ACCRUFER Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Accrufer, and when can generic versions of Accrufer launch?

Accrufer is a drug marketed by Shield Tx and is included in one NDA. There are three patents protecting this drug.

This drug has fifty-one patent family members in nineteen countries.

The generic ingredient in ACCRUFER is ferric maltol. There are twenty drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the ferric maltol profile page.

DrugPatentWatch® Generic Entry Outlook for Accrufer

Accrufer was eligible for patent challenges on July 25, 2023.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be October 23, 2035. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ACCRUFER?

- What are the global sales for ACCRUFER?

- What is Average Wholesale Price for ACCRUFER?

Summary for ACCRUFER

| International Patents: | 51 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Clinical Trials: | 1 |

| Drug Prices: | Drug price information for ACCRUFER |

| What excipients (inactive ingredients) are in ACCRUFER? | ACCRUFER excipients list |

| DailyMed Link: | ACCRUFER at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ACCRUFER

Generic Entry Date for ACCRUFER*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ACCRUFER

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Shield Therapeutics | Phase 1 |

Pharmacology for ACCRUFER

| Drug Class | Parenteral Iron Replacement Phosphate Binder |

| Mechanism of Action | Phosphate Chelating Activity |

US Patents and Regulatory Information for ACCRUFER

ACCRUFER is protected by three US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ACCRUFER is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shield Tx | ACCRUFER | ferric maltol | CAPSULE;ORAL | 212320-001 | Jul 25, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Shield Tx | ACCRUFER | ferric maltol | CAPSULE;ORAL | 212320-001 | Jul 25, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Shield Tx | ACCRUFER | ferric maltol | CAPSULE;ORAL | 212320-001 | Jul 25, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for ACCRUFER

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Norgine B.V. | Feraccru | ferric maltol | EMEA/H/C/002733Feraccru is indicated in adults for the treatment of iron deficiency. | Authorised | no | no | no | 2016-02-18 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ACCRUFER

When does loss-of-exclusivity occur for ACCRUFER?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 15340825

Patent: Crystalline forms of ferric maltol

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2017008903

Patent: formas cristalinas de maltol férrico

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 44210

Patent: FORMES CRISTALLINES DE MALTOL FERRIQUE (CRYSTALLINE FORMS)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17001030

Patent: Formas cristalinas de maltol férrico

Estimated Expiration: ⤷ Get Started Free

China

Patent: 7001310

Patent: 麦芽酚铁的结晶形式 (Crystalline forms of ferric maltol)

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 3323

Patent: КРИСТАЛЛИЧЕСКИЕ ФОРМЫ ЖЕЛЕЗНОЙ СОЛИ МАЛЬТОЛА (CRYSTALLINE FORMS OF FERRIC MALTOL)

Estimated Expiration: ⤷ Get Started Free

Patent: 1790667

Patent: КРИСТАЛЛИЧЕСКИЕ ФОРМЫ ЖЕЛЕЗНОЙ СОЛИ МАЛЬТОЛА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 60951

Patent: FORMES CRISTALLINES DE MALTOL FERRIQUE (CRYSTALLINE FORMS OF FERRIC MALTOL)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 04358

Estimated Expiration: ⤷ Get Started Free

Patent: 78711

Estimated Expiration: ⤷ Get Started Free

Patent: 17535510

Patent: マルトール第二鉄の結晶形態

Estimated Expiration: ⤷ Get Started Free

Patent: 18197268

Patent: マルトール第二鉄の結晶形態 (CRYSTAL FORM OF FERRIC MALTOL)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 0730

Patent: FORMAS CRISTALINAS DE MALTOL FÉRRICO. (CRYSTALLINE FORMS OF FERRIC MALTOL.)

Estimated Expiration: ⤷ Get Started Free

Patent: 17005413

Patent: FORMAS CRISTALINAS DE MALTOL FERRICO. (CRYSTALLINE FORMS OF FERRIC MALTOL.)

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 60951

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 7381406

Patent: صور بلورية من مالتول الحديديك (Crystalline Forms of Ferric Maltol)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201702639R

Patent: CRYSTALLINE FORMS OF FERRIC MALTOL

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1702136

Patent: CRYSTALLINE FORMS OF FERRIC MALTOL

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2576930

Estimated Expiration: ⤷ Get Started Free

Patent: 170071446

Patent: 제2철 말톨의 결정질 형태 (2 CRYSTALLINE FORMS OF FERRIC MALTOL)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 61944

Estimated Expiration: ⤷ Get Started Free

United Kingdom

Patent: 31742

Patent: Crystalline forms

Estimated Expiration: ⤷ Get Started Free

Patent: 1419174

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ACCRUFER around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Australia | 2009247762 | Mono ( iron hydroxypyrone ) and combination ( iron hydroxypyrone and GI inflammation inhibiting agents ) compositions for anaemia or H. pylori infections | ⤷ Get Started Free |

| World Intellectual Property Organization (WIPO) | 2015101971 | ⤷ Get Started Free | |

| European Patent Office | 3160951 | FORMES CRISTALLINES DE MALTOL FERRIQUE (CRYSTALLINE FORMS OF FERRIC MALTOL) | ⤷ Get Started Free |

| Slovenia | 3091974 | ⤷ Get Started Free | |

| Chile | 2017001030 | Formas cristalinas de maltol férrico | ⤷ Get Started Free |

| South Korea | 20160105499 | 철 트리말톨의 복용량 양생법 (DOSAGE REGIMEN OF FERRIC TRIMALTOL) | ⤷ Get Started Free |

| Japan | 2015083572 | 鉄ヒドロキシピロンを含む薬剤組成物 (PHARMACEUTICAL COMPOSITION COMPRISING IRON HYDROXYPYRONE) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

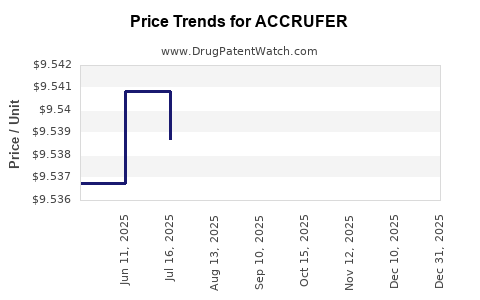

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: ACCRUFER

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.