Last updated: July 27, 2025

Introduction

Ofloxacin, a fluoroquinolone antibiotic, holds a significant position within the global antimicrobial market. Introduced in the late 1980s, it has been widely used for treating a broad spectrum of bacterial infections, including urinary tract infections, respiratory infections, and skin infections. Despite its longstanding presence, the drug's market dynamics and financial trajectory have evolved considerably over the decades, influenced by advances in medical practices, regulatory landscapes, and emerging resistance patterns. This analysis dissects the factors underpinning ofloxacin’s market positioning, explores its financial trends, and projects future developments based on current industry trajectories.

Market Overview and Historical Context

Initially approved in the early 1980s, ofloxacin rapidly gained approval worldwide due to its broad-spectrum antimicrobial activity, favorable pharmacokinetics, and oral formulation convenience. The global demand surged in the 1990s and early 2000s, driven by expanding indications, increased prevalence of bacterial infections, and evolving healthcare infrastructure, particularly in developing economies. The drug was marketed by major pharmaceutical players like Daiichi Sankyo (Japan) and later by various generic manufacturers, bolstering its accessibility and market penetration.

However, the subsequent emergence of antibiotic resistance, especially among gram-negative bacteria, along with the recognition of adverse drug reactions such as tendinopathy and QT interval prolongation, prompted regulatory agencies to impose restrictions and revise usage guidelines. These developments have had a profound impact on ofloxacin’s market share trajectory over recent years.

Market Dynamics Influencing Ofloxacin

1. Regulatory and Safety Profile

Regulatory agencies globally, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have issued warnings about fluoroquinolones, including ofloxacin, citing risks such as musculoskeletal disorders and neuropsychiatric effects. The FDA's 2016 warning against fluoroquinolone use for uncomplicated infections significantly curtailed outpatient prescriptions, impacting ofloxacin sales.

Additionally, several countries restrict the use of fluoroquinolones to specific indications, limiting over-the-counter availability and reducing volume growth. These regulatory constraints have prompted formulary restrictions and encouraged the adoption of alternative antibiotics with better safety profiles.

2. Antibiotic Resistance and Clinical Efficacy

Rising resistance among common pathogens has diminished ofloxacin's clinical effectiveness, especially for urinary tract and respiratory infections. Surveillance data indicate increasing minimum inhibitory concentrations (MICs), necessitating higher dosing or alternative agents. Consequently, clinicians favor other antibiotics such as nitrofurantoin, fosfomycin, or newer fluoroquinolones with better resistance profiles.

The prevalence of resistance has led to reduced prescription volumes, especially in Western markets, where antimicrobial stewardship programs prioritize minimizing fluoroquinolone use. Conversely, in regions with limited access to newer antibiotics, ofloxacin continues to serve as a primary option, sustaining demand.

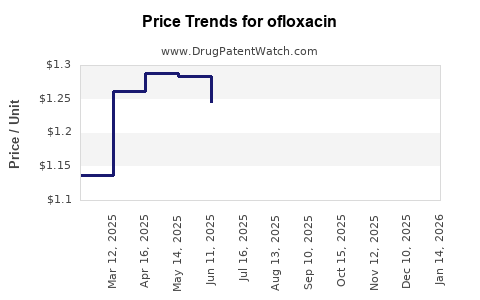

3. Shift Toward Generics and Price Competition

The entry of multiple generic manufacturers has made ofloxacin highly affordable, particularly in developing countries. Price competition has driven volume sales upwards in emerging markets, offsetting decreased demand in developed regions. This has stabilized overall revenues for manufacturers focusing on high-volume, low-margin markets.

4. Competition from Novel Antibiotics and Alternative Therapies

The rise of novel antimicrobial agents, including cephalosporins, carbapenems, and lipoglycopeptides, has further eroded ofloxacin's market share. Additionally, the advent of rapid diagnostics has enabled more targeted therapy, reducing empirical use of broad-spectrum agents like ofloxacin.

5. Market Segmentation and Regional Variations

Demand patterns for ofloxacin display significant regional divergence:

- North America & Europe: Declining due to safety concerns and resistance, with ofloxacin largely replaced by newer agents.

- Asia-Pacific & Latin America: Higher utilization owing to cost-effectiveness, limited access to advanced antibiotics, and persistent bacterial infection burdens.

6. Manufacturing and Patent Landscape

Most ofloxacin formulations are now off-patent, fostering widespread generic production. This has increased accessibility but exerted pressure on profit margins for innovator companies. The commoditization of the drug complicates efforts to sustain high revenues, prompting manufacturers to explore value-added formulations or combination therapies.

Financial Trajectory and Revenue Projections

Historical Revenue Trends

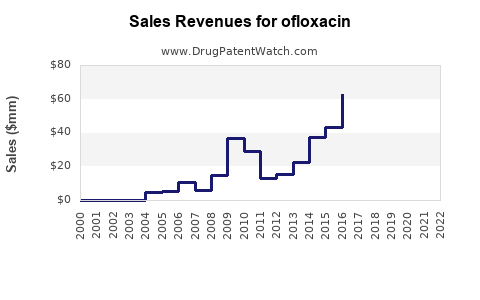

From its peak in the late 1990s and early 2000s, ofloxacin generated robust revenues for several pharmaceutical companies. Market reports estimated global sales exceeding USD 1.2 billion annually at its peak. However, industry estimates suggest that since the mid-2010s, sales have declined sharply in Western markets, with some regions experiencing reductions of over 50%.

Current Market Size and Regional Breakdown

As of 2022, the global ofloxacin market is estimated between USD 500 million and USD 700 million, primarily driven by emerging markets. The Asia-Pacific region accounts for the majority share, reflecting higher usage rates and limited alternatives. North American and European markets have seen contractions due to regulatory restrictions and evolving prescribing behaviors.

Future Outlook and Growth Drivers

The global market is expected to continue shrinking in mature regions, with a compounded annual decline rate (CAGR) of approximately 4–6% over the next five years. Conversely, the growing healthcare infrastructure and bacterial infection burden in Asia-Pacific and Africa could sustain moderate growth, with CAGR projections around 2–3% regionally.

Emerging trends influencing future financial trajectories include:

- Development of Generics and Cost-Effective Alternatives: Continued proliferation of low-cost generics will maintain volume sales in developing markets.

- Expansion in Chronic Infection Management: Exploration of ofloxacin’s role in chronic or resistant infections might open niche markets.

- Shift Toward Newer Fluoroquinolones: Replacement by newer agents with better safety and efficacy profiles could further diminish ofloxacin’s revenue share.

Pharmaceutical Industry Strategies

Companies may pursue diversification strategies, such as reformulation for better safety or combination therapies, to extend market life. Alternatively, some manufacturers may reallocate resources toward newer antibiotics or alternative therapeutic classes.

Strategic Market Considerations

- Regulatory Navigation: Navigating evolving safety guidelines requires robust pharmacovigilance and targeted education to sustain prescribing.

- Regional Penetration: Tapping into emerging markets with tailored pricing strategies can buffer revenue declines in mature markets.

- Research & Development: Investing in novel formulations or adjunct therapies could carve out niche segments, counterbalancing overall declines.

Conclusion

The market dynamics and financial trajectory of ofloxacin are emblematic of broader trends in antimicrobial pharmaceuticals: initial high growth followed by stagnation and decline driven by resistance, safety concerns, and regulatory pressures. While the global market's size has contracted, substantial opportunities remain in emerging economies where affordability is paramount. Companies that adapt through innovative formulations, strategic regional focus, and diversification will better navigate the evolving landscape.

Key Takeaways

- Ofloxacin experienced peak demand in the 1990s-2000s but has faced decline due to resistance and safety concerns.

- Regulatory agencies have imposed usage restrictions, notably in North America and Europe, curbing market size.

- Despite reduced demand in developed regions, emerging markets sustain global sales through generics and affordability.

- Industry revenue estimates indicate a declining trend, with future projections suggesting continued contraction in mature markets but potential stability in developing regions.

- Strategic adaptability—including reformulation, regional focus, and innovation—will determine long-term viability.

FAQs

1. What are the main factors contributing to the decline of ofloxacin in developed markets?

Regulatory restrictions due to safety concerns, increasing bacterial resistance reducing clinical efficacy, and the availability of safer, more effective alternatives have led to decreased prescriptions of ofloxacin in North America and Europe.

2. How do global resistance patterns affect ofloxacin’s market viability?

Rising resistance among key bacterial pathogens diminishes ofloxacin’s effectiveness, prompting clinicians to prefer other antibiotics, thereby reducing demand in regions with high resistance prevalence.

3. What regions are driving the global demand for ofloxacin today?

The Asia-Pacific region, Latin America, and parts of Africa drive most current demand due to affordability, existing healthcare infrastructure, and higher infection burdens.

4. How has the generic drug market impacted ofloxacin’s revenue prospects?

The proliferation of generic manufacturers has lowered prices and increased accessibility, primarily in emerging economies, stabilizing sales volumes but exerting pressure on profit margins for innovators.

5. What strategic opportunities exist for pharmaceutical companies regarding ofloxacin?

Opportunities include developing improved formulations with better safety profiles, exploring combination therapies, expanding into untapped markets, and investing in R&D for next-generation antibiotics.

Sources:

[1] U.S. Food and Drug Administration (FDA). "FDA Drug Safety Communications," 2016.

[2] European Medicines Agency (EMA). "Guideline updates on fluoroquinolone safety," 2019.

[3] Market Research Future. "Global Antibiotics Market Report," 2022.

[4] IQVIA. "Global Use of Antibiotics," 2021.

[5] Antibiotic Resistance Threats in the United States, CDC, 2019.