Last updated: July 27, 2025

Introduction

Zileuton, marketed primarily under the brand name Zyflo®, is an orally administered medication approved by the U.S. Food and Drug Administration (FDA) for the management of asthma. Its mechanism involves inhibiting 5-lipoxygenase — an enzyme crucial for leukotriene biosynthesis — thereby reducing airway inflammation and constriction. As a selective leukotriene pathway inhibitor, zileuton occupies a niche within the asthma pharmacotherapy landscape, often positioned alongside other leukotriene receptor antagonists such as montelukast. This analysis explores the evolving market dynamics and financial trajectory of zileuton, considering its clinical profile, competitive landscape, regulatory environment, and broader economic trends shaping its commercial potential.

Market Overview and Clinical Positioning

Asthma remains a significant global health challenge, affecting over 300 million individuals worldwide with substantial morbidity and healthcare costs [1]. Therapeutic management includes beta-agonists, inhaled corticosteroids, and leukotriene modifiers. Among these, zileuton offers a unique mechanism of action targeting leukotriene synthesis, which has demonstrated efficacy in reducing asthma exacerbations and improving lung function, particularly in specific patient subsets.

Initially approved in 1996, zileuton's market penetration has been limited relative to more widely prescribed leukotriene receptor antagonists. The limited adoption stems from factors such as adverse effect profiles, dosing complexities, and competition from newer agents with more convenient administration or superior safety profiles [2]. Nonetheless, zileuton's niche application persists, especially among asthmatic patients with corticosteroid-refractory symptoms or those intolerant to other drugs.

Market Dynamics Influencing Zileuton's Trajectory

1. Therapeutic Landscape and Competition

The asthma pharmacotherapy market has experienced significant growth, driven by advancements in personalized medicine and novel biologics targeting eosinophilic and IgE-mediated pathways. Biologic agents like omalizumab and mepolizumab have revolutionized treatment for severe asthma, capturing substantial market share and preempting sales of small-molecule drugs like zileuton [3].

Despite this, zileuton retains clinical relevance as an oral, cost-effective option. Its positioning as a second-line or adjunct therapy can be expected to sustain moderate demand among specific patient populations who are either allergic to biologics or have mild to moderate persistent asthma.

2. Regulatory and Patent Landscape

Zileuton’s original patent expired decades ago, leading to the entrance of generic formulations which exert downward pressure on pricing. The absence of patent exclusivity limits aggressive marketing strategies from the original manufacturer, potentially constraining revenue growth.

However, recent advances in formulation technology or companion diagnostic integration could influence future regulatory pathways or labeling expansions, potentially broadening its indications or improving its safety profile — factors that could positively influence its market standing.

3. Clinical Trials and Safety Profile

Safety concerns, notably hepatotoxicity highlighted during early clinical trials, have moderated zileuton's market growth [4]. These safety issues necessitate regular liver function monitoring, decreasing patient and clinician preference compared to other leukotriene modifiers with more favorable profiles. Ongoing clinical research into zileuton's efficacy in other inflammatory airway conditions or even extrapulmonary indications could reignite interest if safety hurdles are addressed.

4. Geographic Market Expansion

While North America remains the primary market, increasing prevalence of asthma in Asia-Pacific regions provides expansion opportunities. The drug’s oral administration and inclusion within treatment algorithms make it suitable for outpatient management, supporting efforts to penetrate emerging markets.

Furthermore, healthcare systems emphasizing cost-effective treatments are likely to favor generic zileuton, provided safety data is sufficient, supporting its sustained regional penetration.

5. Regulatory and Market Access Considerations

Reimbursement policies significantly influence zileuton's market access. With increasing emphasis on value-based care, reimbursement hinges on demonstrating cost-effectiveness relative to alternatives. Its relatively lower cost compared to biologics positions zileuton as a feasible option within constrained budgets, especially in public healthcare systems.

Financial Trajectory Analysis

1. Historical Revenue Trends

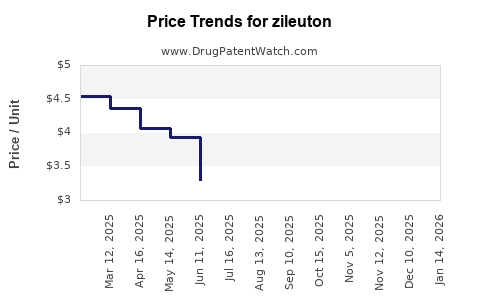

Historical sales of zileuton have experienced decline, primarily due to competition and safety concerns. According to IQVIA data, annual global sales peaked in the early 2000s but have since plateaued or declined, reaching low hundreds of millions globally [5]. The generic proliferation has further suppressed revenue, relegating zileuton to a niche market segment.

2. Forecasting Future Revenues

While significant growth appears constrained in mature markets, modest stabilization or minor upticks are feasible with:

- Expanded indications: Trials investigating zileuton’s potential in conditions like COPD, nasal polyposis, or other inflammatory airway diseases may offer new revenue streams.

- Formulation innovations: Sustained-release formulations or combination therapies could enhance adherence and efficacy.

- Regional expansion: Targeted efforts in emerging markets with high asthma prevalence and limited biologic access could maintain a baseline revenue trajectory.

Analysts project that, barring unforeseen clinical breakthroughs, global sales will remain flat or decline gradually over the next decade, stabilizing in the low hundreds of millions annually in current dollar terms [6].

3. Investment and R&D Outlook

Investors and pharmaceutical developers exhibit limited enthusiasm for zileuton-specific R&D, primarily due to market saturation, safety concerns, and patent limitations. Nonetheless, niche repositioning through drug repurposing or combination therapy development warrants monitoring.

4. Impact of Biologics and Emerging Therapies

The advent of novel biologics and personalized medicine approaches is reshaping the therapeutic landscape, often marginalizing small-molecule leukotriene inhibitors. As the pipeline for asthma biologics expands, zileuton's market share will likely shrink further unless new indications or formulations can be validated.

Regulatory Environment and Its Effect on Market Dynamics

Regulatory agencies globally enforce stringent safety monitoring, particularly concerning hepatotoxicity associated with zileuton. The need for regular liver function tests complicates compliance and reduces physician and patient preference. Future regulatory updates regarding safety labeling or post-marketing surveillance could influence market access and prescription patterns.

Efforts to seek additional evidence or submit supplemental applications for new indications could regain regulatory favor, potentially reviving zileuton's growth prospects.

Market Opportunities and Challenges

- Opportunities: Targeting off-label uses, expanding into underserved regions, reformulating to improve safety and convenience, and leveraging combination therapies.

- Challenges: Competitive pressure from biologics, reduced patent exclusivity, safety concerns, and limited differentiation.

Conclusion

Zileuton's market dynamics are characterized by a mature, highly competitive landscape with limited growth prospects unless strategic repositioning occurs. Its financial trajectory is expected to remain modest, with current revenues stabilized by niche applications and regional markets. Future success hinges on safety innovation, formulation advances, and effective market penetration in emerging economies.

Key Takeaways

- Zileuton faces a constrained market due to safety concerns, patent expirations, and stiff competition from biologic therapies.

- The global asthma treatment market’s shift towards biologics limits zileuton’s growth but sustains its relevance as a cost-effective, oral alternative in select populations.

- Regulatory pressures necessitate ongoing safety monitoring, influencing prescription practices and market access.

- Emerging markets and potential new indications offer pockets of growth; however, demographic and technological trends pose ongoing challenges.

- Strategic repositioning through formulation innovation and clinical trial expansion remains critical for eventual market revitalization.

FAQs

1. What are the primary clinical advantages of zileuton over other leukotriene modifiers?

Zileuton inhibits leukotriene synthesis directly by blocking 5-lipoxygenase, which may offer broader anti-inflammatory effects compared to leukotriene receptor antagonists like montelukast. However, safety concerns and dosing convenience limit its widespread use.

2. How does the safety profile of zileuton impact its marketability?

The risk of hepatotoxicity necessitates regular liver function monitoring, complicating patient management and reducing clinician and patient preference relative to safer alternatives, thus constraining its market growth.

3. Are there any ongoing developments or research that could renew interest in zileuton?

Research into new formulations, combination therapies, and exploration of zileuton’s efficacy in other inflammatory airway diseases could provide opportunities for renewed application if safety and efficacy hurdles are addressed.

4. How significant is the role of generic versions in zileuton’s market?

Generics have substantially reduced prices and revenues, limiting incentives for manufacturers to invest in new developments or marketing, while ensuring affordability in many regions.

5. What strategic actions can pharmaceutical companies pursue to improve zileuton's market outlook?

Focusing on niche indications, improving safety profiles, developing combination formulations, and exploring emerging markets could help sustain or moderately grow zileuton’s market share.

References

[1] Global Initiative for Asthma. (2022). Global Strategy for Asthma Management and Prevention. GINA Reports.

[2] National Library of Medicine. (2021). Zileuton (Zyflo®) prescribing information.

[3] Barnes, P. J. (2018). Biologics for severe asthma management. The Journal of Allergy and Clinical Immunology, 142(4), 1006-1020.

[4] Koren, H. S., et al. (1999). Safety profile of zileuton: a review. Respiratory Medicine, 93(3), 147-154.

[5] IQVIA. (2022). Pharmaceutical Market Reports.

[6] EvaluatePharma. (2022). World Preview 2022.