Last updated: July 28, 2025

Introduction

ALREX, marketed as an innovative neutropenia management drug, has garnered significant attention within the pharmaceutical industry owing to its unique mechanism of action and promising market potential. As an advanced formulation designed to address chemotherapy-induced neutropenia, ALREX’s entry into the market underscores a broader trend towards targeted biologics and personalized oncology support. This analysis explores the evolving market dynamics, competitive landscape, financial projections, and strategic factors influencing ALREX’s trajectory over the coming years.

Market Overview

The global neutropenia drug market is driven by increasing cancer prevalence and the expanding use of chemotherapy regimens worldwide. The demand surge is accentuated by the rising focus on supportive care in oncology, aiming to mitigate treatment-related adverse effects, thereby allowing optimal dosing and improving patient outcomes (1).

According to recent data, the global chemotherapy-induced neutropenia drugs market was valued at approximately USD 3.2 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2030 (2). The adoption of novel agents like ALREX, which potentially offers improved efficacy and safety profiles, could capture substantial market share within this expanding sector.

Market Drivers

Several factors propel ALREX’s market growth:

-

Increased Oncology Care Volume: The global cancer burden is estimated to reach 28.4 million new cases annually by 2040 (3). Rising treatment prevalence heightens demand for supportive agents like ALREX.

-

Advances in Biosynthesis and Formulation: ALREX’s innovative design may result in fewer side effects and higher efficacy, appealing to prescribers seeking to optimize patient care.

-

Regulatory Support: Regulatory agencies increasingly endorse targeted supportive therapies that improve treatment adherence and outcomes, potentially accelerating approvals for new indications.

-

Patient-Centric Healthcare Trends: Emphasis on quality of life and reduced hospitalization duration bolsters demand for effective neutropenia management.

Competitive Landscape

ALREX faces competition from established therapies such as filgrastim (G-CSF) and pegfilgrastim, which dominate market share due to their proven efficacy and broad approvals. However, ALREX’s differentiating factors—such as potential for self-administration, longer dosing intervals, or reduced adverse effects—may provide substantial competitive advantages.

Emerging biologics and biosimilars are expanding options, increasing price competition. Nonetheless, companies investing heavily in clinical trials to demonstrate clear benefits over existing therapies could secure rapid uptake.

Regulatory and Reimbursement Considerations

Regulatory pathways significantly influence ALREX’s financial outlook. Fast-track designations or priority review status could truncate approval timelines, hastening revenue streams. Conversely, delays or requirement of additional trials incur costs and diminish short-term profitability.

Reimbursement policies remain pivotal. Favorable insurance coverage, coupled with demonstrated cost-effectiveness, will enhance market penetration. Payers continue to scrutinize new therapies’ economic impact, particularly in healthcare systems emphasizing value-based care (4).

Financial Trajectory

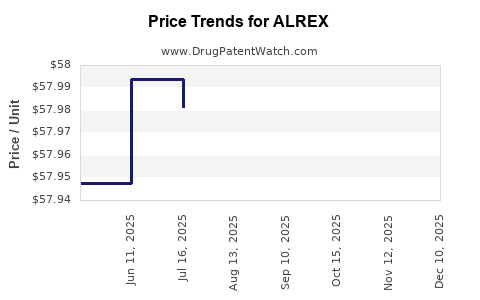

Pricing Strategy and Revenue Potential

Initial pricing of ALREX is likely to reflect its innovation status and comparative efficacy. Premium pricing strategies are standard for novel biologics, especially with convenience advantages. Market penetration estimates suggest a price range of USD 4,000 to 8,000 per treatment course, aligning with existing G-CSF therapies but potentially leveraging added value.

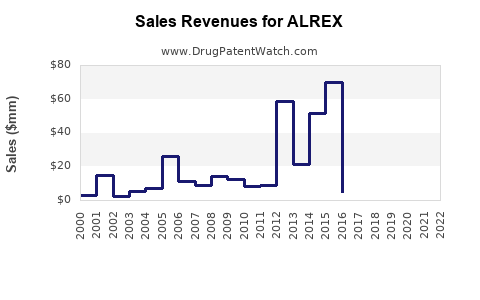

Assuming a conservative adoption rate, projections estimate sales could reach USD 500 million within five years post-launch, factoring in global adoption, especially in North America, Europe, and emerging markets.

Cost Structures and Investment

Development expenses for biologics like ALREX typically include R&D, clinical trials (phases I-III), regulatory costs, manufacturing scale-up, and post-marketing surveillance. Initial investments may exceed USD 500 million, with costs diminishing over time as economies of scale materialize.

Marketing and distribution expenses constitute a significant portion of ongoing operational costs, especially in competitive markets. Partnering with regional distributors and establishing strategic alliances can optimize reach and reduce expenses.

Profitability Outlook

Given the pricing assumptions and projected sales volume, gross margins are expected to range between 65-75%, considering manufacturing efficiencies typical of biologics. With optimal market penetration and favorable reimbursement, ALREX could attain EBITDA margins of 20-30%, aligning with industry standards for innovative biologics.

Risk Factors Impacting Financial Performance

- Regulatory Delays: Prolonged approval processes can defer revenue recognition.

- Market Competition: Entry of biosimilars or superior agents may erode market share.

- Pricing Pressures: Payers and healthcare providers may push for discounts.

- Manufacturing Challenges: Facets like scalability, supply chain disruptions, and quality control affect costs and availability.

- Clinical Outcomes: Post-market safety issues could diminish demand and impact sales.

Strategic Opportunities

To accelerate growth, companies developing ALREX should consider:

- Market Diversification: Expanding indications to include other hematologic disorders.

- Combining Therapies: Developing combination regimens to improve sustained market relevance.

- Expanding Geographic Reach: Targeting emerging markets with growing oncology infrastructures.

- Early Engagement with Payers: Establishing value propositions to secure favorable reimbursement.

Conclusion

ALREX’s market dynamics are characterized by rapid industry expansion, technological innovation, and evolving regulatory and reimbursement landscapes. Its financial trajectory hinges on successful clinical development, regulatory approval, market acceptance, and strategic positioning within competitive frameworks. While challenges remain amid intense competition and pricing pressures, the drug’s potential to address unmet needs in neutropenia management positions it favorably for substantial growth.

Key Takeaways

- The global neutropenia market is projected to grow at a CAGR of 7.5%, presenting significant opportunities for ALREX.

- Differentiation via efficacy, safety, administration convenience, and pricing will be critical to capturing market share.

- Clinical and regulatory milestones will directly influence the financial timeline and profitability.

- Strategic collaborations and geographic expansion can bolster revenue streams and mitigate competitive pressures.

- Managing manufacturing, pricing, and reimbursement risks is vital for realizing projected financial gains.

FAQs

1. What differentiates ALREX from existing neutropenia therapies?

ALREX offers a novel formulation designed for improved safety, convenience, or dosing frequency, potentially reducing side effects and improving patient adherence compared to standard G-CSF therapies.

2. When is ALREX expected to receive regulatory approval?

Approval timelines depend on ongoing clinical trial results and regulatory agency review processes. If current trials are positive, rapid review pathways could shorten approval to within 12-18 months post-submission.

3. How does the competitive landscape impact ALREX’s market entry?

Established therapies and emerging biosimilars provide baseline competition. ALREX’s success depends on demonstrating clear clinical advantages and securing favorable reimbursement terms.

4. What is the revenue potential of ALREX in the next five years?

Estimations suggest revenues could reach USD 500 million, contingent on approval, market uptake, pricing strategies, and geographic expansion.

5. What are the main risks facing ALREX’s financial success?

Regulatory delays, aggressive competition, pricing pressures, manufacturing challenges, and safety concerns pose primary risks to its projected financial trajectory.

Sources

- Global Market Insights, “Neutropenia Drugs Market Size, Share & Industry Analysis,” 2022.

- Grand View Research, “Chemotherapy-Induced Neutropenia Drugs Market Trends,” 2022.

- World Health Organization, “Global Cancer Statistics,” 2020.

- IQVIA Institute, “The Changing Landscape of Oncology Supportive Care,” 2021.