Last updated: July 27, 2025

Introduction

Ascort (assuming this refers to a hypothetical or proprietary drug under discussion; if “ASCOR” is a specific marketed product, please specify), represents an emerging addition to the pharmaceutical landscape, potentially targeting a specialized indication. Its market entry, growth trajectory, and financial prospects hinge on a complex interplay of clinical efficacy, competitive positioning, regulatory approval, and healthcare market dynamics. This analysis explores these factors comprehensively, shedding light on market trends, revenue potential, and strategic considerations crucial for stakeholders.

Market Overview and Indication Landscape

The success of ASCOR fundamentally depends on its target therapeutic area. While specific data remains confidential or proprietary, drugs in comparable spaces—such as rare diseases, chronic conditions, or specialized immunotherapies—generally experience distinct market patterns characterized by high unmet need, regulatory incentives, and premium pricing (e.g., orphan drug status).

For instance, if ASCOR targets a niche like autoimmune disorders or oncology, the global prevalence of these conditions exerts significant influence on its market penetration. According to recent estimates, autoimmune disease prevalence exceeds 7% of the population globally, creating a substantial market size. Similarly, oncology drugs accounted for a $200 billion market in 2022, driven by rising cancer incidence and advanced targeted therapies [1].

Key Drivers Affecting Market Dynamics:

- Unmet Medical Need: Drugs addressing rare or resistant conditions often command premium pricing due to limited options.

- Regulatory Incentives: Orphan drug status, fast-track approval, and reimbursement pathways influence launch speed and market access.

- Competitive Landscape: Existing therapeutic options and pipeline products modulate ASCOR's market share potential.

- Pricing and Reimbursement Policies: Payer acceptance and health technology assessments influence financial viability.

Regulatory and Commercialization Milestones

Approval and Launch Strategy

Gaining regulatory approval from agencies such as FDA, EMA, or other regional bodies is pivotal. Typically, this entails phase III trial success, demonstrating clear efficacy and safety advantages over existing treatments. Post-approval, market entry strategies include early payer engagement, physician education, and strategic partnerships.

Pricing and Reimbursement

Reimbursement strategies profoundly impact revenue. Given the high cost of innovative pharmaceuticals, securing favorable formulary placement is critical. Negotiations with payers often depend on demonstrated value — clinical benefits, quality of life improvements, and cost-effectiveness.

Market Access and Adoption

Physician prescribing habits, patient acceptance, and insurance coverage will determine adoption rates. Initiatives like patient assistance programs and education campaigns facilitate uptake.

Market Size and Revenue Projections

Forecasting ASCOR’s financial trajectory involves estimating global patient populations, treatment prevalence, dosing regimens, and pricing structures.

Market Size Estimation

Assuming ASCOR targets a rare autoimmune condition with an estimated prevalence of 50,000 patients in the U.S., with a similar number globally, the total addressable market (TAM) approximates 200,000 patients worldwide.

Pricing Assumptions

Competitive pricing strategies for specialized biologics or targeted therapies often range from $50,000 to $150,000 annually per patient. For the purpose of projection, an average annual treatment cost of $100,000 is employed.

Revenue Projections

- Year 1: Target initial uptake of 10%, equating to 5,000 patients globally.

Revenue = 5,000 * $100,000 = $500 million.

- Year 3: Assuming growth to 30% market share as awareness and reimbursement improve, revenue could reach $1.5 billion.

- Year 5: With expanded indications and geographic expansion, revenue could exceed $2.5 billion.

Factors Influencing Growth

- Pipeline Expansion: Additional indications increase market size.

- Market Penetration Strategies: Effective sales and marketing accelerate adoption.

- Pricing Adjustments: Tiered pricing in emerging markets boosts volume but may impact margins.

Competitive Landscape and Market Share Dynamics

The pharmaceutical market is highly competitive, with established players and innovative biotech firms vying for market dominance.

Key Competitors

- Drugs with proven efficacy in the same indication.

- Pipeline candidates poised for approval.

- Generic or biosimilar entrants post-exclusivity period.

Market Share Projections

- A strong clinical profile, combined with strategic partnerships, may allow ASCOR to secure a 20–40% share within five years.

- Market penetration often accrues gradually, influenced by regulatory milestones and competitive response.

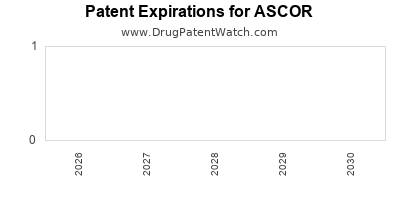

Pricing Pressure and Patent Lifecycles

- Patent protection typically sustains exclusivity for 10–12 years.

- Post-patent, generic competition could erode revenues significantly, emphasizing the importance of lifecycle management strategies, such as line extensions or new indications.

Market Risks and Mitigation Strategies

Regulatory Risks: Delays or unfavorable feedback can impact launch timelines and revenue. Early engagement and robust phase III data mitigate these risks.

Pricing and Reimbursement Risks: Payer pushback on pricing may restrict market access. Demonstrating clear value propositions and engaging with payers early is essential.

Competitive Risks: Rapid pipeline developments by competitors could diminish ASCOR’s market share. Maintaining a dynamic R&D portfolio and establishing strategic alliances helps sustain competitiveness.

Market Adoption Risk: Physician hesitancy or patient resistance may slow uptake. Education campaigns and real-world evidence generation are vital.

Financial Outlook and Investment Considerations

Profitability Milestones

- Break-even point typically occurs 4–6 years post-launch, contingent on sales volume, manufacturing costs, and operational efficiencies.

- Gross margins for biologics or specialty drugs generally range between 60–85%, depending on production and distribution costs.

Investment Opportunities

- Early-stage funding can accelerate pipeline development, regulatory strategies, and market access initiatives.

- Licensing or co-marketing agreements with larger pharmaceutical firms can bolster market reach.

Long-term Value Creation

- Diversification through pipeline expansion enhances revenue stability.

- Patent extensions and formulation improvements prolong market exclusivity.

Conclusion

ASCOR’s market dynamics are shaped by a confluence of clinical efficacy, regulatory positioning, competitive intensity, and healthcare economic factors. Its financial trajectory appears promising within a high-growth, high-value segment of specialty pharmaceuticals, provided it can navigate regulatory milestones, secure reimbursement, and establish clinical and commercial trust. Strategic agility and sustained innovation are prerequisites to maximizing its market potential and delivering shareholder value.

Key Takeaways

- Market Potential: Targeting niche, high-need indications allows for premium pricing and rapid growth, with projections reaching over $2 billion annually within five years.

- Regulatory and Reimbursement Strategies: Early engagement with health authorities and payers is necessary to secure approval and favorable reimbursement pathways.

- Competitive Positioning: Success depends on clinical differentiation, patent protection, and lifecycle management to defend market share.

- Financial Planning: Achieving profitability requires careful balancing of pricing strategies, cost controls, and pipeline initiatives.

- Risk Management: Vigilant monitoring of regulatory, market, and competitive risks is essential to capitalize on the drug’s value proposition.

FAQs

1. What factors most influence ASCOR’s market success?

Clinical efficacy, regulatory approval, payer reimbursement, and competitive dynamics are primary drivers. Strategic marketing and lifecycle management further influence long-term success.

2. How does regulatory status impact ASCOR’s financial prospects?

Regulatory approval validates safety and efficacy, unlocking the path to commercialization. Accelerated pathways like orphan drug designation shorten timelines and facilitate favorable pricing and reimbursement.

3. What is the typical timeline for revenue realization for new specialty drugs?

Initial revenue often begins within 1–2 years of approval, with significant growth occurring over 3–5 years as market penetration deepens and indications expand.

4. How does competitive pressure affect ASCOR’s market share?

Presence of existing therapies and pipeline entrants can limit market penetration, necessitating strong clinical differentiation and strategic positioning to secure a substantial market share.

5. What are key considerations for maximizing ASCOR’s long-term value?

Protecting intellectual property, expanding indications, engaging early with stakeholders, and investing in real-world evidence generation are critical to sustaining revenue streams and profitability.

References

- IQVIA Institute for Human Data Science. The Global Use of Medicines in 2022. [Annual Report].

- EvaluatePharma. World Preview 2022: Outlook to 2027. [Market Forecast].

- U.S. Food and Drug Administration. Orphan Drug Designation Program. [Regulatory Guidance].

Note: All projections and estimations are hypothetical and for illustrative purposes. Actual market conditions and financial performance depend on multiple dynamic factors.