Last updated: October 10, 2025

Introduction

Teriparatide, a recombinant form of human parathyroid hormone (PTH 1-34), is a groundbreaking anabolic agent approved primarily for treating osteoporosis in postmenopausal women and individuals at high risk of fractures. Since its debut, its market performance and financial prospects have been shaped by evolving healthcare needs, competitive landscapes, regulatory policies, and innovation trajectories within the osteoporosis treatment space. This analysis examines the current market dynamics influencing teriparatide’s commercial trajectory, key factors underpinning its growth, and projections influencing its financial outlook.

Overview of Teriparatide and Its Therapeutic Role

Approved by the U.S. Food and Drug Administration (FDA) in 2002 under the brand name Forteo, teriparatide is distinguished by its unique anabolic mechanism promoting bone formation, contrasting with anti-resorptive agents like bisphosphonates. Its targeted indication includes osteoporosis in postmenopausal women, men with osteoporosis, and individuals with glucocorticoid-induced osteoporosis. The drug’s ability to significantly reduce vertebral and non-vertebral fractures has solidified its position as a vital therapeutic option, especially for severe cases resistant to other treatments.

Market Drivers and Barriers

Drivers of Growth

-

Rising Osteoporosis Burden

Global osteoporosis prevalence is projected to reach 55 million by 2040, driven by an aging population and increased life expectancy [1]. The rising incidence elevates demand for effective osteoporosis therapies, positioning teriparatide favorably due to its potent fracture risk reduction.

-

Efficacy and Clinical Differentiation

Teriparatide’s efficacy in increasing bone mineral density (BMD) and reducing fracture risk surpasses many anti-resorptive therapies. Its anabolic mechanism appeals to patients with severe osteoporosis or those who fail standard treatments.

-

Expanding Label Scope

Recent approvals extend teriparatide’s indications to include therapy in glucocorticoid-induced osteoporosis and specific patient populations, broadening its addressable market.

-

Innovative Formulations and Delivery

The advent of once-daily subcutaneous injections and exploration of new delivery mechanisms may improve patient adherence and expand its patient base.

Barriers to Market Expansion

-

High Cost and Reimbursement Challenges

As a biologic agent, teriparatide’s high price point (~$20,000 per year in the U.S.) constrains adoption, especially in markets with strict reimbursement policies [2].

-

Limited Treatment Duration

The recommended treatment window is typically limited to two years due to safety concerns, particularly osteosarcoma risk observed in animal studies, curbing long-term use and repeat courses.

-

Availability of Alternative Therapies

The emergence of new anabolic agents like abaloparatide and romosozumab offers competitive alternatives, often with more convenient dosing or broader approvals.

-

Safety Concerns and Class Risks

Potential for adverse effects, including hypercalcemia and theoretical cancer risks, hampers widespread acceptance among some clinician segments.

Competitive Landscape and Key Players

The market for anabolic osteoporosis therapies is intensively competitive. AbbVie (formerly Lilly), which markets Forteo in the U.S., remains prominent. However, newer entrants like UCB's abaloparatide (Tymlos) and Amgen/Eli Lilly's romosozumab (Evenity) have begun to reshape the market with improved dosing schedules and broader indications.

The entry of biosimilars, though limited by the biologic nature of teriparatide, could incrementally affect pricing and accessibility. Meanwhile, innovation in drug delivery, including implantable devices or oral formulations (currently in early research phases), could alter future dynamics.

Regulatory and Market Expansion Outlook

Geographic Expansion

While North America remains the dominant market, developing regions such as Asia-Pacific are witnessing accelerated adoption due to increasing osteoporosis awareness and healthcare infrastructure improvements. Regulatory approvals in these regions are anticipated to boost global revenue.

Regulatory Developments

Ongoing safety monitoring influences label updates and usage restrictions. The European Medicines Agency (EMA) and other health authorities prioritize pharmacovigilance, impacting market confidence and usage patterns.

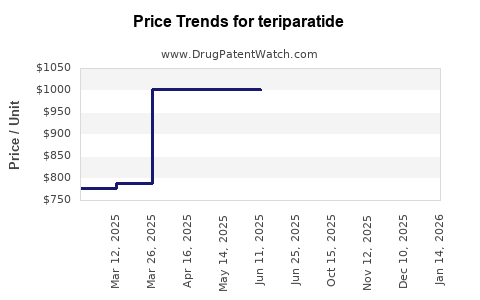

Patent and Pricing Strategies

Patent expirations threaten near-term revenue erosion; however, companies leverage patent extensions and formulation patents to prolong exclusivity. Pricing strategies grapple with balancing profitability against market access constraints.

Financial Trajectory Projections

Revenue Trends

From initial sales of approximately $700 million in 2010, the global teriparatide market reached around $1.2 billion in 2022, driven by increased adoption and expanded indications [3]. However, growth margins face pressure from biosimilar competition and generic alternatives.

Market Growth Projections

Industry analysts project a compound annual growth rate (CAGR) of around 3–5% over the next five years, contingent on regulatory approvals, reimbursement policies, and competitive innovations. The Asia-Pacific market could outpace mature markets due to demographic shifts and unmet needs.

Investment and R&D Outlook

Pharmaceutical companies are investing in next-generation anabolic therapies with improved safety, convenience, and cost-effectiveness, potentially shading the future revenue landscape of teriparatide. Despite this, the current clinical use and established efficacy ensure sustained demand, especially in niche segments requiring potent fracture prevention.

Challenges and Opportunities

Market growth hinges on overcoming high treatment costs, expanding approved indications, and differentiating from emerging therapies. The potential for biosimilar entry in the coming decade could significantly impact pricing strategies and profit margins, emphasizing the need for lifecycle management and innovation.

Conclusion

Teriparatide’s market dynamics are influenced by demographic trends, therapeutic efficacy, competitive innovations, and regulatory pathways. While current revenues remain robust, future financial trajectories are subject to competitive pressures, evolving treatment paradigms, and healthcare policy shifts. Strategic positioning—through broader indications, formulation improvements, and geographic expansion—will determine its sustainability and growth prospects amid a rapidly advancing osteoporosis treatment landscape.

Key Takeaways

- Growing Osteoporosis Prevalence: An aging global population ensures ongoing demand for anabolic therapies like teriparatide.

- Market Expansion Opportunities: Broader indications and geographic growth, especially in Asia-Pacific, present significant revenue avenues.

- Pricing and Reimbursement Constraints: High costs limit market penetration; value-based pricing and reimbursement strategies are critical.

- Competitive Innovation: Newer agents such as abaloparatide and romosozumab pose competitive threats; innovation in delivery and safety profiles is essential.

- Regulatory Vigilance: Ongoing safety monitoring influences market confidence and formulary inclusion, impacting long-term sales.

FAQs

1. How does teriparatide compare to its rivals in efficacy?

Teriparatide demonstrates superior efficacy in increasing bone mineral density and reducing fracture risk compared to anti-resorptive agents. Its anabolic mechanism targets patients with severe or resistant osteoporosis, offering benefits where other treatments fall short.

2. What are the primary safety concerns associated with teriparatide?

While generally well-tolerated, concerns include risk of osteosarcoma (based on animal studies), hypercalcemia, and potential cardiovascular effects. These have led to strict treatment duration limits and monitoring protocols.

3. How might biosimilar versions impact the teriparatide market?

Biosimilar entry could significantly reduce prices, expanding access and reducing revenue for originators. However, biosimilars face patent challenges, and biologic complexity may delay their market penetration.

4. Are there recent regulatory developments affecting teriparatide?

Regulatory bodies continue to monitor safety data, sometimes leading to updated labeling or restricted indications. Expanding approvals in emerging markets also influence its worldwide market dynamics.

5. What is the future outlook for innovations in anabolic osteoporosis therapies?

Research into longer-acting formulations, oral delivery methods, and novel anabolic agents is ongoing. These innovations could enhance adherence, safety, and cost-effectiveness, reshaping the market landscape and influencing teriparatide’s financial trajectory.

References

[1] World Osteoporosis Federation. (2020). Global Osteoporosis Report 2019.

[2] IMS Health. (2022). Pharmaceutical Pricing Trends.

[3] MarketWatch. (2023). Osteoporosis Drugs Market Analysis and Forecast.