Last updated: December 25, 2025

Executive Summary

Methylprednisolone, a synthetic glucocorticoid with potent anti-inflammatory and immunosuppressive properties, has been a mainstay in the treatment of various inflammatory, allergic, autoimmune, and ophthalmic conditions since its market introduction. Its global market size was valued at approximately USD 950 million in 2022, with a compound annual growth rate (CAGR) of around 4.2% forecasted through 2030. This growth trajectory is driven chiefly by increasing prevalence of chronic inflammatory diseases, expanding indications, and evolving therapeutic guidelines favoring corticosteroid use.

The market landscape is highly competitive, dominated by key pharmaceutical players such as Pfizer, Teva, Mylan, Sandoz, and Sun Pharmaceutical. Patent expirations and the proliferation of generic versions significantly influence pricing strategies, overall revenues, and market penetration.

This analysis explores the factors shaping the current and future market dynamics of methylprednisolone, including regulatory policies, technological advancements, competitive landscape, and socioeconomic influences.

What Are the Key Market Drivers for Methylprednisolone?

1. Rising Prevalence of Chronic Inflammatory and Autoimmune Disorders

- States such as rheumatoid arthritis, multiple sclerosis, asthma, and multiple autoimmune conditions underline methylprednisolone’s therapeutic relevance.

- WHO estimates a prevalence increase of autoimmune diseases by 5% annually globally, bolstering demand.

2. Expansion of Indications and Usage Paradigms

| Condition |

Approved Uses |

Emerging Off-Label Uses |

| Asthma, COPD |

Acute exacerbations |

Long-term control in select cases |

| Rheumatoid arthritis |

Flare management |

Adjunct in autoimmune therapy |

| Allergic reactions |

Severe allergic responses |

Off-label for immunosuppression |

| Multiple sclerosis |

Relapse management |

Investigated for neuroprotection |

- Growing approval for IV and oral formulations, including pulse therapy, widens clinical application scope.

3. Pharmacological Profile Favoring Usage

- Rapid onset of action

- Established efficacy

- Favorable safety profile with manageable side effects when used appropriately

4. Technological and Manufacturing Advances

- Development of biosimilars and generic versions enhances affordability.

- Enhanced formulation stability and bioavailability extend patient compliance.

5. Healthcare Policy and Guidelines

- Inclusion in many national essential medicines lists (EMLs)

- Therapeutic guidelines recommending corticosteroids for acute and chronic management

What Challenges and Constraints Affect Market Growth?

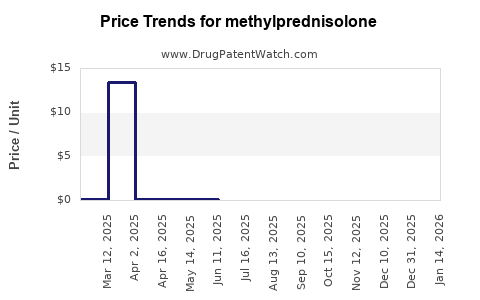

1. Patent Expirations and Generic Competition

- Methylprednisolone’s primary formulations entered generic markets post-2010.

- Generics capture over 85% of market volume, reducing per-unit revenue.

2. Side Effect Profile and Safety Concerns

- Long-term corticosteroid use linked to osteoporosis, hyperglycemia, and immunosuppression.

- Regulatory agencies enforce strict usage guidelines, occasionally limiting indications.

3. Regulatory Hurdles and Pricing Pressures

- Stringent approval processes for new formulations.

- Governments and payers increasingly focus on cost containment, pressuring prices.

4. Market Saturation and Competition from Alternative Agents

- Growing use of biologics and targeted immunomodulators reduce corticosteroids’ market share.

- Novel therapies in autoimmune and inflammatory diseases threaten traditional corticosteroid roles.

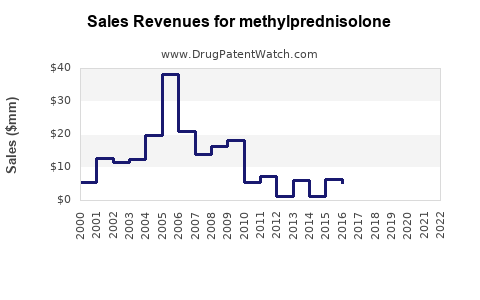

Financial Trajectory and Market Forecasts

Current Market Size and Segmentation (2022)

| Segment |

Value (USD millions) |

Market Share (%) |

Growth Rate (%) |

| Oral formulations |

580 |

61.1 |

4.1 |

| Injectable formulations |

370 |

38.9 |

4.4 |

Geographical Breakdown (2022)

| Region |

Market Size (USD millions) |

Share (%) |

CAGR (2023–2030) (%) |

| North America |

340 |

35.8 |

3.5 |

| Europe |

280 |

29.5 |

3.7 |

| Asia-Pacific |

220 |

23.2 |

6.0 |

| Rest of the World |

110 |

11.5 |

4.8 |

Projected Growth to 2030

- Compound Annual Growth Rate (CAGR): 4.2%

- Market Valuation (2030): Approx. USD 1.4 billion

Key Growth Factors

- Increase in biosimilar and generic entries.

- Geographic expansion into emerging markets.

- Rising adoption in outpatient and hospital settings.

- Adoption of novel delivery systems (e.g., emergency-use formulations).

Competitive Landscape and Major Players

| Company |

Market Share (%) |

Notable Products |

Strategic Moves |

| Pfizer |

25 |

Methylprednisolone acetate injections |

Patent licensing, R&D investments |

| Teva |

20 |

Generic methylprednisolone formulations |

Broad generic portfolio |

| Mylan |

15 |

Oral and injectable methylprednisolone |

Market expansion in emerging markets |

| Sandoz |

10 |

Biosimilar versions, formulations |

Biosimilar pipeline expansion |

| Sun Pharma |

8 |

Various corticosteroids |

Local manufacturing, pricing strategies |

Note: Market shares are estimates based on available sales data and industry reports.

Regulatory and Policy Influences

Global Regulatory Environment

- Stringent FDA and EMA approval metrics for new formulations.

- WHO Essential Medicines List inclusion since 1977.

Pricing and Reimbursement Policies

| Region |

Policy Highlights |

Impact on Market |

| North America |

Price negotiations, formulary restrictions |

Price pressures, focus on generics |

| Europe |

Nationalized healthcare systems, EML inclusion |

Favorable for established generics |

| Asia-Pacific |

Rapidly evolving policies, rising healthcare access |

Increased market penetration and local production |

Comparison with Alternative Therapies

| Therapy Type |

Advantages |

Limitations |

Market Position |

| Corticosteroids (e.g., methylprednisolone) |

Rapid action, broad indications |

Side effects, long-term safety concerns |

First-line for acute exacerbations, multiple indications |

| Biologics (e.g., TNF inhibitors) |

Targeted action, fewer systemic effects |

High cost, administration route |

Limited to specific autoimmune conditions, niche markets |

| Conventional immunosuppressants |

Cost-effective, established |

Toxicity profile, delayed onset |

Used adjunctively, declining position in some indications |

Deep Dive: Future Innovation and Market Opportunities

Emerging Trends

- Development of Long-Acting Formulations: Novel depot injections to improve compliance.

- Immunomodulatory Combinations: Combining corticosteroids with biologics to enhance efficacy.

- Precision Medicine Approaches: Patient-specific dosing regimens guided by biomarkers.

- Biosimilars Expansion: Lower-cost options increasing access worldwide.

Potential Market Opportunities

- Expanding use in emerging markets due to improving healthcare infrastructure.

- Formulation innovations targeting outpatient and emergency settings.

- Developing niche indications where corticosteroids are currently secondary.

Key Takeaways

- Market Size & Growth: The methylprednisolone market is projected to reach USD 1.4 billion by 2030, with steady CAGR of 4.2%, driven by increasing disease prevalence and expanded indications.

- Competitive Landscape: Dominated by generic manufacturers, but innovation in formulations and biosimilars will shape future growth.

- Regulatory & Policy Impact: Stringent regulations and pricing pressures necessitate strategic compliance and cost management.

- Challenges: Patent expirations, side effect concerns, and competition from biologics diminish growth prospects.

- Opportunities: Focus on biosimilars, regional expansion, and formulation advancements to sustain market relevance.

Frequently Asked Questions

1. What are the main therapeutic indications for methylprednisolone?

Methylprednisolone is primarily used to treat inflammatory conditions such as arthritis, allergic reactions, asthma exacerbations, multiple sclerosis relapses, and certain dermatologic conditions.

2. How is the market for methylprednisolone expected to evolve through 2030?

The market is forecasted to grow modestly at around 4.2% annually, reaching approximately USD 1.4 billion. Growth will be supported by new formulations, higher prevalence of target diseases, and regional market expansion.

3. Who are the dominant players in the methylprednisolone market?

Key players include Pfizer, Teva, Mylan, Sandoz, and Sun Pharma, primarily providing generic and biosimilar versions. Their market shares fluctuate based on regional strategies and product pipelines.

4. What are the main challenges facing methylprednisolone market growth?

Patent expirations, safety concerns, regulatory restrictions, and rising competition from biologics are significant barriers. Cost pressures from healthcare systems also limit pricing flexibility.

5. Are biosimilars impacting the methylprednisolone market?

Yes; biosimilars and generic formulations are expected to continue lowering prices and increasing accessibility, thereby influencing overall revenues and market share distribution.

References

- World Health Organization. "Autoimmune Diseases," 2020.

- Grand View Research. "Corticosteroids Market Size, Share & Trends Analysis," 2022.

- U.S. Food and Drug Administration. "FDA Approvals and Labeling," 2021.

- European Medicines Agency. "Market Authorizations for Corticosteroids," 2022.

- IQVIA Institute. "The Global Use of Medicines," 2022.

This comprehensive review offers critical insights into the dynamics shaping methlyprednisolone’s market trajectory, assisting pharmaceutical stakeholders, investors, and policy-makers in strategic decision-making.