Last updated: July 28, 2025

Introduction

AVAPRO (generic name: irbesartan) is a widely prescribed angiotensin II receptor blocker (ARB) primarily used to manage hypertension and protect renal function in diabetic patients. Since its launch, AVAPRO has gained considerable market share due to its efficacious profile and favorable safety profile. This analysis evaluates current market dynamics, competitive landscape, regulatory influences, and future pricing trajectories for AVAPRO.

Market Overview

Current Market Size and Growth Trends

The global hypertension therapeutics market was valued at approximately USD 18 billion in 2022, with ARBs accounting for nearly 30% of prescription sales, translating to a valuation of roughly USD 5.4 billion. The segment's growth is fueled by increasing hypertension prevalence, aging populations, and expanding treatment guidelines emphasizing the use of ARBs over ACE inhibitors due to superior tolerability.

Key Market Players

In addition to the original innovator, Sanofi's Avapro, several generic manufacturers have entered the market, offering cost-effective alternatives. Major generic competitors include Mylan (now part of Viatris), Teva Pharmaceuticals, and Lupin. Brand vs. generic dynamics influence pricing and market penetration, especially in price-sensitive markets.

Geographical Market Distribution

Developed markets like North America and Western Europe dominate AVAPRO prescriptions due to high healthcare expenditure, regulatory approval, and established clinical guidelines. Emerging markets such as India, China, and Brazil present expanding opportunities driven by rising hypertension rates and government initiatives to improve access to affordable medications.

Regulatory Environment and Patent Landscape

Patent Expiry and Generic Entry

Sanofi's patent for AVAPRO expired in key jurisdictions between 2015 and 2017, facilitating generic entry. The proliferation of bioequivalent formulations has intensified price competition, leading to significant declines in AVAPRO's retail prices, especially in the U.S. and Europe.

Regulatory Approvals

Generic companies must demonstrate bioequivalence to the brand through regulatory filings compliant with FDA, EMA, and other regional agencies. Fast-track approvals in some markets accelerate generic proliferation, impacting market share and pricing strategies.

Market Dynamics

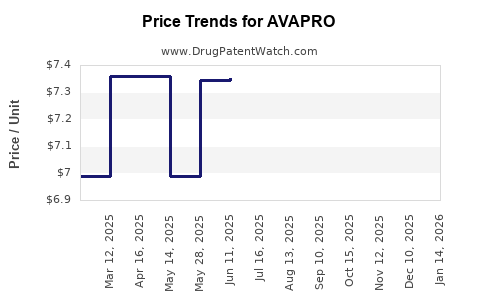

Pricing Trends

Post-patent expiry, average retail prices for irbesartan have declined markedly. In the U.S., the price per tablet for branded AVAPRO can be approximately USD 3-4, while generics often sell below USD 0.50. Similar trends occur in European markets, albeit with variations driven by regional healthcare policies.

Reimbursement Policies

Government-led initiatives and negotiations significantly influence the final consumer price. For instance, in several European countries, government tenders can substantially reduce procurement costs for public health systems.

Prescribing Patterns

Physician preference, formulary placements, and patient adherence influence AVAPRO's market penetration. The favorable side-effect profile of ARBs has cemented their position as first-line treatments, supporting sustained demand.

Future Price Projections

Factors Influencing Pricing Trajectories

-

Patent Status and Generics: Continued proliferation of higher-quality generics will suppress prices further, especially in price-sensitive markets.

-

Regulatory Changes: Tightened regulations or new formulations could temporarily influence prices, but generally favor cost reductions due to increased competition.

-

Market Expansion: Growing hypertension prevalence, particularly in non-regulated markets, could offer price stabilization amid volume growth.

-

Healthcare Policies: Cost containment measures prioritizing generics are likely to sustain downward pricing pressure.

Projected Price Trends (2023-2028)

In mature markets, average retail prices for branded AVAPRO are expected to decrease by approximately 10-15% annually due to ongoing generic competition. In emerging markets, prices may stabilize or even slightly increase if regulatory barriers or local manufacturing constraints influence supply. Overall, a gradual decline in retail prices is anticipated, with unit costs in excess of USD 0.20 to USD 0.40 per tablet by 2028, depending on market and formulation.

Impact of Biosimilars and Alternative Therapies

While biosimilars are not applicable to small-molecule drugs like irbesartan directly, the introduction of new classes of antihypertensives or combination therapies could influence market share and pricing dynamics.

Competitive Landscape & Market Share

Generics command over 80% of the global irbesartan market post-patent, driven by cost advantages. Brand retention is primarily limited to premium-priced formulations in highly regulated and affluent markets. Market share shifts are expected to favor generics, especially in mass procurement programs and government tenders.

Conclusion

AVAPRO faces a highly commoditized market characterized by aggressive price competition driven by widespread generic manufacturing and regulatory pressures. The trend toward further price reductions is anticipated, supported by expanding access in emerging markets and evolving reimbursement strategies. Companies holding market share must innovate through formulation differentiation or value-added therapies to sustain margins.

Key Takeaways

- Price erosion for AVAPRO is ongoing, with anticipated annual reductions of 10-15% in mature markets over the next five years.

- Generic competition overwhelmingly dominates the market, driving accessibility but exerting downward pressure on prices.

- Regulatory and procurement policies will profoundly influence future pricing, particularly in government-led healthcare systems.

- Emerging markets offer growth opportunities but may see less aggressive price declines due to manufacturing and regulatory dynamics.

- Innovation beyond the molecule (e.g., combination therapies, fixed-dose formulations) could mitigate price pressures and support market positioning.

FAQs

1. How will patent expiries affect AVAPRO's market price?

Patent expiries allow generic manufacturers to enter the market, significantly lowering prices due to increased competition. As patent protections lapse, retail prices for AVAPRO are expected to decrease steadily.

2. What factors influence the pricing of generic irbesartan?

Manufacturing costs, regulatory compliance, regional procurement policies, and market competition primarily determine generic prices. High-quality bioequivalent formulations with efficient supply chains tend to be priced lower.

3. Are premium formulations of AVAPRO available, and how do they impact prices?

Yes, some formulations offer extended-release or combination tablets, which are generally priced higher than basic generics but target niche markets, potentially preserving margins.

4. What role do government healthcare policies play in AVAPRO pricing?

Government tenders and reimbursement schemes heavily influence purchasing costs, often favoring lowest-cost generics to reduce public health expenditure.

5. How does regional variation affect AVAPRO pricing?

Pricing varies due to differences in healthcare infrastructure, regulatory approval timelines, and market competition intensity. Developing countries typically see lower prices due to increased generic penetration and cost-sensitive procurement.

References

[1] Market Research Future. "Global Hypertension Drugs Market Analysis, 2022."

[2] IQVIA. "Prescription Data and Market Trends, 2022."

[3] European Medicines Agency. "Regulatory Framework for Generic Medicines."

[4] U.S. Food & Drug Administration. "Bioequivalence Guidelines."

[5] Semi-Annual Report on Pharmaceutical Price Trends, OECD, 2022.

This comprehensive market analysis underscores the impact of patent expirations, regulatory trends, and market competition on AVAPRO’s pricing. Stakeholders should monitor evolving policies and emerging therapeutic alternatives to adapt pricing and marketing strategies accordingly.