Share This Page

Drug Price Trends for BELSOMRA

✉ Email this page to a colleague

Average Pharmacy Cost for BELSOMRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BELSOMRA 10 MG TABLET | 00006-0033-10 | 14.85459 | EACH | 2025-12-17 |

| BELSOMRA 15 MG TABLET | 00006-0325-10 | 14.85770 | EACH | 2025-12-17 |

| BELSOMRA 5 MG TABLET | 00006-0005-10 | 14.86895 | EACH | 2025-12-17 |

| BELSOMRA 5 MG TABLET | 00006-0005-30 | 14.86895 | EACH | 2025-12-17 |

| BELSOMRA 10 MG TABLET | 00006-0033-30 | 14.85459 | EACH | 2025-12-17 |

| BELSOMRA 20 MG TABLET | 00006-0335-10 | 14.85204 | EACH | 2025-12-17 |

| BELSOMRA 15 MG TABLET | 00006-0325-30 | 14.85770 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Belsomra (Suvorexant)

Introduction

Belsomra (suvorexant) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) in 2014 for the treatment of insomnia characterized by difficulty with sleep onset and/or sleep maintenance. As a dual orexin receptor antagonist, Belsomra marks a novel pharmacological approach in sleep disorder therapeutics, competing in a growing market landscape. This analysis assesses Belsomra's current market positioning, competitive environment, and projects its pricing trajectory over the next five years, considering regulatory, economic, and clinical factors.

Market Landscape and Dynamics

The global insomnia market is expanding notably, driven by increasing prevalence, aging populations, and growing awareness of sleep disorders. According to Grand View Research, the global sleep disorder therapeutics market was valued at approximately USD 7.8 billion in 2022 and is expected to grow at an CAGR of 7.2% from 2023 to 2030. Belsomra occupies a premium segment, targeting a subset of patients inadequately served by traditional sedative-hypnotics such as benzodiazepines and non-benzodiazepine receptor agonists.

Key Market Drivers:

- Increasing Insomnia Prevalence: Chronic insomnia affects 10-30% of adults globally, with higher incidences among older adults and those with comorbid conditions.

- Shift Toward Safer Therapies: Clinicians are increasingly cautious of the adverse effects linked to traditional sleep aids, including dependence and cognitive impairment, favoring novel mechanisms like orexin antagonism.

- Expanding Indications: Current approval limits Belsomra to insomnia, but ongoing trials explore broader sleep-related disorders, potentially expanding its market.

Competitive Environment: Belsomra's primary competitors include:

- Non-benzodiazepine hypnotics: Zolpidem (Ambien), Eszopiclone (Lunesta), and Zaleplon (Sonata).

- Other orexin antagonists: Upcoming drugs like Suvorexant's derivatives and alternative mechanisms.

While Belsomra faces stiff generic competition for older hypnotics, its unique mechanism offers a premium positioning, particularly for patients with contraindications or adverse reactions to traditional agents.

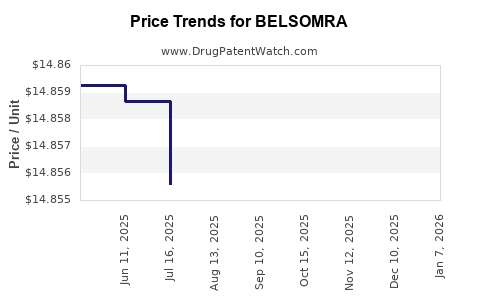

Pricing Overview and Historical Trends

When launched, Belsomra was priced approximately at USD 10-15 per tablet, reflecting its premium status and innovative mechanism. Current retail prices vary by region, formulation, and pharmacy, but in the U.S., the average wholesale price (AWP) hovers around USD 12-15 per tablet, with a typical treatment regimen involving 10-20 mg taken at bedtime.

Insurance and Reimbursement Impact:

- Many insurers categorize Belsomra as a specialty drug, influencing copay structures. Patients often face copays ranging from USD 30-50 per month, although manufacturer assistance programs mitigate costs.

Pricing Trends:

- Since launch, no significant price reductions have taken place, maintaining high per-unit costs aligned with specialty drug policies.

- Brand premiums are justified by clinical benefits, albeit with competitive pressure from generics in the future, which could impact pricing.

Forecasting Price Trends (2023–2028)

Given current market dynamics and drug development trajectories, several scenarios influence Belsomra’s future pricing:

1. Consolidation and Biosimilar Entry:

- While no biosimilar competitors for suvorexant are currently approved, heightened interest in sleep disorder therapeutics could stimulate competitive entries over five years.

- Introduction of generics typically reduces prices by 40-60%, contingent on patent life and market exclusivity.

2. Expanded Indications and Formulations:

- Approval for additional sleep disorders or new formulations (e.g., injectable, longer-acting) could command premium pricing or influence volume-based discounts.

- Extended-release formulations may allow for higher pricing due to enhanced convenience and efficacy.

3. Market Penetration and Reimbursement Policies:

- Increasing adoption in outpatient and hospital settings, combined with tighter reimbursement standards, could pressure prices downward.

- However, if Belsomra sustains its position as the preferred orexin antagonist for specific patient subsets, premium pricing could persist.

4. Regulatory and Patent Landscape:

- Patent expirations set for the late 2020s will open the market for generics, likely precipitating a sharp price decline.

- Patent litigations or supplementary patents on formulations could temporarily delay generic entry, maintaining high prices.

Projected Price Trajectory:

- 2023–2025: Prices stabilized at approximately USD 12-15 per tablet, with minor fluctuations due to market adjustments.

- 2026–2028: Anticipated patent expiration and generic entry could depress prices to USD 5-8 per tablet, aligning with typical generic reductions.

Implications for Stakeholders

Pharmaceutical Companies:

- Investment in patent protection and formulation innovations can sustain premium pricing.

- Strategic launch of extended formulations might maximize revenue before patent expiry.

Healthcare Providers:

- Understanding pricing trends helps optimize prescribing practices—balancing efficacy, safety, and cost.

- Awareness of potential price reductions informs budgetary decisions and formulary management.

Patients and Payers:

- Anticipated price drops post-patent expiry will increase access but may influence brand loyalty.

- Insurers may prefer generics, affecting Belsomra’s premium positioning.

Conclusion

Belsomra occupies a strategic niche in the insomnia treatment landscape, leveraging its novel mechanism to command premium pricing. While current prices are stable, impending patent expirations and market evolution portend significant price reductions by 2028. Stakeholders must consider these dynamics in research, investment, and clinical decision-making.

Key Takeaways

- Belsomra’s market position is reinforced by its unique mechanism as a dual orexin antagonist, addressing unmet needs in insomnia care.

- Current pricing remains high, driven by clinical innovation and limited generics; ongoing reimbursement strategies support sustained premium pricing.

- Patent expiration around the late 2020s is likely to trigger price erosion, with generic versions potentially reducing the cost per tablet by over 50%.

- Market expansion through new indications and formulations offers opportunities for maintaining higher price points but faces competition from conventional sleep aids.

- Regulatory and market factors necessitate vigilant monitoring for positioning strategies, especially approaching patent cliffs.

FAQs

1. How does Belsomra compare to traditional sleep aids in terms of cost?

Belsomra’s premium price reflects its novel mechanism and clinical benefits; traditional hypnotics like zolpidem are generally lower-cost, especially post-generic entry.

2. When are generic versions of suvorexant expected to enter the market?

Patent protections are expected to expire around 2026–2028, after which generics are likely to enter, significantly reducing prices.

3. Will expanding indications increase Belsomra’s market share?

Potentially, yes. Approved additional uses could broaden its patient population, supporting higher revenues before patent expiry.

4. How do insurance plans typically cover Belsomra?

It is categorized as a specialty drug, often requiring prior authorization; copays range from USD 30-50 monthly, with assistance programs available.

5. What factors could delay or accelerate price reductions?

Patent litigation, formulation innovations, and market uptake influence timing. Biosimilar development and regulatory changes could accelerate price declines.

References:

[1] Grand View Research. Sleep Disorder Therapeutics Market Analysis (2022).

[2] FDA approval documents for Belsomra.

[3] Industry pricing reports and formulary data (2023).

More… ↓