Last updated: July 29, 2025

Introduction

ADIPEX-P, a brand of phentermine hydrochloride, remains a prominent pharmaceutical agent prescribed predominantly for weight management. As an appetite suppressant with stimulant properties, ADIPEX-P is integral in the treatment landscape for obesity and related metabolic syndromes. Its market dynamics are shaped by evolving regulatory environments, societal health trends, and scientific advancements. The drug’s financial trajectory hinges on regulatory statuses, patent landscapes, market demand, and competitive forces.

Regulatory Status and Market Penetration

ADIPEX-P’s approval by the U.S. Food and Drug Administration (FDA) dates back to the 1950s, positioning it as a longstanding pharmacological tool for weight loss [1]. The FDA classifies phentermine as a Schedule IV controlled substance, reflecting its potential for abuse and dependence. This scheduling influences prescribing patterns, prescription quantity limits, and monitoring protocols. Regions outside the U.S., including Europe, have varied stances; for example, phentermine is not approved or widely available in Europe, limiting international expansion.

Within the United States, ADIPEX-P’s patent protections have long expired, making it a generic drug. Its over-the-counter availability is restricted, preserving a niche for branded formulations under strict regulation. The consistent demand for weight management therapies sustains its market presence, despite the advent of newer agents.

Market Dynamics Influences

Societal Health Trends:

Increasing prevalence of obesity—affecting over 42% of U.S. adults—as per CDC data [2], sustains demand for pharmacotherapies like ADIPEX-P. While lifestyle interventions remain primary, pharmacological options serve as adjuncts, especially among patients with comorbidities such as diabetes and hypertension.

Regulatory and Safety Considerations:

Post-marketing surveillance and safety concerns about cardiovascular side effects have led agencies to restrict or advise caution in ADIPEX-P’s use [3]. These concerns have occasionally resulted in prescribing restrictions, impacting market size and growth potential.

Competitive Landscape:

The weight loss pharmaceutical market hosts agents such as liraglutide (Saxenda), naltrexone-batientin (Contrave), and newer drugs like semaglutide (Wegovy). These agents often offer improved safety profiles but at higher costs, impinging on ADIPEX-P’s market share, especially in affluent demographics.

Prescriber Preferences and Cultural Attitudes:

Physicians favor medications with favorable safety profiles and clear efficacy data. The stigma attached to stimulant drugs sometimes limits prescriptions. Regulatory risk aversion further constrains prescription volume.

Availability of Alternatives and Over-the-Counter Options:

The proliferation of non-prescription weight management supplements and dietary interventions exerts downward pressure on ADIPEX-P’s market share.

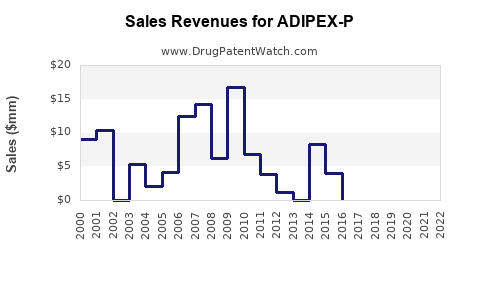

Financial Trajectory

Revenue Streams:

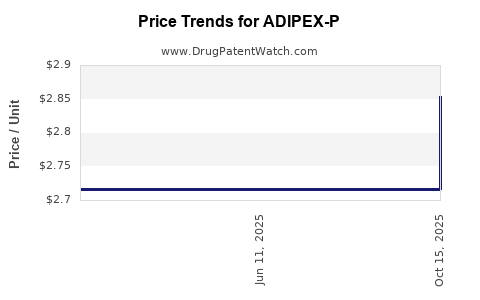

Given its status as a generic, ADIPEX-P’s direct revenue contribution has historically been modest but stable, supported by steady demand. Premium pricing is largely absent, and profit margins depend on manufacturing costs and distribution.

Market Growth Forecasts:

The global weight management drug market is projected to grow at a compounded annual growth rate (CAGR) of approximately 8-10% over the next five years, driven by rising obesity rates [4]. However, ADIPEX-P’s growth is likely to plateau or decline slightly owing to safety scrutiny and emerging competitors.

Patent and Market Exclusivity:

Since the expiration of any original patents, the generic manufacturing landscape dominates, producing downward pressure on prices. Some formulations or brand rights may have trademark protections, but these are limited.

Emerging Trends and Investment Opportunities:

Companies may explore reformulations, combination therapies, or regulatory designations (e.g., orphan drug status) to carve market niches. The potential repositioning of phentermine derivatives with improved safety profiles opens avenues for future financial growth.

Regulatory and Legal Environment Impact

Regulations remain a critical determinant. The DEA’s scheduling limits prescribing volume, influencing overall sales. Regulatory agencies’ evolving stance on stimulant medications may impose tighter controls, reducing ADIPEX-P’s market accessibility. Conversely, positive indications and expanded prescribing guidelines could bolster use.

Conclusion

The financial trajectory of ADIPEX-P is characterized by stability amidst challenges. While societal obesity trends ensure sustained demand, regulatory restrictions, safety concerns, and competitive innovations temper growth prospects. Pharmaceutical companies that navigate these dynamics through strategic marketing, safety profile enhancements, or niche targeting can optimize revenue streams.

Key Takeaways

- Persistent Demand: Rising obesity prevalence sustains baseline demand for ADIPEX-P despite the emergence of newer agents.

- Regulatory Challenges: As a Schedule IV controlled substance, prescribing is tightly regulated, constraining market expansion.

- Market Competition: Novel weight loss drugs with superior safety profiles and efficacy are eroding ADIPEX-P’s market share.

- Pricing and Profitability: Generics offer low margins; profit is sensitive to manufacturing costs and regulatory changes.

- Future Opportunities: Reformulations, combination therapies, and regulatory incentives could diversify applications and revitalize growth.

FAQs

1. What are the primary regulatory restrictions affecting ADIPEX-P sales?

As a Schedule IV controlled substance in the U.S., ADIPEX-P faces strict prescribing and dispensing regulations, including dosage limits and mandatory monitoring, which influence market size and access.

2. How does the safety profile of ADIPEX-P impact its market trajectory?

Concerns over cardiovascular effects and potential misuse have led to regulatory caution, restricting prescriber confidence and limiting expansion in certain demographics.

3. Can ADIPEX-P be a viable investment opportunity today?

While stable within its niche, growth prospects are limited unless companies develop safer formulations or find new therapeutic indications. The market favors innovative agents with improved safety profiles.

4. What competitive threats does ADIPEX-P face?

Newer pharmacotherapies like semaglutide and combined agents offer higher efficacy and safety, attracting prescribers and patients away from traditional stimulants.

5. Are there emerging scientific developments that could alter ADIPEX-P's market outlook?

Research into phentermine derivatives with reduced stimulant effects and improved safety, as well as potential reclassification or expanded indications, may influence future market dynamics.

References

[1] U.S. FDA. Phentermine Prescribing Information. 2020.

[2] CDC. Adult Obesity Facts. Centers for Disease Control and Prevention, 2022.

[3] FDA. Drug Safety Communications: Phentermine Use. 2016.

[4] Grand View Research. Weight Management Market Size & Trends. 2022.