Last updated: July 30, 2025

Introduction

AVAPRO, the brand name for the angiotensin II receptor blocker (ARB) irbesartan, has established itself as a key player in the management of hypertension and diabetic nephropathy. Since its approval, AVAPRO has navigated evolving market conditions influenced by regulatory changes, competitive dynamics, and healthcare trends. This analysis explores the current market landscape, factors shaping its financial trajectory, and strategic opportunities for stakeholders.

Market Overview

Therapeutic Segment and Demand Drivers

AVAPRO operates primarily within the antihypertensive and nephrology segments. The global prevalence of hypertension, estimated at over 1.3 billion individuals (WHO, 2021), sustains consistent demand for effective agents like AVAPRO. Furthermore, the rising incidence of diabetic nephropathy—affording additional therapeutic relevance to irbesartan—amplifies its market potential.

Regulatory Environment

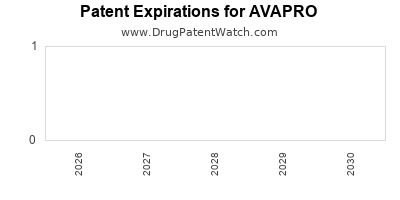

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) regulate ARBs under rigorous standards. The expiration of basic patents and the subsequent proliferation of generic versions have significantly impacted AVAPRO's market share. Generic entry typically correlates with substantial price erosion, influencing revenue streams and market positioning.

Market Competition

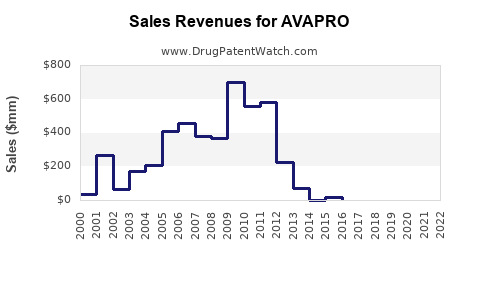

The ARB class faces competition from multiple drugs, notably losartan, valsartan, and newer agents like azilsartan. The competitive landscape is further complicated by patent litigations and biosimilar developments. For example, the expiration of irbesartan’s patent in the U.S. in 2017 precipitated a sharp decline in branded sales, replaced largely by generics.

Financial Trajectory

Revenue Trends and Market Share

Initially, AVAPRO experienced robust growth, driven by its efficacy and favorable safety profile. However, patent expirations led to a steep decline in branded sales. According to IQVIA data, in the U.S., AVAPRO’s sales peaked around 2012, with subsequent rapid decline post-generic entry [1]. Globally, the drug's revenue profile has similarly shifted, with revenues increasingly attributable to generics.

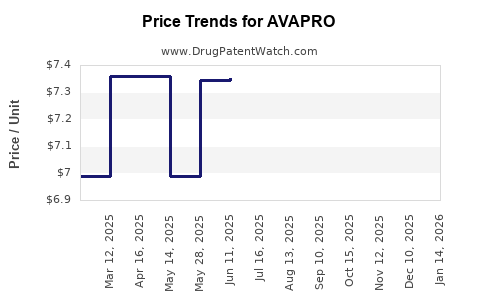

Pricing Dynamics

While brand-name AVAPRO commanded premiums, the advent of generics caused a steep price reduction—often over 80%. The price erosion directly impacts profit margins but enables broader accessibility, which may support volume-driven revenue strategies in emerging markets.

Market Expansion and Strategic Alliances

Emerging markets such as China and India, with their expanding healthcare infrastructure and rising hypertension prevalence, represent key growth opportunities. Partnering with local distributors or engaging in licensing agreements can drive volume sales. Additionally, some manufacturers explore fixed-dose combinations (FDCs) enhancing adherence and competitive differentiation.

Pipeline and Future Developments

While the original irbesartan molecule is now available generically, ongoing efforts focus on novel indications, combination therapies, or modified formulations to extend product life cycles. Nonetheless, the current primary revenue driver remains generic sales.

Market Challenges and Opportunities

Challenges

- Patent Expiry and Generics: The dominant challenge stems from patent expiration, leading to commoditization and price competition.

- Regulatory Hurdles: Variations in approval processes and drug registration requirements across countries hinder swift market expansion.

- Market Saturation: Mature markets exhibit limited growth potential, necessitating diversification.

Opportunities

- Biosimilars and Innovative Formulations: Investing in new formulations or biosimilar derivatives could recast AVAPRO’s market positioning.

- Expanding Indications: Emerging evidence supports broader use in conditions such as heart failure or stroke prevention, potentially creating new revenue streams.

- Digital and Precision Medicine Initiatives: Leveraging digital adherence tools or personalized dosing strategies can differentiate future offerings.

Conclusion: Financial Outlook

The outlook for AVAPRO's revenue primarily hinges on the management of patent expiration impacts and strategic adaptation to generic competition. While traditional branded sales have declined markedly, revenues generated via generics, licensing, and newer indications underpin a stable but evolving financial trajectory. Stakeholders should focus on innovation, geographic expansion, and value-added services to sustain long-term profitability.

Key Takeaways

- Patent expiration has significantly shifted AVAPRO’s revenue from brand-name sales to generics, requiring strategic adaptation.

- Market expansion in emerging economies offers substantial growth potential, especially with local partnerships.

- Future financial strength depends on diversification into new indications, formulations, and leveraging digital health trends.

- Competitive dynamics demand ongoing innovation to mitigate intense price competition from alternative ARBs.

- Lifecycle management strategies, including combination therapies and biosimilars, are essential to extend AVAPRO’s market relevance.

FAQs

-

What caused the decline in AVAPRO’s sales post-2017?

Patent expiration and the entry of generic irbesartan dramatically reduced branded sales, naturally shifting revenues toward generics.

-

Are there new therapeutic indications for AVAPRO beyond hypertension and diabetic nephropathy?

Current research explores potential uses in heart failure and stroke prevention, but these are not yet approved indications.

-

How can pharmaceutical companies sustain profits for drugs like AVAPRO post-patent expiration?

Strategies include developing improved formulations, exploring new indications, expanding geographies, and engaging in licensing deals.

-

What are the primary health policy drivers influencing AVAPRO’s market?

Increased emphasis on hypertension control, guidelines favoring ARBs over ACE inhibitors, and access initiatives in emerging markets bolster demand.

-

What is the future outlook for branded AVAPRO in a landscape dominated by generics?

The future is likely constrained unless innovative differentiation efforts emerge. Focus on niche markets or combination therapies may offer viable paths.

Sources:

[1] IQVIA. (2022). Global Pharmaceutical Market Data.