BELSOMRA Drug Patent Profile

✉ Email this page to a colleague

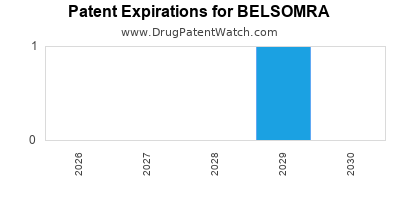

When do Belsomra patents expire, and when can generic versions of Belsomra launch?

Belsomra is a drug marketed by Merck Sharp Dohme and is included in one NDA. There are three patents protecting this drug and one Paragraph IV challenge.

This drug has seventy-five patent family members in thirty-six countries.

The generic ingredient in BELSOMRA is suvorexant. One supplier is listed for this compound. Additional details are available on the suvorexant profile page.

DrugPatentWatch® Generic Entry Outlook for Belsomra

Belsomra was eligible for patent challenges on August 13, 2018.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be November 20, 2029. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for BELSOMRA?

- What are the global sales for BELSOMRA?

- What is Average Wholesale Price for BELSOMRA?

Summary for BELSOMRA

| International Patents: | 75 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 35 |

| Clinical Trials: | 34 |

| Patent Applications: | 495 |

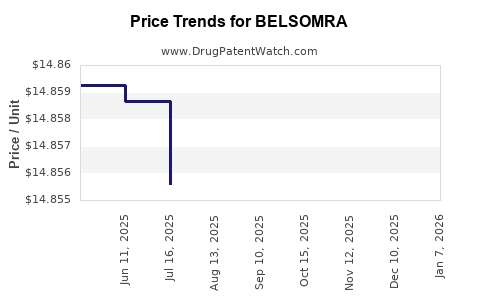

| Drug Prices: | Drug price information for BELSOMRA |

| What excipients (inactive ingredients) are in BELSOMRA? | BELSOMRA excipients list |

| DailyMed Link: | BELSOMRA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for BELSOMRA

Generic Entry Date for BELSOMRA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for BELSOMRA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Massachusetts Institute of Technology | PHASE4 |

| Massachusetts General Hospital | PHASE4 |

| Merck Sharp & Dohme LLC | Phase 2 |

Pharmacology for BELSOMRA

| Drug Class | Orexin Receptor Antagonist |

| Mechanism of Action | Cytochrome P450 3A Inhibitors Orexin Receptor Antagonists P-Glycoprotein Inhibitors |

Paragraph IV (Patent) Challenges for BELSOMRA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| BELSOMRA | Tablets | suvorexant | 5 mg, 10 mg, 15 mg and 20 mg | 204569 | 1 | 2024-03-04 |

US Patents and Regulatory Information for BELSOMRA

BELSOMRA is protected by three US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of BELSOMRA is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Merck Sharp Dohme | BELSOMRA | suvorexant | TABLET;ORAL | 204569-001 | Aug 13, 2014 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Merck Sharp Dohme | BELSOMRA | suvorexant | TABLET;ORAL | 204569-003 | Aug 13, 2014 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Merck Sharp Dohme | BELSOMRA | suvorexant | TABLET;ORAL | 204569-002 | Aug 13, 2014 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Merck Sharp Dohme | BELSOMRA | suvorexant | TABLET;ORAL | 204569-004 | Aug 13, 2014 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for BELSOMRA

When does loss-of-exclusivity occur for BELSOMRA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 3979

Estimated Expiration: ⤷ Get Started Free

Patent: 8881

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07328267

Estimated Expiration: ⤷ Get Started Free

Patent: 10249269

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0719361

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 70892

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07003441

Estimated Expiration: ⤷ Get Started Free

Patent: 10001173

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1627028

Estimated Expiration: ⤷ Get Started Free

Patent: 1880276

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 90524

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 859

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0130002

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 13798

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 89382

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 009000126

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 099374

Estimated Expiration: ⤷ Get Started Free

El Salvador

Patent: 09003276

Patent: ANTAGONISTAS DE RECEPTOR DE OREXINA DE DIAZEPAN SUSTITUIDO

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 89382

Estimated Expiration: ⤷ Get Started Free

Patent: 92572

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 09001067

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 28691

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 75427

Estimated Expiration: ⤷ Get Started Free

Patent: 35758

Estimated Expiration: ⤷ Get Started Free

Patent: 67803

Estimated Expiration: ⤷ Get Started Free

Patent: 10511621

Estimated Expiration: ⤷ Get Started Free

Patent: 11068665

Estimated Expiration: ⤷ Get Started Free

Patent: 11079848

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 1834

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09005712

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 016

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7334

Patent: SUBSTITUTED DIAZEPAN COMPOUNDS AS OREXIN RECEPTOR ANTAGONISTS

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 0900100

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 2586

Estimated Expiration: ⤷ Get Started Free

Patent: 092470

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 081229

Patent: ANTAGONISTAS DE RECEPTOR DE OREXINA DE DIAZEPAM SUSTITUIDO

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 89382

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 89382

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 58924

Patent: СОЕДИНЕНИЯ ЗАМЕЩЕННЫХ ДИАЗЕПАНОВ В КАЧЕСТВЕ АНТАГОНИСТОВ ОРЕКСИНОВЫХ РЕЦЕПТОРОВ (DIAZEPANE SUBSTITUTED COMPOUNDS AS OREXIN RECEPTOR ANTAGONISTS)

Estimated Expiration: ⤷ Get Started Free

Patent: 61727

Patent: СОЕДИНЕНИЯ ЗАМЕЩЕННЫХ ДИАЗЕПАНОВ В КАЧЕСТВЕ АНТАГОНИСТОВ ОРЕКСИНОВЫХ РЕЦЕПТОРОВ (COMPOUNDS OF SUBSTITUTED DIAZEPANES AS ANTAGONISTS OF OREXIN RECEPTORS)

Estimated Expiration: ⤷ Get Started Free

Patent: 09125024

Patent: СОЕДИНЕНИЯ ЗАМЕЩЕННЫХ ДИАЗЕПАНОВ В КАЧЕСТВЕ АНТАГОНИСТОВ ОРЕКСИНОВЫХ РЕЦЕПТОРОВ

Estimated Expiration: ⤷ Get Started Free

Patent: 10150818

Patent: СОЕДИНЕНИЯ ЗАМЕЩЕННЫХ ДИАЗЕПАНОВ В КАЧЕСТВЕ АНТАГОНИСТОВ ОРЕКСИНОВЫХ РЕЦЕПТОРОВ

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 617

Patent: SUPSTITUISANA JEDINJENJA DIAZEPANA KAO ANTAGONISTI RECEPTORA ZA OREKSIN (SUBSTITUTED DIAZEPAN COMPOUNDS AS OREXIN RECEPTOR ANTAGONISTS)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 89382

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0903334

Patent: Substituted diazepan compounds as orexin receptor antagonists

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1217057

Estimated Expiration: ⤷ Get Started Free

Patent: 1299426

Estimated Expiration: ⤷ Get Started Free

Patent: 090087110

Estimated Expiration: ⤷ Get Started Free

Patent: 100031767

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 97188

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 13696

Estimated Expiration: ⤷ Get Started Free

Patent: 15188

Estimated Expiration: ⤷ Get Started Free

Patent: 0831494

Patent: Substituted diazepan orexin receptor antagonists

Estimated Expiration: ⤷ Get Started Free

Patent: 1109318

Patent: Substituted diazepan orexin receptor antagonists

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 0974

Patent: СОЕДИНЕНИЯ ЗАМЕЩЕННЫХ ДИАЗЕПАНОВ КАК АНТАГОНИСТЫ ОРЕКСИНОВЫХ РЕЦЕПТОРОВ;СПОЛУКИ ЗАМІЩЕНИХ ДІАЗЕПАНІВ ЯК АНТАГОНІСТИ ОРЕКСИНОВИХ РЕЦЕПТОРІВ (SUBSTITUTED DIAZEPAN COMPOUNDS AS OREXIN RECEPTOR ANTAGONISTS)

Estimated Expiration: ⤷ Get Started Free

Patent: 6873

Patent: СПОЛУКИ ЗАМІЩЕНИХ ДІАЗЕПАНІВ ЯК АНТАГОНІСТИ ОРЕКСИНОВИХ РЕЦЕПТОРІВ

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering BELSOMRA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Korea | 20150014940 | SOLID DOSAGE FORMULATIONS OF AN OREXIN RECEPTOR ANTAGONIST | ⤷ Get Started Free |

| Mexico | 368859 | FORMULACIONES DE DOSIS SOLIDA DE UN ANTAGONISTA DEL RECEPTOR DE OREXINA. (SOLID DOSAGE FORMULATIONS OF AN OREXIN RECEPTOR ANTAGONIST.) | ⤷ Get Started Free |

| Peru | 20081229 | ANTAGONISTAS DE RECEPTOR DE OREXINA DE DIAZEPAM SUSTITUIDO | ⤷ Get Started Free |

| Russian Federation | 2019126797 | СОСТАВЫ ТВЕРДЫХ ДОЗИРОВАННЫХ ЛЕКАРСТВЕННЫХ ФОРМ АНТАГОНИСТА ОРЕКСИНОВОГО РЕЦЕПТОРА | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for BELSOMRA (Suvorexant)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.