Last updated: July 28, 2025

Introduction

Nitrofurantoin, a long-standing antimicrobial agent, primarily treats uncomplicated urinary tract infections (UTIs). Since its approval in the 1950s, its clinical utility has sustained market relevance, despite increasing antibiotic resistance. This analysis delineates the evolving market landscape, regulatory environment, competitive forces, and financial forecasts driving Nitrofurantoin’s trajectory in the global pharmaceutical industry.

Market Overview

Nitrofurantoin’s market is predominantly characterized by its niche role in antimicrobial therapy. The drug’s robust efficacy against common uropathogens—Escherichia coli, Enterococcus faecalis—alongside its minimal systemic absorption, affirms its utility in outpatient settings. The global UTI treatment market, valued at approximately $5.8 billion in 2022 (per reports from MarketsandMarkets), underscores the significant demand attributable to the high prevalence of UTIs, especially among women.

While newer antibiotics have emerged, Nitrofurantoin remains a preferred first-line agent in many clinical guidelines due to its favorable safety profile, cost-effectiveness, and resistance patterns. Nevertheless, its market share faces pressure from evolving resistance patterns, regulatory scrutiny, and the advent of alternative therapeutic options.

Regulatory and Clinical Dynamics

Regulatory Environment

In recent years, regulatory agencies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have evaluated Nitrofurantoin’s safety, especially concerning its use in renal impairment and pregnancy. The FDA issued warnings regarding pulmonary toxicity in 2020, emphasizing cautious prescribing practices. These safety concerns influence market access and formulary placements.

Clinical Practice Trends

Guidelines from the Infectious Diseases Society of America (IDSA) recommend Nitrofurantoin as a first-line agent for uncomplicated cystitis, boosting its demand. Conversely, concerns over resistance, particularly in certain regions, could impact future prescription patterns. Research into resistance mechanisms continues, with some surveillance data indicating increased resistance in specific bacterial strains, potentially constraining growth.

Competitive Landscape

Generic Competition

The majority of Nitrofurantoin formulations are off-patent generics, resulting in heightened price competition and wider accessibility. Limited innovation or patent protection restricts revenue growth potential but sustains volume-based sales.

Emerging Alternatives and Resistance

New antibiotics such as fosfomycin and pivmecillinam are gaining favor, especially in resistant infections. These alternatives, coupled with the rising trend of antimicrobial stewardship, could reduce Nitrofurantoin’s market share in the longer term.

Market Entry and Innovation

Despite challenges, companies exploring novel formulations—extended-release versions, combination therapies—aim to enhance efficacy and safety, potentially rejuvenating market interest.

Financial Trajectory Outlook

Current Valuation and Revenue Drivers

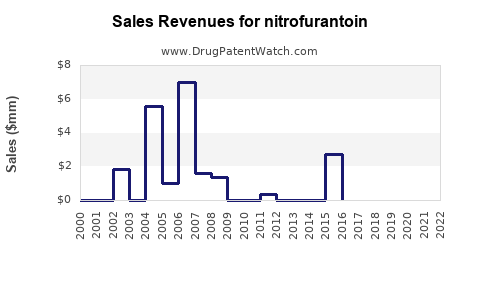

Nitrofurantoin’s revenue remains primarily driven by generic sales, with global sales estimated at approximately $300–$500 million annually. Its low-cost manufacturing and widespread demand sustain stable profit margins, especially in mature markets with high outpatient prescription rates.

Forecasting Future Market Trends

-

Moderate Growth (2023–2028): Given the steady prevalence of UTIs and established clinical guidelines, sales are projected to grow modestly at 3-5% annually. This aligns with general trends in antimicrobial sales and reflects the enduring clinical role of Nitrofurantoin.

-

Impact of Resistance and Safety Concerns: Resistance trends and safety warnings could stifle growth, necessitating investment in safer formulations or stewardship programs that potentially restrict prescribing volumes.

-

Market Consolidation and Strategic Moves: Multinational pharmaceutical firms may seek to expand portfolios through licensing or acquiring regional manufacturers to leverage cost efficiencies and diversify risks.

-

Potential for Innovation: Development of novel formulations and adjunctive therapies could create premium segments, enhancing profit margins and extending the drug’s lifecycle.

Emerging Market Dynamics

Developing economies represent significant growth avenues, driven by increased access to generics and rising healthcare infrastructure. However, these markets may face challenges related to regulatory disparities and resistance patterns.

Market Challenges and Opportunities

Challenges

-

Antimicrobial Resistance (AMR): Growing resistance threatens effective utility and may necessitate repositioning or reformulation efforts.

-

Regulatory Limitations: Safety warnings or restrictions, particularly regarding renal function and pregnancy, could limit prescribing.

-

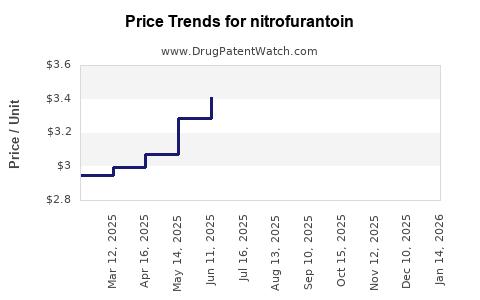

Pricing Pressures: Cost-containment policies and generics commoditization suppress pricing power.

Opportunities

-

Formulation Innovation: Extended-release or combination therapies could sustain interest and address safety concerns.

-

Global Expansion: Increasing penetration into emerging markets offers revenue diversification.

-

Stewardship Integration: Aligning with antimicrobial stewardship programs can enhance sustainable use, preserving market relevance.

Key Takeaways

-

Nitrofuranontoin remains a essential treatment for uncomplicated UTIs, with a stable, albeit mature, market position.

-

Generics dominate the landscape, restricting revenue growth but offering consistent volume sales.

-

Resistance development and safety concerns pose risks but also open avenues for innovation and differentiated formulations.

-

The global market outlook underpins steady growth, primarily driven by emerging markets and clinical guideline endorsements.

-

Strategic investments in formulation innovation, regional expansion, and stewardship programs will be crucial for companies seeking to capitalize on Nitrofuranontoin’s enduring relevance.

FAQs

1. What factors are influencing Nitrofurantoin’s market growth?

Market growth is driven by high UTI prevalence, clinical guideline endorsement, generics availability, and regional healthcare infrastructure. Resistance patterns and safety concerns are constraining further expansion.

2. How does antimicrobial resistance impact Nitrofurantoin’s future?

Rising resistance, particularly among E. coli strains, reduces efficacy, risking market share decline. Surveillance and development of formulations with broader activity could mitigate this impact.

3. Are there any recent regulatory changes affecting Nitrofurantoin?

Yes, FDA safety warnings regarding pulmonary toxicity and precautions in renal impairment influence prescribing patterns and formulatory development.

4. What opportunities exist for innovation in Nitrofurantoin formulations?

Extended-release versions, combination therapies, and targeted delivery systems could improve safety profiles and extend market viability.

5. How do emerging markets influence Nitrofurantoin’s overall revenue?

Emerging markets present sizable growth opportunities due to increasing healthcare access and demand for affordable antibiotics, potentially offsetting stagnation in mature markets.

References

[1] MarketsandMarkets, "UTI Treatment Market," 2022.

[2] Infectious Diseases Society of America (IDSA), Clinical Guidelines for UTIs, 2021.

[3] FDA Safety Communications, Pulmonary Toxicity Risks, 2020.

[4] World Health Organization, Antibiotic Resistance Reports, 2022.