ACZONE Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Aczone, and when can generic versions of Aczone launch?

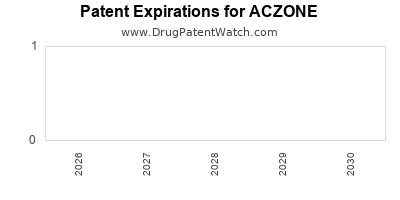

Aczone is a drug marketed by Almirall and is included in two NDAs. There is one patent protecting this drug and one Paragraph IV challenge.

This drug has twenty-three patent family members in fifteen countries.

The generic ingredient in ACZONE is dapsone. There are eight drug master file entries for this compound. Thirty-two suppliers are listed for this compound. Additional details are available on the dapsone profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Aczone

A generic version of ACZONE was approved as dapsone by SOLIS PHARMS on May 6th, 2016.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ACZONE?

- What are the global sales for ACZONE?

- What is Average Wholesale Price for ACZONE?

Summary for ACZONE

| International Patents: | 23 |

| US Patents: | 1 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 3 |

| Raw Ingredient (Bulk) Api Vendors: | 115 |

| Clinical Trials: | 15 |

| Drug Prices: | Drug price information for ACZONE |

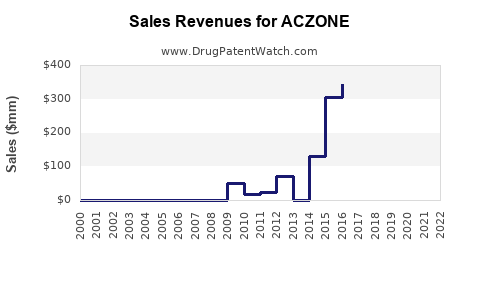

| Drug Sales Revenues: | Drug sales revenues for ACZONE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ACZONE |

| What excipients (inactive ingredients) are in ACZONE? | ACZONE excipients list |

| DailyMed Link: | ACZONE at DailyMed |

Recent Clinical Trials for ACZONE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Catawba Research | Phase 3 |

| Torrent Pharmaceuticals Limited | Phase 3 |

| Icahn School of Medicine at Mount Sinai | Phase 4 |

Pharmacology for ACZONE

| Drug Class | Sulfone |

US Patents and Regulatory Information for ACZONE

ACZONE is protected by one US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 021794-001 | Jul 7, 2005 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 207154-001 | Feb 24, 2016 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ACZONE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 207154-001 | Feb 24, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 021794-001 | Jul 7, 2005 | ⤷ Get Started Free | ⤷ Get Started Free |

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 207154-001 | Feb 24, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 207154-001 | Feb 24, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 021794-001 | Jul 7, 2005 | ⤷ Get Started Free | ⤷ Get Started Free |

| Almirall | ACZONE | dapsone | GEL;TOPICAL | 021794-001 | Jul 7, 2005 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for ACZONE

See the table below for patents covering ACZONE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Mexico | PA02006593 | DAPSONA TOPICA PARA TRATAMIENTO DEL ACNE. (TOPICAL DAPSONE FOR THE TREATMENT OF ACNE.) | ⤷ Get Started Free |

| Japan | 2005524651 | ⤷ Get Started Free | |

| Slovenia | 1485059 | ⤷ Get Started Free | |

| Spain | 2280629 | ⤷ Get Started Free | |

| Mexico | 362520 | COMPOSICIONES DE DAPSONA Y DAPSONA/ADAPALENO TOPICAS Y METODOS PARA SU USO. (TOPICAL DAPSONE AND DAPSONE/ADAPALENE COMPOSITIONS AND METHODS FOR USE THEREOF.) | ⤷ Get Started Free |

| South Africa | 200407439 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for ACZONE (Dapsone Gel 7.5%)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.