it as a cornerstone in topical psoriasis management. As pharmaceutical companies and healthcare systems navigate evolving market forces, understanding Calcipotriene's current landscape and future trajectory is vital for informed investment and strategic planning.

Pharmacological Profile and Therapeutic Significance

Calcipotriene, marketed under various brand names such as Daivonex and Calcipotriol, exerts its effects by modulating calcium metabolism within keratinocytes, thus normalizing proliferation and differentiation. Its efficacy, coupled with a well-understood safety profile when used appropriately, secures its role in psoriasis treatment regimens. The drug's topical formulation offers advantages over systemic therapies, including minimized systemic side effects and ease of use.

Market Drivers

1. Rising Prevalence of Psoriasis

Global epidemiological data indicates a steady increase in psoriasis prevalence, notably in North America, Europe, and parts of Asia. The World Psoriasis Atlas estimates that approximately 2-3% of the global population suffers from psoriasis, with fluctuations influenced by genetics and environmental factors (1). As the condition becomes more recognized and diagnosed, demand for effective topical therapies like Calcipotriene is expected to sustain growth.

2. Advancements in Formulation Technologies

Innovations in topical drug delivery, including foam, gel, and ointment formulations, have improved patient compliance and therapeutic outcomes. Companies investing in novel formulations of Calcipotriene can capture higher market share by offering enhanced efficacy and patient experience.

3. Growing Awareness and Treatment Adoption

Increased awareness campaigns and dermatology guidelines endorsing Calcipotriene have broadened its use. The inclusion of Calcipotriene in first-line therapy recommendations, alongside corticosteroids, augments its adoption, particularly in mild-to-moderate psoriasis cases.

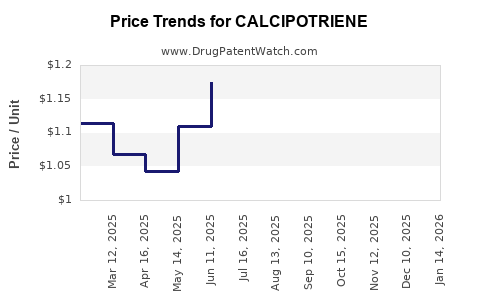

4. Strategic Partnerships and Generic Entry

The entry of generics and biosimilars influences market dynamics significantly. Patent expirations open avenues for manufacturers to expand access and reduce prices, fostering broader adoption and increasing market penetration (2).

Market Constraints and Challenges

1. Competition from Alternative Therapies

While Calcipotriene remains a mainstay, new systemic agents, biologics, and other topical formulations pose competitive threats. For instance, biologics like adalimumab and secukinumab demonstrate efficacy in moderate-to-severe cases, although their high costs limit use in milder psoriasis (3).

2. Safety Concerns and Side Effects

Rare adverse effects, such as hypercalcemia with excessive use, and concerns over long-term safety influence prescribing patterns. Ongoing research to optimize dosing minimizes these risks but remains a consideration.

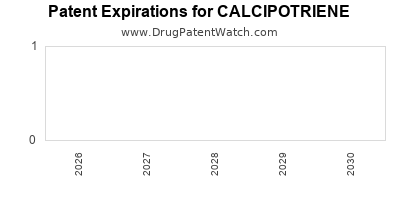

3. Regulatory and Patent Environment

Patent protections and regulatory approval processes influence market stability. The expiration timelines of key patents dictate the timing of generic entry, impacting revenue streams for original manufacturers.

Financial Trajectory and Market Forecasts

Current Market Size

The global psoriasis therapeutics market, valued at approximately USD 8 billion in 2022, anticipates robust growth driven by increased adoption of topical agents, including Calcipotriene (4). Calcipotriene's share, estimated at around 20%, underscores its pivotal role in topical treatment modalities.

Growth Projections

Analysts project a compound annual growth rate (CAGR) of approximately 5-7% from 2023 to 2030. Factors underpinning this growth include:

- Expansion in emerging markets such as Asia-Pacific, where healthcare infrastructure investments and rising psoriasis prevalence catalyze market access.

- Continued patent expirations in mature markets, prompting the proliferation of generics, thus lowering prices and expanding consumer base.

- Research and development investments aimed at novel formulations and combination therapies.

Emerging Trends Impacting Financial Trajectory

- Combination Products: Core to market expansion, combining Calcipotriene with corticosteroids or other agents increases therapeutic efficacy and patient adherence, presenting additional revenue streams.

- Digital and Telemedicine Integration: Enhanced diagnostic and treatment adherence monitoring, driven by teledermatology, may influence prescribing rates positively.

- Regulatory Approvals in New Indications: Investigations into Calcipotriene's efficacy in other dermatological conditions could open new markets and diversify revenue.

Market Share and Competitive Landscape

Leading pharmaceutical companies such as Leo Pharma and Mylan have historically dominated Calcipotriene formulations. The consolidation of market share, combined with aggressive pricing strategies post-patent expiry, compels ongoing innovation and market differentiation. The entry of biosimilar and generic versions is expected to intensify price competition but also expand overall market volume.

Regulatory and Patent Outlook

Patent expiration for key formulations is anticipated between 2024 and 2028 in various regions. This timeline influences revenue projections and stimulates generic manufacturer investments. Regulatory agencies' approval of combination therapies and new formulations may extend market exclusivity indirectly.

Strategic Implications for Stakeholders

- Pharmaceutical Firms: Prioritize formulation innovation and explore new delivery methods to sustain growth.

- Investors: Monitor patent statuses and emerging biosimilars to assess market risk and opportunity.

- Healthcare Providers: Embrace combination therapies and personalized treatment plans to optimize patient outcomes and market demand.

Key Takeaways

- The global Calcipotriene market benefits from rising psoriasis prevalence, technological innovations, and evolving treatment paradigms.

- Competition from biologics and alternative topicals necessitates continuous innovation and strategic positioning.

- Patent expirations and regulatory approvals are pivotal in shaping the financial trajectory, with generics poised to increase access and volume.

- Emerging markets, combination therapies, and digital health integration present significant growth opportunities.

- Stakeholders must balance innovation with cost competitiveness to capitalize on market dynamics effectively.

Conclusion

Calcipotriene's market dynamics reflect a mature yet evolving therapeutic landscape driven by epidemiological trends, technological advancements, and regulatory changes. Its financial trajectory remains positive, bolstered by broadening indications, formulation diversification, and strategic market entry. Stakeholders capable of navigating patent landscapes and innovating within safety and efficacy parameters will secure competitive advantages, ensuring continued growth and value creation in this segment.

FAQs

1. How is Calcipotriene expected to perform against newer biologic therapies in psoriasis management?

Calcipotriene primarily addresses mild-to-moderate psoriasis and offers a topical option with a favorable safety profile. While biologics are more effective in severe cases, Calcipotriene maintains relevance due to its affordability, safety, and ease of use in suitable patient populations.

2. What impact do patent expirations have on Calcipotriene's market share?

Patent expirations typically lead to the entry of generics, increasing market competition, lowering prices, and expanding accessibility. While this can dilute revenues for original developers, it often boosts overall market volume and broadens treatment adoption.

3. Are there promising new formulations of Calcipotriene in development?

Yes, ongoing research focuses on enhanced delivery systems, such as foam formulations and combination products, which aim to improve efficacy, reduce side effects, and enhance patient adherence.

4. How does geographic variation influence Calcipotriene's market dynamics?

Developing regions exhibit growing demand due to increasing psoriasis awareness and healthcare infrastructure improvements. Conversely, mature markets experience more pressure from generics, influencing pricing and brand strategies.

5. What role does digital health play in the future of Calcipotriene's market?

Digital health tools facilitate remote monitoring, adherence tracking, and personalized treatment adjustments, potentially increasing prescription rates and optimizing outcomes, thereby positively influencing the drug’s market trajectory.

Sources

- World Psoriasis Atlas. International Psoriasis Council, 2022.

- MarketWatch. "Pharmaceuticals - Topical Psoriasis Market Trends," 2023.

- National Psoriasis Foundation. "Psoriasis Treatment Guidelines," 2022.

- Grand View Research. "Psoriasis Therapeutics Market Size & Trends," 2023.