Last updated: July 28, 2025

Introduction

ALREX, the trade name for levalbuterol, is a nebulized bronchodilator primarily used for the management of asthma and chronic obstructive pulmonary disease (COPD). As a short-acting β2-adrenergic receptor agonist, ALREX provides rapid relief of bronchospasm. Its market trajectory hinges on factors such as competitive landscape, price trends, regulatory environment, and healthcare adoption rates. This report synthesizes current market data, assesses key drivers, and projects future pricing pathways up to 2028.

Market Overview

Pharmacological Profile and clinical use

Levalbuterol (the active enantiomer of albuterol) is favored in certain patient subsets due to its reduced side-effect profile. It is administered via nebulizer, predominantly for acute symptom relief in hospitalized and outpatient settings. The drug benefits from widespread recognition, driven by its efficacy and safety profile, which positions it within a competitive respiratory therapeutics segment.

Current market value

As of 2023, the global nebulized bronchodilator market, which includes drugs like ALREX, is valued at approximately $2.4 billion (per GlobalData estimates). ALREX contributes a significant share due to its prescription volume, especially in the United States, which dominates North American inhalation therapy markets. The drug's revenue is driven by:

- Increasing prevalence of asthma and COPD

- Growing awareness for rapid relief therapies

- Broader adoption in outpatient care settings

Competitive landscape

ALREX faces competition from generic formulations of levalbuterol (e.g., Xopenex HFA in inhaler form) and other bronchodilators, such as albuterol inhalers, at varying price points. The entry of generics has exerted downward pressure on branded drug pricing but also segmented the market into differentiated formulations and delivery mechanisms.

Major competitors include:

- Teva Pharmaceuticals (Xopenex HFA)

- Sunovion Pharmaceuticals (original manufacturer of ALREX)

- Generic manufacturers worldwide

Market Drivers and Barriers

Drivers

- Rising prevalence of respiratory diseases: The CDC estimates asthma affects over 25 million Americans, with COPD impacting approximately 16 million. These trends underpin demand growth [1].

- Advanced delivery systems: Nebulizers are essential for pediatric, elderly, and severe asthmatic populations, ensuring sustained demand.

- Regulatory approvals and formulations: Ongoing approvals of combination therapies and novel delivery devices contribute to market expansion.

- Healthcare policy shifts: Increased focus on outpatient management of chronic respiratory conditions reduces hospitalization costs and enhances home-based therapeutics.

Barriers

- Competitive generics: The availability of cost-effective generics pressures brands to innovate or justify premium pricing.

- Insurance and formulary restrictions: Reimbursement policies limit prices, favoring lower-cost generics.

- Patient preferences: Inhalers and dry powder inhalers are substituting nebulizers in some regions, affecting nebulized drug demand.

- Regulatory constraints: Tightening safety standards and drug label updates influence market access and marketing strategies.

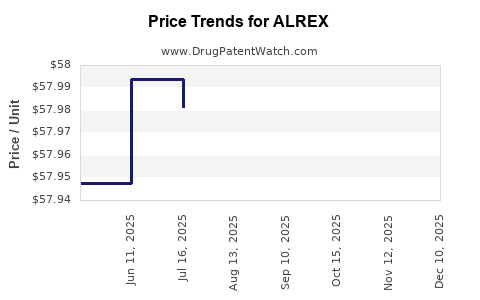

Price Trends and Projections

Historical pricing

In the US, the average wholesale price (AWP) for ALREX has shown a downward trend post-generic entry:

- 2018: Approximately $75 per 20 mL vial

- 2020: Declined to roughly $65

- 2022: Stabilized around $60 due to limited patent expiry

In contrast, branded levalbuterol nebulizer solutions in Europe average €25-€35 per treatment, influenced by local reimbursement schemes.

Forecasting future prices (2023-2028)

Based on market signals, patent expiries, and generic competition, the following projections are anticipated:

- 2023-2024: Price stabilization at ~$55-$60 due to limited brand-specific exclusivity

- 2025-2026: Potential decline to $45-$50 as more generics enter the US market and reimbursement pressures mount

- 2027-2028: Prices are expected to reach $40-$45 in developed markets, with some variability based on regional healthcare policies

The price trajectory may be tempered by innovations such as combination inhalers, sustained-release formulations, or advanced delivery devices commanding premium prices.

Regional Market Dynamics

| Region |

2023 Price Range |

Key Factors Influencing Prices |

Future Trends |

| United States |

$55-$60 |

High prescription volume, insurance negotiations |

Gradual decline, patent expiry effects in some formulations |

| Europe |

€25-€35 |

Reimbursement policies, competition |

Moderate price reduction, increased generics |

| Asia-Pacific |

$10-$30 |

Growing respiratory disease burden, lower healthcare costs |

Potential price increases with market maturation |

| Latin America & Africa |

$5-$15 |

Market access barriers, local manufacturing |

Prices relatively stable with regional variations |

Implications for Stakeholders

- Pharmaceutical companies need continuous innovation, such as novel delivery systems or combination therapies, to sustain premium prices.

- Healthcare providers should weigh cost-effectiveness, especially with increasing generic options.

- Payers and policymakers influence market prices via formulary decisions and reimbursement frameworks, impacting future pricing.

Conclusion

ALREX (levalbuterol) remains a vital therapy in respiratory care. Its market is characterized by stable demand, yet pricing faces downward pressures driven by generic competition and policy reforms. Projected prices suggest a gradual decline over the next five years, with regional differences reflecting local healthcare landscapes. Companies must innovate to protect market share and optimize pricing strategies amidst evolving market dynamics.

Key Takeaways

-

Market Size & Growth: The global nebulized bronchodilator market, including ALREX, is valued at over $2.4 billion, with steady growth driven by rising respiratory disease prevalence.

-

Pricing Trends: Prices for ALREX are projected to decline from approximately $55-$60 in 2023 to $40-$45 by 2028, influenced by generic entry and reimbursement policies.

-

Competitive Pressures: Generic versions and alternative formulations mandate innovation, particularly in delivery systems, to maintain pricing power.

-

Regional Variations: Developed markets will experience moderate price declines, while emerging markets might see price stabilization or growth, contingent on healthcare infrastructure.

-

Strategic Focus: Stakeholders should focus on product differentiation, clinical innovations, and navigating regulatory landscapes to optimize market position and profitability.

FAQs

-

What are the primary factors influencing ALREX pricing?

Patent status, generic competition, healthcare reimbursement policies, and innovation in delivery mechanisms significantly impact prices.

-

How does generic competition affect ALREX's market share?

The availability of generics typically leads to price reductions and shifts market share from branded ALREX to more affordable alternatives.

-

What regions are most promising for ALREX sales growth?

Asia-Pacific and Latin America offer growth opportunities due to increasing respiratory disease prevalence and expanding healthcare access.

-

Are there upcoming regulatory changes that could impact ALREX pricing?

Regulatory pressures focused on safety, efficacy, and market approval standards could influence prices, especially if new combination therapies are approved.

-

What strategic moves should pharmaceutical companies consider to sustain ALREX's market value?

Investing in formulation improvements, expanding indications, and demonstrating cost-effectiveness are critical for maintaining market competitiveness and pricing power.

References

[1] Centers for Disease Control and Prevention. "Most Recent Asthma Data." CDC, 2022.