Last updated: November 19, 2025

Introduction

Brexpiprazole, marketed primarily under the brand name Rexulti, is an atypical antipsychotic developed by Otsuka Pharmaceutical and Lundbeck. Approved by the U.S. Food and Drug Administration (FDA) in 2015 for schizophrenia and in 2017 for major depressive disorder (MDD), the drug has carved out a significant niche within the psychiatric therapeutics landscape. This article explores the market dynamics and financial trajectory of brexpiprazole, analyzing factors influencing its growth, competitive positioning, and future prospects within the pharmaceutical industry.

Market Landscape and Adoption Drivers

Growing Prevalence of Psychiatric Disorders

The increasing global burden of schizophrenia and MDD directly accelerates demand for innovative therapies such as brexpiprazole. According to the World Health Organization (WHO), approximately 1 in 100 people worldwide suffer from schizophrenia, and depression affects over 264 million individuals globally [1]. The rising prevalence emphasizes the need for efficacious, well-tolerated medications that improve patient adherence and outcomes.

Pharmacological Profile and Positioning

Brexpiprazole acts as a serotonin-dopamine activity modulator, offering a distinctive profile compared to first-generation antipsychotics. Its safety and tolerability, including lower incidences of metabolic side effects, favor its adoption in long-term treatment settings. The drug is indicated not only for schizophrenia and MDD but also explored for adjunctive therapy in agitation associated with dementia, broadening its potential market scope [2].

Competitive Dynamics

The antipsychotic market is highly competitive, dominated by products such as aripiprazole (Abilify), risperidone, and olanzapine. Brexpiprazole's differentiation hinges on a favorable side effect profile, especially regarding weight gain and metabolic disturbances—key factors influencing prescribing decisions. However, the entrenched positions of established drugs pose significant barriers to market penetration. The availability of generics for older antipsychotics further constrains price premiums for newer entrants.

Regulatory and Reimbursement Factors

Regulatory approvals worldwide influence brexpiprazole’s market expansion. While approved in the U.S., Europe and other markets are still evaluating regulatory pathways. Reimbursement policies, formulary placements, and pricing negotiations also impact sales trajectories. In the U.S., the drug secured designation as a preferred agent in certain insurance formularies, facilitating broad patient access.

Commercial Performance and Financial Trends

Revenue Generation and Growth Trajectory

Initially launched in 2015, brexpiprazole’s revenue growth has been steady yet moderate. For instance, Otsuka reported global sales of approximately \$600 million in 2021, with the U.S. contributing a significant share [3]. The compound annual growth rate (CAGR) has hovered around 8-10%, reflecting incremental adoption amidst stiff competition.

R&D Investment and Pipeline Potential

Otsuka and Lundbeck continue investment in R&D to expand indications, including schizophrenia maintenance, bipolar disorder, and agitation in Alzheimer’s disease. Success in obtaining regulatory approvals or label expansions could boost sales. Additionally, exploring combination therapies may open new revenue streams.

Pricing and Market Penetration Strategy

Pricing strategies aim to balance profitability with affordability to maximize market penetration. Managed care negotiations and tiered formulary inclusion influence patient access and, consequently, revenue. The premium positioning based on tolerability may justify higher prices compared to older antipsychotics.

Challenges Impacting Financial Trajectory

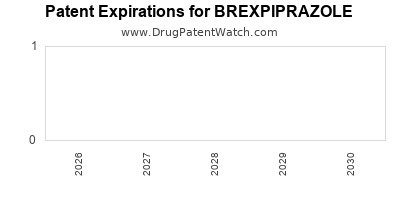

- Generic Competition: As patents expire in the future, generic versions of brexpiprazole could erode market share, pressuring prices and margins.

- Market Saturation: In regions with high penetration, growth opportunities are limited unless coupled with expanded indications.

- Uncertain Off-Label Use: Off-label prescribing can influence sales unpredictably, given regulatory scrutiny.

Future Outlook and Growth Opportunities

Expanding Indications

Clinical trials for adjunctive treatments in anxiety, bipolar disorder, and dementia-related agitation are ongoing, with positive outcomes potentially expanding the drug's use cases. Such approvals could significantly enlarge the market.

Emerging Market Penetration

Growing healthcare infrastructure in Asia-Pacific and Latin America presents opportunities for market expansion. Cost-effective marketing and local regulatory engagement are pivotal.

Competitive Innovation

Future biosimilar or generic entrants, coupled with innovation in delivery mechanisms (e.g., long-acting injectables), could reshape the competitive landscape. Otsuka’s focus on patient-centric formulations could sustain its market share.

Risks and Mitigation Strategies

- Patent Expiry Risks: Strategic patent filings and life cycle management can delay generic erosion.

- Pricing Pressures: Engagement with payers and value-based pricing models mitigate revenue risks.

- Pipeline Development: Accelerating clinical development and securing approvals for new indications sustain long-term growth.

Conclusion

Brexpiprazole’s market dynamics are shaped by its differentiated pharmacological profile, the growing burden of psychiatric disorders, and competitive forces within the antipsychotic segment. Its financial trajectory has demonstrated steady growth, buoyed by ongoing indication expansion, strategic pricing, and geographic penetration. However, patent expirations and market saturation pose risks that require vigilant management. With continued innovation and broader indication approvals, brexpiprazole is positioned to maintain a viable growth trajectory in the evolving psychiatric pharmacopeia.

Key Takeaways

- Brexpiprazole benefits from favorable tolerability, supporting long-term adherence and market acceptance.

- The drug’s revenue remains growth-oriented due to ongoing clinical trials and expanding indications.

- Competitive pressures from generics and entrenched drugs necessitate strategic differentiation and pipeline expansion.

- Emerging markets and new formulation innovations offer substantial growth opportunities.

- Long-term success depends on timely regulatory approvals, regional market strategies, and patent life cycle management.

FAQs

-

What are the primary therapeutic uses of brexpiprazole?

Brexpiprazole is approved for schizophrenia and as an adjunctive treatment for major depressive disorder.

-

How does brexpiprazole differentiate itself from other atypical antipsychotics?

It offers a unique pharmacological profile with lower metabolic side effects, improving tolerability and adherence.

-

What are the main challenges facing brexpiprazole’s market growth?

Patent expirations, competitive generic drugs, market saturation, and regulatory hurdles are principal challenges.

-

Are there ongoing clinical trials to expand brexpiprazole’s indications?

Yes, trials are underway for bipolar disorder, agitation in Alzheimer’s disease, and other psychiatric conditions.

-

What is the outlook for brexpiprazole in emerging markets?

Expanding healthcare infrastructure and strategic market entry can significantly enhance sales in developing regions.

References

- WHO. "Mental Health." World Health Organization, 2022.

- Otsuka Pharmaceutical. "Brexpiprazole Product Information." 2023.

- Otsuka Annual Report 2021.