Last updated: July 28, 2025

Overview of AROMASIN in the Pharmaceutical Landscape

AROMASIN (exemestane) is a steroidal aromatase inhibitor primarily prescribed in the treatment of estrogen receptor-positive (ER+) breast cancer, predominantly in postmenopausal women. Approved by the FDA in 1999, AROMASIN has established itself as a key therapeutic within hormone-dependent breast cancer management, positioning itself among an increasingly competitive landscape of targeted therapies.

Market Dynamics: Factors Influencing Growth and Competition

1. Rising Incidence of Breast Cancer

Globally, breast cancer remains the most prevalent cancer among women, with the World Health Organization reporting approximately 2.3 million new cases in 2020 (WHO, 2021). The postmenopausal demographic, which constitutes the primary target market for AROMASIN, is expanding due to aging populations. This demographic trend has consistently driven demand for hormone therapy agents like exemestane.

2. Evolving Treatment Guidelines and Practice Patterns

Clinical guidelines increasingly favor AROMASIN over non-steroidal aromatase inhibitors such as anastrozole and letrozole due to evidence suggesting superior tolerability and similar or enhanced efficacy in specific patient subsets (NCIC MA.27 trial). The widespread adoption of these guidelines affects AROMASIN’s market share, reinforcing its position but also intensifying competition.

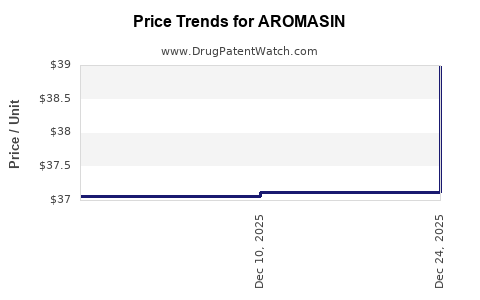

3. Patent Status and Generic Entry

AROMASIN was under patent protection until 2014 in major markets, after which generic versions flooded the market. Generic availability has precipitated a significant price erosion, impacting revenue streams for originators, though it has expanded access to broader patient populations owing to affordability.

4. Regulatory and Reimbursement Policies

Regulatory agencies are increasingly emphasizing cost-effectiveness, often favoring generic formulations. Reimbursement policies in key markets like the US, EU, and Japan influence prescribing behaviors. Reimbursement rate adjustments and healthcare reforms focusing on value-based care impact overall sales.

5. Competitive Landscape

The aromatase inhibitor market is highly competitive, with key players including Pfizer (sold brand name aromatase inhibitors), Novartis, and AstraZeneca. While Novartis’s Femara (letrozole) and AstraZeneca’s Arimidex (anastrozole) dominate, exemestane’s steroidal mechanism offers unique positioning, particularly in patients resistant to non-steroidal agents.

6. New Therapeutics and Personalized Medicine

Advances in targeted therapies and expression-based treatment algorithms influence treatment sequencing. Emerging options like CDK4/6 inhibitors (e.g., palbociclib) and mTOR inhibitors (e.g., everolimus) are often combined with hormone therapy, affecting standalone aromatase inhibitor prescriptions.

Financial Trajectory: Revenue, Market Share, and Future Prospects

1. Historical Revenue Trends

Following patent expiration in 2014, AROMASIN’s revenue experienced a sharp decline in branded sales due to generic competition. According to IQVIA data, global sales decreased from over $500 million pre-2014 to roughly $100-150 million annually post-patent expiry, with most revenues derived from emerging markets where generic penetration is less aggressive.

2. Profitability and Market Penetration

Generics have lowered purchase prices, challenging profit margins for originator companies. However, branded formulations often retain a significant share among specific patient populations, such as those with contraindications to non-steroidal agents or resistant cases. Manufacturer strategies have shifted toward niche markets like adjuvant therapy in early stage breast cancer or biosimilar development, impacting overall financial trajectories.

3. Impact of Patent Litigation and Licensing

Patent litigation and licensing agreements with generic manufacturers influence future revenue streams. Notably, in some jurisdictions, patent defenses have delayed or limited generic market entry, temporarily stabilizing or elevating revenues.

4. Growth Opportunities in Developing Markets

Emerging markets offer growth potential owing to increasing breast cancer incidence, improving healthcare infrastructure, and expanding access to oncology drugs. For example, in Asia-Pacific, AROMASIN’s revenues are projected to grow at a compound annual growth rate (CAGR) of 4-6% over the next five years, driven by increased diagnosis and treatment access.

5. Strategic Focus on Adjunct and Combination Therapies

While monotherapy sales decline, pharmaceutical companies are exploring combination regimens incorporating exemestane to address resistance pathways and improve outcomes. These combination therapies, especially with targeted agents, could open new revenue avenues, although they are currently in the clinical trial phase.

Market Outlook and Key Drivers for Future Financial Performance

- Regulatory Support and Reimbursement Policies

Ongoing reimbursement reforms in developed countries emphasizing value-based care could favor branded sales if demonstrable superiority emerges, although cost-effectiveness remains crucial. Payers may favor generics, but niche premium products could command higher margins in resistant cases.

- Innovation and Pipeline Development

Next-generation aromatase inhibitors or novel delivery mechanisms may extend AROMASIN’s therapeutic relevance. Although no direct “next-gen” exemestane versions are widely rumored, derivative compounds optimizing bioavailability or reducing side effects represent potential development trajectories.

- Patient Advocacy and Awareness Campaigns

Healthcare initiatives promoting early detection and tailored therapy are expected to sustain demand. Patient-centric approaches may favor therapies with proven tolerability, potentially benefitting exemestane in certain cohorts.

Conclusion and Strategic Insights

The market dynamics surrounding AROMASIN are shaped by aging demographics, evolving clinical practices, regulatory policies, and intense generic competition. While branded revenues declined post-patent expiry, niche applications, emerging markets, and combination therapy developments offer avenues for sustained or enhanced financial performance. Companies investing in clinical validations, competitive pricing, and targeted marketing can leverage these trends. In the broader breast cancer treatment paradigm, exemestane remains a relevant component, with its long-term prospects tied to healthcare policy shifts, innovation efforts, and the evolving therapeutic landscape.

Key Takeaways

- Market Shifts: Patent expiration and generic entry significantly reduced AROMASIN’s global revenues, but targeted niche markets and emerging economies continue to offer growth potential.

- Competitive Landscape: Non-steroidal aromatase inhibitors dominate, but exemestane’s unique steroidal mechanism offers differentiation in resistant cases.

- Therapeutic Trends: Integration with targeted therapies like CDK4/6 inhibitors may unlock new revenue streams through combination regimens.

- Regulatory & Reimbursement: Cost considerations heavily influence prescribing patterns; premium formulations may find space in resistant or special patient subsets.

- Future Opportunities: Innovation in drug delivery, clinical validation of combination strategies, and expansion into developing markets are vital to enhancing AROMASIN’s financial trajectory.

FAQs

-

What factors primarily influence AROMASIN’s market share post-patent expiry?

Generic competition, evolving treatment standards favoring non-steroidal aromatase inhibitors, and regulatory policies determine market share dynamics.

-

How does exemestane differ from other aromatase inhibitors in terms of mechanism?

Exemestane is a steroidal (irreversible) aromatase inhibitor, whereas anastrozole and letrozole are non-steroidal (reversible). This difference may influence resistance patterns and side-effect profiles.

-

What are the prospects for AROMASIN in emerging markets?

Growing breast cancer incidence, healthcare infrastructure improvements, and affordability of generics make emerging markets promising for ongoing and future sales.

-

Can new combination therapies significantly impact AROMASIN’s financial outlook?

Yes. Combining exemestane with agents like CDK4/6 inhibitors shows promise in clinical trials, potentially leading to premium-priced therapies that could boost revenues.

-

What strategic moves should pharmaceutical companies consider to sustain revenue from AROMASIN?

Focus on niche patient populations, develop biosimilars or formulations with improved tolerability, and expand into emerging markets while exploring new combination therapies.

References

- WHO. (2021). Global breast cancer statistics. World Health Organization.

- NCIC MA.27 Trial. (2014). Lancet Oncology.

- IQVIA. (2022). Oncology market analysis report.

- U.S. FDA. (1999). AROMASIN (Exemestane) Approval Summary.

- Industry reports on generic aromatase inhibitors’ market share and pricing strategies.

[End of Article]