Last updated: July 27, 2025

Introduction

Apremilast, marketed under the brand name Otezla, is an oral phosphodiesterase 4 (PDE4) inhibitor developed by Celgene (now part of Bristol-Myers Squibb). Primarily approved for treating moderate to severe plaque psoriasis, psoriatic arthritis, and oral ulcers associated with Behçet’s disease, apremilast has established a significant footprint within the niche of immunomodulatory therapies. This analysis explores the evolving market landscape, competitive positioning, and financial trajectory forecast for apremilast, providing strategic insights for industry stakeholders.

Market Overview

The global psoriasis drug market, into which apremilast primarily falls, was valued at approximately USD 4.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 8% through 2030, driven by increasing prevalence, unmet needs, and expanding approval of novel agents ([1]). Psoriasis affects around 125 million globally, with a subset requiring systemic or biologic therapy, thus creating steady demand.

Key Indications and Market Penetration

- Plaque Psoriasis: Constitutes the majority of apremilast's prescriptions due to its oral administration advantage over injectable biologics.

- Psoriatic Arthritis (PsA): Represented a second significant indication, complementing psoriasis treatment.

- Oral Ulcers in Behçet’s Disease: An off-label but growing niche.

Competitive Landscape

Apremilast competes chiefly with biologics such as adalimumab, ustekinumab, secukinumab, and emerging oral agents like risankizumab. The competitive edge relies on administration route, safety profile, and reimbursement factors. Orally administered drugs like apremilast appeal for their convenience and perceived safety, but biologics offer higher efficacy in some severe cases.

Market Dynamics Influencing Apremilast

1. Evolving Treatment Paradigms

- Shift to Biologics and Biosimilars: Biologics dominate moderate-to-severe psoriasis treatments but face patent expirations, prompting shifts towards biosimilars and oral small molecules.

- Emergence of Novel Oral Agents: Janus kinase (JAK) inhibitors and phosphodiesterase 4 inhibitors like apremilast balance efficacy with safety, impacting market share.

2. Regulatory and Approval Trends

- Apremilast has received various approvals across markets—USD 6 billion in global sales in 2022 ([2]), with recent approvals for new indications and formulations in select countries fueling growth.

- Regulatory authorities are emphasizing safety profiles, especially cardiovascular and psychiatric risks, influencing prescribing behavior.

3. Price and Reimbursement Dynamics

- Price pressures, especially in mature markets like the US, Europe, and Japan, are influencing revenue. Payers favor cost-effective oral therapies, provided efficacy benchmarks meet standards.

- Reimbursement policies, including value-based pricing, impact market access.

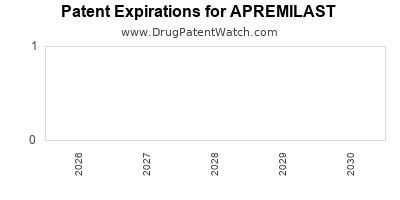

4. Patent and Exclusivity

- Patents on Otezla remain valid till approximately 2028-2029; after expiration, biosimilar competition may erode revenues.

5. Impact of COVID-19

- Pandemic-related disruptions initially decreased new prescriptions but later spurred demand for convenient oral therapies, favoring apremilast.

Financial Trajectory and Revenue Projections

Historical Performance

Bristol-Myers Squibb reported apremilast sales of around USD 6.3 billion in 2022, effectively making it a mid-tier franchise. The growth trajectory was stabilized by solid market penetration and expanding indications.

Forecasted Trends

- Short-term (2023-2025): Growth expected to stabilize at 4-6% CAGR due to market saturation in established countries and steady approval of new indications. Renewed emphasis on combination therapy and expanded use in off-label indications could marginally boost revenues.

- Medium to Long-term (2026-2030): As patent exclusivity diminishes, revenues could decline unless offset by biosimilar competition or new formulations. Nonetheless, strategic pipeline expansion and brand loyalty may sustain revenues around USD 6-7 billion annually until 2030.

Key Factors Affecting Financial Outlook

- Patent Cliff: Predicted expiry around 2028 poses significant risk. Potential biosimilar entry may cut revenues by 30-50%, similar to other biologic and targeted small molecule transitions.

- Pipeline and Line Extensions: Development of formulations such as topical, injectable combinations, or biomarkers for personalized therapy can foster future growth.

- Emerging Markets: Rapid growth in Asia-Pacific and Latin America —expected CAGR of 10%— offers revenue expansion opportunities.

- Cost-Effectiveness and Reimbursement Policies: Cost containment pressures threaten margins but also incentivize demonstrating value through health economics.

Strategic Considerations

- Investment in Pipeline Innovation: Developing next-generation PDE4 inhibitors or combining apremilast with biologics could extend market relevance.

- Market Expansion: Securing approvals for additional indications and broader geographies will sustain revenue streams.

- Lifecycle Management: Leveraging patents and exclusive rights while preparing for biosimilar transition is critical.

- Digital and Patient-Centric Approaches: Integrating digital health tools and real-world evidence can enhance market positioning and demonstrate long-term value.

Conclusion

Apremilast stands at a pivotal juncture in its lifecycle, balancing its established market position against the impending patent expiry and intensifying competition. Its financial trajectory will hinge on effective lifecycle management, pipeline development, and strategic market expansion. The drug’s ongoing success will depend on adapting to evolving treatment paradigms and healthcare policies emphasizing safety, efficacy, and cost-efficiency.

Key Takeaways

- Apremilast's stronghold in oral immunomodulatory therapy offers resilience amid biologic competition but faces patent expiry risks post-2028.

- Market growth will rely on expanding indications, geographic penetration, and innovative formulations.

- Cost containment and reimbursement landscape are vital factors influencing future revenues.

- Biosimilar entry and emerging oral therapies may pressure sales but also open partnership and licensing avenues.

- Strategic pipeline investments and digital health integration will be critical for maintaining market relevance.

FAQs

1. When will apremilast’s patent protection expire?

Patents for Otezla are expected to expire around 2028-2029, after which biosimilar competition could significantly impact market share.

2. How does apremilast compare with biologics in efficacy?

While biologics generally demonstrate higher efficacy in severe cases, apremilast offers a convenient oral route with a favorable safety profile, making it suitable for moderate disease or patients preferring oral therapy.

3. What are the key risks facing apremilast’s market longevity?

Patent expiration, biosimilar competition, safety concerns, and pricing pressures in payers’ reimbursement policies pose significant risks.

4. Are there new indications or formulations in development?

Celgene/BMS continues to explore new formulations and off-label applications, aiming to extend its therapeutic scope and lifecycle.

5. How is market growth influenced by emerging markets?

High growth potential exists in Asia-Pacific and Latin America, driven by increasing disease prevalence and rising healthcare investments.

Sources

[1] Grand View Research, "Psoriasis Drugs Market Size, Share & Trends Analysis Report," 2023.

[2] Bristol-Myers Squibb Annual Report, 2022.