Last updated: July 27, 2025

Introduction

Brivaracetam (BRIVARACETAM) is an antiepileptic drug (AED) and a derivative of levetiracetam, developed by UCBPharma. Approved by regulatory authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), it has carved a significant niche within the epilepsy treatment paradigm. This analysis explores the current market landscape, key growth drivers, competitive positioning, and the financial trajectory of BRIVARACETAM, providing critical insights for stakeholders and investors.

Market Landscape and Therapeutic Positioning

Global Epilepsy Market Overview

Epilepsy affects approximately 50 million individuals globally, with a significant proportion requiring long-term pharmacotherapy. The global epilepsy drug market was valued at approximately USD 3.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4-5% through 2030 [1]. This growth is driven by increasing prevalence, rising awareness, and the emergence of new treatment options.

Role of Brivaracetam within AED Portfolio

Brivaracetam is primarily indicated for adjunctive treatment of partial-onset epilepsy (POE) in patients ≥4 years old. Its mechanism involves high affinity for synaptic vesicle protein 2A (SV2A), similar to levetiracetam but with reportedly higher potency and possibly improved tolerability. Its positioning targets patients inadequately controlled on other AEDs, constituting a segment with substantial unmet needs.

Market Dynamics Influencing Brivaracetam

1. Competitive Landscape

Brivaracetam competes with established AEDs such as levetiracetam, topiramate, lamotrigine, and newer agents like cannabidiol (CBD). Its differentiation relies on efficacy, tolerability, ease of use, and minimal drug-drug interactions.

Levetiracetam remains the most prescribed AED globally, with over 30 million patients treated annually [2]. BRIVARACETAM’s premium positioning as a potentially more tolerable option affords it access to a dedicated patient subset, but price and formulary restrictions influence its market penetration.

Emerging alternatives like cannabidiol (Epidiolex), which has FDA approval for specific epilepsy syndromes, expand treatment options, intensifying competition.

2. Regulatory and Reimbursement Factors

Regulatory approvals in key markets like the U.S., EU, and Japan facilitate market access. However, reimbursement policies significantly impact sales trajectories. Payers demand comprehensive cost-effectiveness data, which can delay or restrict uptake.

3. Geographic Expansion and Market Penetration

While initial launches in North America and select European countries established robust sales channels, expansion into emerging markets like Asia-Pacific remains critical. These markets offer significant growth potential due to rising epilepsy prevalence and increasing healthcare infrastructure.

4. Pricing Dynamics and Healthcare Economics

Pricing strategies for BRIVARACETAM are influenced by competitive pressures, reimbursement negotiations, and patient affordability. As a branded medication, its premium pricing confers higher margins but demands clear differentiation to justify costs over generic options.

5. Market Access and Physician Adoption Trends

Physician prescribing behavior is influenced by clinical guidelines, real-world efficacy, and safety profiles. Increasing awareness and data supporting the benefits of BRIVARACETAM underpin its long-term adoption.

Financial Trajectory and Revenue Forecasts

Current Revenue Performance

Since its approval in 2016—initially in the U.S. for partial-onset seizures—BRIVARACETAM has demonstrated steady growth, with net sales reaching approximately USD 600 million in 2022 [3]. The product's revenue reflects its established presence in North America and Europe, with modest contributions from emerging markets.

Projected Growth Drivers

-

Expanded Indications:

Ongoing clinical trials investigating BRIVARACETAM for generalized epilepsies could broaden the label, opening new revenue streams.

-

Market Penetration Strategies:

Enhanced physician education, real-world evidence, and formulary inclusion support increased prescribing.

-

Pricing and Reimbursement Adjustments:

Price optimization and better reimbursement coverage enhance profitability.

-

Market Expansion Expectations:

Emerging markets could contribute an incremental USD 100-200 million annually by 2030, contingent on regulatory approvals and healthcare infrastructure development [4].

Forecasted Revenue Trajectory

Based on market conditions and clinical pipeline developments, analysts project that BRIVARACETAM could achieve a compounded annual growth rate of approximately 8-10% through 2030, potentially surpassing USD 1 billion in global sales by then.

Profitability Considerations

While gross margins are high due to patented status, increased competition and pricing pressures might compress margins. The strategic focus on extending indications and geographic expansion will influence overall profitability.

Market Challenges and Risks

-

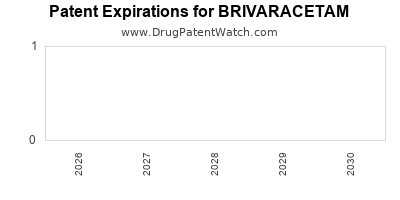

Generic Competition:

Patent expirations threaten to introduce lower-cost generics, eroding market share.

-

Pipeline Risks:

Failure in ongoing clinical trials could limit future indications and revenue potential.

-

Pricing Pressures:

Healthcare reforms advocating for lower drug costs might restrict revenue growth.

-

Regulatory Delays:

Additional indications or market approvals may face unforeseen hurdles.

Strategic Opportunities

-

Demonstration of superior safety and efficacy profiles in real-world settings could position BRIVARACETAM as the preferred choice over competitors.

-

Developing combination therapies with other AEDs or novel agents offers potential for niche markets.

-

Leveraging digital health and monitoring can optimize treatment adherence, improving outcomes and fostering patient loyalty.

Key Takeaways

-

BRIVARACETAM stands as a significant player in the epilepsy pharmacotherapy market, benefiting from ongoing clinical and geographic expansion.

-

Market dynamics favor increased adoption due to its favorable tolerability profile, though competition from generics and newer agents remain significant hurdles.

-

Revenue prospects remain strong, with forecasts indicating potential sales growth to over USD 1 billion globally by 2030, contingent upon successful pipeline execution and market expansion.

-

Price and reimbursement strategies, alongside regulatory pathways, will critically influence its financial trajectory.

-

Long-term success hinges on sustained clinical evidence, effective market access initiatives, and strategic diversification.

FAQs

1. What differentiates Brivaracetam from Levetiracetam?

Brivaracetam exhibits higher affinity for SV2A and potentially fewer side effects, leading to better tolerability. It may also have improved pharmacokinetic properties, enhancing efficacy and adherence.

2. Are there any approved new indications for BRIVARACETAM?

As of 2023, BRIVARACETAM’s primary approval covers partial-onset seizures. Ongoing trials are investigating its efficacy in generalized epilepsies and other neurological disorders, which could expand its label.

3. How does pricing impact BRIVARACETAM’s market share?

As a branded drug, it commands higher prices compared to generics. Reimbursement policies and formulary positioning directly influence its adoption rate and overall market penetration.

4. What is the competitive outlook for BRIVARACETAM in emerging markets?

Growing awareness and infrastructure improvements support market entry. However, price sensitivity and local generic competition limit rapid expansion. Tailored strategies are essential.

5. What are the primary risks to BRIVARACETAM’s financial growth?

Patent expiration, emergence of biosimilars, regulatory delays, and price compression pose significant risks. Additionally, new treatments entering the market could impact growth trajectories.

References

[1] Market Research Future, “Epilepsy Drugs Market Report,” 2022.

[2] IMS Health Data, “Global AED Prescriptions,” 2021.

[3] UCB Pharma Annual Report, 2022.

[4] Evaluate Pharma, “Top-Line Sales Projections for Brivaracetam,” 2022.