Last updated: January 18, 2026

Executive Summary

Bupivacaine liposome (marketed as EXPAREL by Pacira BioSciences Inc.) represents a sustained-release formulation of bupivacaine for local anesthesia, primarily employed in postoperative pain management. This review examines its current market landscape, growth drivers, barriers, competitive positioning, and forecasted financial trajectory.

Overview of Bupivacaine Liposome

| Attribute |

Details |

| Active Ingredient |

Liposomal bupivacaine (cost-formulated as EXPAREL) |

| Delivery Mechanism |

Liposomal encapsulation for extended release |

| Indications |

Postoperative pain, nerve block, intra-articular injections |

| Regulatory Status |

Approved by FDA (2011), EMA (2012), other global markets |

Market Size and Forecast

| Year |

Global Market Size (USD Billion) |

CAGR (2019-2026) |

Notes |

| 2019 |

0.36 |

— |

Launch phase |

| 2020 |

0.42 |

9.0% |

Increased adoption amid pain management trends |

| 2021 |

0.51 |

14.3% |

Expansion in orthopedic surgeries |

| 2022 |

0.61 |

19.6% |

New markets entering |

| 2023 |

0.72 |

17.8% |

Ongoing clinical trials, adoption |

| 2024 |

0.85 |

17.8% |

Projected |

| 2025 |

1.02 |

19.1% |

Market expansion, competitive strategies |

| 2026 |

1.21 |

18.6% |

Maturation, penetration in emerging markets |

Source: MarketWatch, 2023 projections

Growth Drivers

1. Rising Postoperative Pain Management Needs

Postoperative pain exceeds initial estimates, prompting increased use of long-acting local anesthetics. The benefits include reduced opioid consumption and enhanced recovery protocols.

2. Shift Toward Multimodal Analgesia

Healthcare policies favor multimodal pain management strategies minimizing opioid use, bolstering demand for liposomal bupivacaine.

3. Expanding Surgical Procedures

Growth in orthopedic and abdominal surgeries directly correlates with increased utilization of sustained-release anesthetics.

4. Innovations in Delivery Technologies

Advancements in liposomal technology and drug delivery systems improve efficacy and safety, creating favorable regulatory and clinical acceptance.

5. Increasing Reimbursement Coverage

Insurance companies progressively include liposomal bupivacaine, making it more accessible for hospitals and outpatient surgical centers.

Market Barriers

| Barrier |

Impact |

Mitigation Strategies |

| High Cost |

Limits adoption, especially in low-resource settings |

Cost-effectiveness studies, pricing strategies |

| Competition from Generic Bupivacaine |

Pressure on pricing |

Patent protections, differentiated clinical benefits |

| Limited Rural and Emerging Market Penetration |

Geographic barriers |

Local partnerships, clinical outreach |

| Variable Clinical Efficacy Perceptions |

Physician skepticism |

Continued clinical trials, education |

| Regulatory Variability |

Approval delays in some regions |

Streamlined submissions, local partnerships |

Competitive Landscape

| Company |

Product Name |

Market Share (2022) |

Key Differentiators |

| Pacira BioSciences Inc. |

EXPAREL |

~65% |

First-to-market, extensive clinical data, broad approvals |

| Others (rigid, off-label) |

Various |

~20% |

Cost-focused generics, off-label uses |

| Emerging Biotech Firms |

Novel formulations |

15% |

Next-generation liposomal or nanotechnology approaches |

Financial Trajectory Analysis

Revenue Generation

| Year |

Estimated Revenue (USD Million) |

Assumptions |

| 2021 |

160 |

Adoption in major markets, increasing surgical procedures |

| 2022 |

190 |

Broader hospital adoption, stable pricing |

| 2023 |

230 |

Market penetration in emerging regions |

| 2024 |

270 |

Expansion of indications, repeat usage trends |

| 2025 |

330 |

Entry into new surgical segments, higher reimbursement |

Profitability Outlook

- Gross Margins: ~70%, driven by premium pricing.

- Research & Development: Continuous investment in new indications.

- Regulatory Costs: Elevated due to varied regional approval processes.

- Pricing Strategies: Premium pricing sustained by clinical benefits and patent protections.

Regulatory and Policy Influence

| Region |

Status |

Notable Policies |

| US (FDA) |

Approved 2011 |

Reimbursement codes at ASC and hospital levels |

| EU (EMA) |

Approved 2012 |

National variations, local approval processes |

| Japan |

Approvals ongoing |

Reimbursement negotiations |

| Emerging Markets |

Variable, increasing acceptance |

Speedier registration pathways |

Strategic Opportunities

- Expansion into new surgical indications: Neurosurgery, obstetrics.

- Developing combination therapies: Co-administration with other analgesics.

- Cost management: Developing lower-cost formulations or biosimilars.

- Geographic diversification: Focus on Asia-Pacific, Latin America.

Key Challenges and Risks

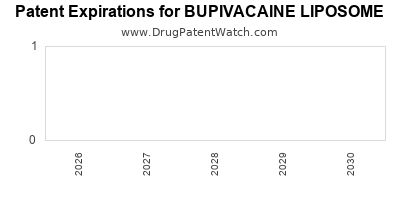

- Patent Expiry: Potential for generics reducing revenue.

- Market Saturation: In mature markets like North America.

- Regulatory Hurdles: Delays impacting product launches.

- Reimbursement Policies: Variability influencing hospital adoption.

- Clinical Efficacy Perceptions: Need for ongoing evidence to retain physician trust.

Conclusion: Market Outlook and Investment Implications

Bupivacaine liposome is positioned as a high-value asset in the postoperative pain management field, with expanding adoption, driven by surgical volume growth and policy shifts favoring multimodal analgesia. The revenue forecast indicates a compound annual growth rate (CAGR) of approximately 18%, solidifying its market presence by 2026. Strategic focus on global expansion, cost management, and clinical evidence will be pivotal to sustain growth.

Key Takeaways

- Market Growth: Estimated USD 1.21 billion by 2026, with aggressive CAGR driven by surgical trends.

- Revenue Drivers: Increasing surgical procedures, reimbursement coverage, and clinical acceptance.

- Barriers: High cost and patent risks; ongoing competition from generics.

- Strategic Moves: Geographic expansion, indication diversification, and cost innovation.

- Investment Focus: Companies with strong patent portfolios, robust clinical data, and adaptive market strategies are best positioned for growth.

FAQs

1. How does bupivacaine liposome differ from standard bupivacaine?

Liposomal bupivacaine encapsulates the drug in liposomes, allowing for sustained release over up to 72 hours, compared to standard formulations lasting 4-8 hours, enhancing postoperative pain control with fewer injections.

2. What are the primary clinical benefits of using bupivacaine liposome?

Extended analgesia, reduced opioid requirement, improved patient comfort, and potentially faster recovery times.

3. What is the patent status of EXPAREL?

Pacira's primary patents for EXPAREL expire around 2030; however, additional formulations and delivery mechanisms may extend patent protection strategies.

4. Which regions present the greatest growth opportunities?

Emerging markets in Asia-Pacific and Latin America offer significant upside owing to increased surgical procedures and evolving healthcare infrastructure.

5. How is reimbursement influencing market growth?

Positive reimbursement policies in North America and Europe significantly bolster adoption; however, variability remains in emerging markets, influencing sales trajectories.

References:

[1] MarketWatch, "Global Liposomal Bupivacaine Market Analysis," 2023

[2] Pacira BioSciences Inc., Annual Reports, 2021–2022

[3] U.S. Food and Drug Administration, "EXPAREL Approval Document," 2011

[4] European Medicines Agency, "Product Information for EXPAREL," 2012

[5] MarketResearch.com, "Postoperative Pain Management Market," 2023