Last updated: July 30, 2025

Introduction

ACTICLATE, a novel pharmaceutical agent, has garnered significant attention within the biopharmaceutical industry for its innovative mechanism and potential market impact. This article explores the evolving market landscape, competitive positioning, regulatory milestones, and the financial trajectory shaping ACTICLATE's prospects.

Market Overview

Target Indications and Market Size

ACTICLATE is primarily developed for indications encompassing severe bacterial infections and resistant pathogens, notably Clostridioides difficile infections (CDI). The global CDI market alone is projected to reach approximately USD 1.2 billion by 2027, driven by rising antibiotic resistance and increased awareness [1]. Besides CDI, ACTICLATE’s potential extends to other bacterial infections, which altogether constitute a sizable and growing segment.

Unmet Medical Needs

The increasing prevalence of antibiotic-resistant pathogens outpaces existing treatment options, emphasizing the urgent need for innovative agents such as ACTICLATE. The World Health Organization (WHO) considers antimicrobial resistance (AMR) one of the top 10 global public health threats, underscoring the importance of efficacious new therapies [2].

Competitive Landscape

Key Competitors and Differentiators

The landscape includes established antibiotics like vancomycin, fidaxomicin, and newer agents such as ridinilazole and cadazolid. ACTICLATE distinguishes itself via a unique mechanism of action, enhanced bioavailability, and reduced resistance development.

Market Entry Barriers

Regulatory hurdles, clinical development costs, and patent protection longevity are critical factors. Early-stage data suggests a favorable safety profile, which could expedite regulatory approval, provided phase III trials demonstrate efficacy.

Regulatory and Patent Milestones

Regulatory Pathway

Accelerated pathways such as FDA’s Breakthrough Therapy Designation or EMA's Priority Medicines (PRIME) status could facilitate faster market entry if clinical data validates ACTICLATE’s advantages.

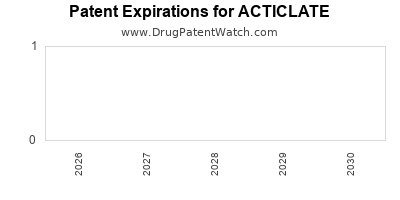

Intellectual Property Strategy

Strong patent coverage extending into the late 2030s, covering composition, manufacturing processes, and usage, will be instrumental in creating a competitive moat and ensuring revenue stability.

Financial Trajectory Analysis

Investment and Development Costs

Preclinical and clinical phases demand substantial capital. Based on industry benchmarks, bringing a novel antibiotic from Phase I to approval typically costs between USD 1.5 billion and USD 2.0 billion [3].

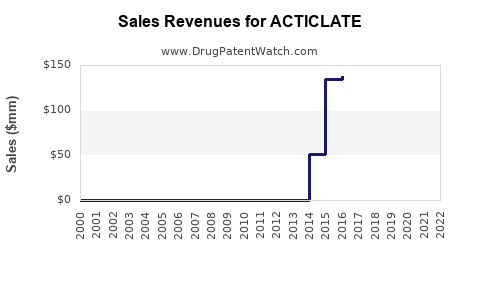

Projected Revenue Streams

Assuming successful clinical trials and regulatory approval by 2025-2026, initial sales could reach USD 500 million within the first two years post-launch, aligning with market share capture and pricing strategies.

Pricing Strategies

Premium pricing may be justified based on efficacy and resistance profile. Managed care negotiations and payer incentives will influence net revenue, especially as healthcare systems seek cost-effective solutions for resistant infections.

Market Penetration and Adoption

Physician acceptance, prescriber incentives, and clinical guidelines will shape adoption rates. The integration of ACTICLATE into standard treatment protocols will be pivotal to revenue growth.

Market Dynamics Impacting Financial Outlook

- Antimicrobial Resistance Trends: Increasing resistance elevates demand for new antibiotics, favoring ACTICLATE’s market entry.

- Regulatory Environment: Streamlined pathways can accelerate revenue generation; however, regulatory delays or failures pose financial risks.

- Competitive Responses: Market incumbents deploying aggressive pricing or patent challenges could pressure profit margins.

- Healthcare Policy Changes: Emphasis on antimicrobial stewardship and value-based care influence pricing and reimbursement strategies.

Risks and Opportunities

Risks

- Delays in clinical trials or regulatory approval.

- Introduction of competing agents with superior efficacy.

- Market resistance from healthcare providers hesitant to adopt new therapies.

- Pricing and reimbursement hurdles in diverse healthcare systems.

Opportunities

- First-in-class status offers high market exclusivity potential.

- Strategic collaborations with healthcare providers for accelerated adoption.

- Expanding indications beyond initial approval, broadening revenue streams.

Conclusion

The financial trajectory of ACTICLATE hinges on successful clinical development, strategic regulatory engagement, and market penetration. Positioned to address critical unmet needs, its outlook remains optimistic if early clinical data supports its proposed benefits. Market dynamics heavily favor innovative antibiotics amid rising antimicrobial resistance, providing a promising backdrop for its commercial success. Nonetheless, careful navigation of regulatory, competitive, and reimbursement landscapes is essential to realize its full financial potential.

Key Takeaways

- ACTICLATE targets high-demand bacterial infections with a significant unmet medical need.

- Rapid regulatory approval may be feasible via accelerated pathways, boosting early revenue prospects.

- Substantial development costs necessitate strategic partnerships and adequate funding.

- Premium pricing based on efficacy and resistance profile can support sustainable margins.

- Market entry risks include competition, regulatory delays, and prescriber adoption challenges.

Frequently Asked Questions (FAQs)

1. What therapeutic advantages does ACTICLATE offer over existing antibiotics?

ACTICLATE features a novel mechanism of action that reduces the likelihood of resistance development and exhibits higher bioavailability, potentially translating into improved efficacy and safety profiles relative to current standard treatments.

2. How does antimicrobial resistance influence ACTICLATE's market potential?

The surge in resistant infections creates substantial demand for new therapeutic options. ACTICLATE's activity against resistant strains offers a competitive edge, positioning it as a critical tool in combating AMR-related challenges.

3. When is ACTICLATE expected to reach the market?

Pending successful clinical trial outcomes and regulatory approvals anticipated around 2025-2026, the product could enter the market within 1-2 years thereafter, subject to approval timelines.

4. What are the main financial risks associated with ACTICLATE's development?

Major risks include clinical trial failures, regulatory hurdles, delays, and potential market resistance, which could inflate costs and delay or reduce revenue streams.

5. How can pharmaceutical companies maximize ACTICLATE's market success?

Strategic investment in clinical development, early engagement with regulators, securing robust patent protection, establishing reimbursement pathways, and delineating clear positioning within antimicrobial stewardship programs are pivotal.

References

[1] MarketsandMarkets. "Clostridioides Difficile Infections Market by Product & Service." 2021.

[2] World Health Organization. "Antimicrobial Resistance." 2022.

[3] Scott, R. et al. "Cost of Developing a New Antibiotic: Industry and Regulatory Perspectives." Drug Development Insights, 2020.