ANGELIQ Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Angeliq, and what generic alternatives are available?

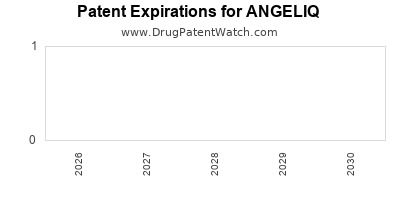

Angeliq is a drug marketed by Bayer Hlthcare and is included in one NDA. There is one patent protecting this drug and two Paragraph IV challenges.

This drug has twenty-one patent family members in sixteen countries.

The generic ingredient in ANGELIQ is drospirenone; estradiol. There are eleven drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the drospirenone; estradiol profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Angeliq

A generic version of ANGELIQ was approved as drospirenone; estradiol by NOVAST LABS on October 28th, 2025.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ANGELIQ?

- What are the global sales for ANGELIQ?

- What is Average Wholesale Price for ANGELIQ?

Summary for ANGELIQ

| International Patents: | 21 |

| US Patents: | 1 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 7 |

| Patent Applications: | 30 |

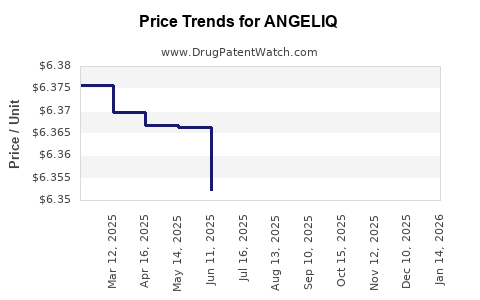

| Drug Prices: | Drug price information for ANGELIQ |

| What excipients (inactive ingredients) are in ANGELIQ? | ANGELIQ excipients list |

| DailyMed Link: | ANGELIQ at DailyMed |

Recent Clinical Trials for ANGELIQ

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Brigham and Women's Hospital | Phase 4 |

| Bayer | |

| Bayer | Phase 2 |

Pharmacology for ANGELIQ

| Drug Class | Estrogen Progestin |

| Mechanism of Action | Estrogen Receptor Agonists |

Paragraph IV (Patent) Challenges for ANGELIQ

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ANGELIQ | Tablets | drospirenone; estradiol | 0.25 mg/0.5 mg | 021355 | 1 | 2015-01-08 |

| ANGELIQ | Tablets | drospirenone; estradiol | 0.5 mg/1 mg | 021355 | 1 | 2007-12-26 |

US Patents and Regulatory Information for ANGELIQ

ANGELIQ is protected by one US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bayer Hlthcare | ANGELIQ | drospirenone; estradiol | TABLET;ORAL | 021355-001 | Feb 29, 2012 | RX | Yes | No | 8,906,890 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Bayer Hlthcare | ANGELIQ | drospirenone; estradiol | TABLET;ORAL | 021355-002 | Sep 28, 2005 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ANGELIQ

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Bayer Hlthcare | ANGELIQ | drospirenone; estradiol | TABLET;ORAL | 021355-002 | Sep 28, 2005 | 6,933,395 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for ANGELIQ

When does loss-of-exclusivity occur for ANGELIQ?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0912

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11240102

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2012026115

Patent: forma de dosagem oral sólida, seu uso, e unidade de acondicionamento

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 95801

Patent: FORMES PHARMACEUTIQUES ORALES SOLIDES A TRES FAIBLE DOSE POUR HRT (VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HRT)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2985070

Patent: Very low-dosed solid oral dosage forms for HRT

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 30107

Patent: Formas de dosificación sólidas orales con dosis muy bajas para hrt

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 120523

Patent: FORMAS DE DOSIFICACIÓN SOLIDAS ORALES CON DOSIS MUY BAJAS PARA LA HRT

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 6095

Patent: ОЧЕНЬ НИЗКОДОЗИРОВАННЫЕ ТВЕРДЫЕ ПЕРОРАЛЬНЫЕ ЛЕКАРСТВЕННЫЕ ФОРМЫ ДЛЯ ГОРМОНОЗАМЕСТИТЕЛЬНОЙ ТЕРАПИИ (ГЗТ) (VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HORMONE REPLACEMENT THERAPY (HRT))

Estimated Expiration: ⤷ Get Started Free

Patent: 1201403

Patent: ОЧЕНЬ НИЗКОДОЗИРОВАННЫЕ ТВЕРДЫЕ ПЕРОРАЛЬНЫЕ ЛЕКАРСТВЕННЫЕ ФОРМЫ ДЛЯ ГЗТ

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 58063

Patent: FORMULATION SOLIDE A TRÈS BAS DOSAGE POUR LA THERAPIE HORMONALE DE REMPLACEMENT (MENOPAUSE) (VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HRT)

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 1200281

Patent: FORMAS DE DOSIFICACIÓN SÓLIDAS ORALES CON DOSIS MUY BAJAS PARA LA HRT

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 20465

Estimated Expiration: ⤷ Get Started Free

Patent: 13523860

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 6702

Patent: FORMAS DE DOSIFICACIÓN SÓLIDAS ORALES CON DOSIS MUY BAJAS PARA LA HRT. (VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HRT.)

Estimated Expiration: ⤷ Get Started Free

Patent: 12012026

Patent: FORMAS DE DOSIFICACION SOLIDAS ORALES CON DOSIS MUY BAJAS PARA LA HRT. (VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HRT.)

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 130097073

Patent: VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HRT

Estimated Expiration: ⤷ Get Started Free

Patent: 180018827

Patent: 초저-용량의 HRT용 고체 경구 투여 형태 (- VERY LOW-DOSED SOLID ORAL DOSAGE FORMS FOR HRT)

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 19300

Estimated Expiration: ⤷ Get Started Free

Patent: 1204368

Patent: Very low-dosed solid oral dosage forms for HRT

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 343

Patent: FORMAS DE DOSIFICACIÓN SÓLIDAS ORALES CON DOSIS MUY BAJAS PARA LA HRT

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ANGELIQ around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hungary | 223106 | Eljárás droszpirenon előállítására és az eljárás köztiterméke (PROCESS FOR PRODUCING DROSPIRENONE AND INTERMEDIATE THEREOF) | ⤷ Get Started Free |

| Germany | 59706887 | ⤷ Get Started Free | |

| Bulgaria | 62776 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ANGELIQ

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0398460 | SPC/GB04/032 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: ESTRADIOL, OPTIONALLY IN THE FORM OF A HYDRATE, TOGETHER WITH DROSPIRENONE; REGISTERED: NL RVG 27505 20021211; UK PL 00053/0341 20040310 |

| 2588114 | LUC00227 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: DROSPIRENONE; AUTHORISATION NUMBER AND DATE: 31332 20191022 |

| 0398460 | 04C0022 | France | ⤷ Get Started Free | PRODUCT NAME: ESTRADIOL ANHYDRE DROSPIRENONE; REGISTRATION NO/DATE IN FRANCE: NL 28661 DU 20040316; REGISTRATION NO/DATE AT EEC: RVG 27505 DU 20021211 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ANGELIQ (Eskalith)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.