Last updated: August 15, 2025

Introduction

Bisoprolol Fumarate, a selective beta-1 adrenergic receptor blocker, stands as a cornerstone in cardiovascular therapeutics. Prescribed primarily for hypertension and heart failure, bisoprolol's clinical efficacy and safety profile have cemented its position within the beta-blocker class. This report delineates the evolving market dynamics and financial trajectory of bisoprolol fumarate, analyzing current trends, competitive landscape, regulatory influences, and future growth prospects essential for stakeholders in the pharmaceutical sector.

Market Overview

Global Market Size and Growth Trends

The global beta-blockers market, valued at approximately USD 5.4 billion in 2022, is projected to expand at a compound annual growth rate (CAGR) of around 4.5% through 2030[1]. Bisoprolol accounts for a significant share within this segment due to its selectivity, tolerability, and dosing convenience. Key markets include North America, Europe, and Asia-Pacific, with emerging economies contributing increased adoption owing to rising cardiovascular disease prevalence.

Market Drivers

- Increasing Cardiovascular Disease (CVD) Burden: Ischemic heart disease and hypertension remain leading causes of morbidity and mortality, propelling demand for effective antihypertensives like bisoprolol.

- Aging Population: The demographic shift toward older populations enhances the prevalence of hypertension and heart failure, fueling growth.

- Therapeutic Advantages: Bisoprolol's once-daily dosing and favorable side effect profile make it a preferred choice among clinicians.

- Generic Competition: Patent expirations of branded bisoprolol products have catalyzed generic entry, increasing affordability and accessibility.

Market Restraints

- Competition from Alternative Therapies: Rising use of combination therapies and novel agents (e.g., vasodilating beta-blockers, angiotensin receptor-neprilysin inhibitors) challenge bisoprolol's market dominance.

- Regulatory Scrutiny: Concerns over beta-blockers' side effects necessitate ongoing safety evaluations and labeling considerations.

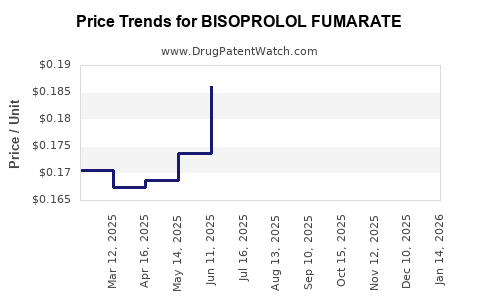

- Pricing Pressures: Discounting, especially in emerging markets, compresss profit margins for manufacturers.

Regulatory and Patent Landscape

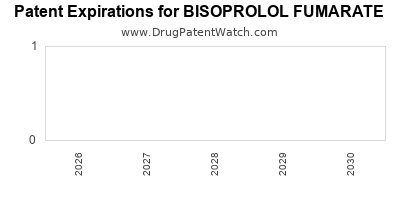

Patent Expirations and Genericization

Bisoprolol's original patents have expired in major markets, notably in the U.S. and Europe, fostering a surge in generic versions. The advent of generics accounts for over 70% of the sales volume in key regions, significantly impacting revenue streams for branded formulations[2].

Regulatory Approvals and New Indications

While primarily approved for hypertension and heart failure management, ongoing clinical research explores bisoprolol's application in postoperative arrhythmias and stroke prevention, potentially broadening its therapeutic scope.

Competitive Landscape

Key Manufacturers

- Pfizer (Now Viatris): Originally marketed bisoprolol under the brand Zebeta, now primarily through generics.

- Teva Pharmaceuticals: A major producer with extensive global distribution.

- Sandoz and Mylan: Prominent generics suppliers offering low-cost alternatives.

- Local Manufacturers: In emerging markets, local firms produce generic bisoprolol, often with significant price advantages.

Market Share Distribution

Generic manufacturers dominate in volume and value, exerting downward pressure on prices. Branded versions maintain a niche, primarily driven by physician loyalty and patient preferences where formulary restrictions favor established brands.

Financial Trajectory

Revenue Trends

Initially, branded sales of bisoprolol peaked in the late 2000s, with worldwide revenues exceeding USD 1 billion. Post-patent expiry, revenues declined substantially in developed markets but remained stable in regions with limited generic penetration.

Profitability and Pricing Dynamics

The shift to generics has compressed profit margins, with generic bisoprolol priced approximately 60-80% lower than original branded formulations. Pricing strategies focus on volume sales, particularly in cost-sensitive markets.

Emerging Markets Growth

In Asia, Latin America, and Africa, increased healthcare spending, expanding insurance coverage, and the absence of patent restrictions have transformed bisoprolol into a high-volume, low-margin product. These markets are projected to sustain growth rates of 3-6% annually over the next decade.

Investment in Formulations and Delivery

Innovations such as fixed-dose combination packs integrating bisoprolol with other antihypertensive agents are under development, promising incremental revenue streams and improved patient compliance.

Future Outlook and Growth Opportunities

Market Expansion

The continued rise in hypertension and heart failure cases, coupled with increasing awareness and diagnostic rates, supports steady demand. Expansion into neighboring indications, such as migraine prophylaxis or arrhythmia management, presents additional avenues, pending regulatory approvals.

Technological Innovations

Advanced delivery systems like transdermal patches and sustained-release formulations could improve bioavailability, adherence, and therapeutic outcomes, providing differentiation in a competitive market.

Regulatory and Policy Influences

Reimbursement policies, especially in the U.S. and Europe, favor generics, reinforcing the shift toward low-cost formulations. Conversely, stringent safety assessments could introduce hurdles, particularly with new formulations or indications.

Patent Litigation and Exclusivity

Generic manufacturers leverage patent challenges to accelerate market entry, directly impacting revenues of original innovators. Strategic patent filings and data exclusivity periods are critical for safeguarding market share.

Key Challenges and Risks

- Pricing and Reimbursement Pressure: Public payers and private insurers emphasis on cost containment limit revenue growth.

- Market Saturation: High penetration in developed markets diminishes growth potential; reliance on emerging markets increases geopolitical and economic risks.

- Clinical Practice Evolution: Adoption of newer agents with superior efficacy or safety profiles could erode bisoprolol’s market share.

- Regulatory Changes: Future safety advisories or labeling updates could affect prescribing patterns and sales.

Strategic Recommendations

- Diversify Portfolio: Invest in formulation innovations and combination therapies.

- Expand Geographically: Focus on emerging markets to leverage growth opportunities.

- Enhance Clinical Data: Support studies to confirm safety and efficacy, facilitating broader indications.

- Optimize Pricing: Balance affordability with profitability, especially in cost-sensitive markets.

- Strengthen Patent and Regulatory Protections: Continue securing intellectual property rights and navigate approvals efficiently.

Conclusion

Bisoprolol fumarate's market dynamics are characterized by a mature, highly competitive landscape influenced heavily by genericization, regulatory scrutiny, and evolving clinical needs. While revenues have declined in developed markets due to patent expiry, emerging economies present substantial growth opportunities driven by increasing cardiovascular disease burden and healthcare reform initiatives. The drug’s financial trajectory hinges on strategic adaptation to market forces, innovation, and geographic expansion.

Key Takeaways

- The global bisoprolol market remains sizable, with growth driven by the rising prevalence of cardiovascular diseases.

- Patent expirations have shifted revenue streams from branded to generic versions, compressing margins but expanding volume sales.

- Emerging markets offer significant growth prospects, although challenges include pricing pressures and regulatory hurdles.

- Innovation in formulations and broader indications could buffer against market saturation.

- Stakeholders should focus on geographic diversification, strategic patent protection, and lifecycle management to maximize long-term financial returns.

FAQs

1. What factors have contributed to the decline of branded bisoprolol sales?

Patent expirations and the subsequent entry of generic manufacturers have significantly reduced branded drug sales due to price competition and increased availability of low-cost alternatives.

2. How does the growth potential of bisoprolol vary across regions?

While mature markets experience moderate growth primarily from generic volume increases, emerging economies offer higher growth rates driven by expanding healthcare access and rising cardiovascular disease prevalence.

3. What are the future therapeutic opportunities for bisoprolol?

Potential expansion includes novel formulations (e.g., transdermal patches), fixed-dose combinations, and exploration in additional indications like arrhythmias or migraine prevention, contingent upon regulatory approval.

4. How do reimbursement policies impact bisoprolol’s market trajectory?

Reimbursement and formulary decisions favor cost-effective generics, enhancing access but limiting premium pricing for branded formulations, thus influencing revenue streams.

5. What strategic moves can pharmaceutical companies undertake to sustain bisoprolol’s profitability?

Investing in formulation innovation, expanding geographic footprint, securing robust patent protections, and supporting clinical trials for new indications are vital strategies.

References

[1] Grand View Research. "Beta-Blockers Market Size, Share & Trends Analysis Report." 2022.

[2] IMS Health. "Generic Drug Market Dynamics." 2021.