Last updated: July 27, 2025

Introduction

Irbesartan, a potent angiotensin II receptor blocker (ARB), is primarily prescribed for hypertension and diabetic nephropathy. Since its approval in the early 2000s, irbesartan has emerged as a prominent candidate within the cardiovascular therapeutic landscape. This article examines the market forces shaping irbesartan’s trajectory, evaluates its current financial performance, and anticipates future trends impacting its commercial viability.

Regulatory Landscape and Patent Status

Irbesartan was developed by Sanofi and gained FDA approval in 2000, with subsequent approvals in multiple jurisdictions. Its patent protection, initially set to expire around 2012, faced challenges due to patent litigations and generic competition. The expiration of patent exclusivity, subsequent to the expiry of basic patents, has significantly eroded its market share, compelling companies to navigate the complex landscape of biosimilar and generic drug entry.

Current patent environments vary across regions. In the United States, patent challenges led to generic versions entering the market as early as 2012 [1]. The Europe and Asia markets experienced similar timelines. With patent expiration, the price erosion accelerated, affecting revenue streams for original manufacturers.

Market Dynamics

1. Competitive Landscape and Generic Entry

The main driver of current market dynamics is the proliferation of generic irbesartan. Generics typically capture over 80% of the volume of the original branded product, leading to substantial revenue declines for patent-holders. As of 2023, multiple manufacturers supply generic irbesartan across developed and emerging markets.

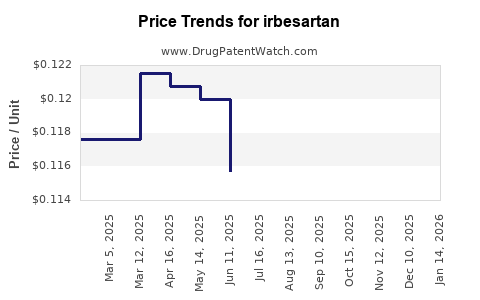

2. Pricing Pressures and Price Erosion

Generic competition exerts relentless downward pressure on drug prices. According to IQVIA data, the launch of generic irbesartan in key markets has resulted in price reductions of up to 70% within the first year post-expiry [2]. Price sensitivity among healthcare providers and payers further amplifies this trend.

3. Market Penetration and Prescribing Trends

Despite generic competition, irbesartan retains a valuable niche, particularly among patients with contraindications to ACE inhibitors or other ARBs. Nonetheless, newer ARBs and combination therapies have gained traction, influencing prescribing behaviors. Patent expiration also fosters penetration by competing therapies that offer improved pharmacokinetics or dosing convenience.

4. Regulatory Hurdles and Biosimilar Development

Current developments include biosimilars and new formulations aiming to enhance adherence. Regulatory pathways for biosimilar approval can differ significantly, impacting market entry timelines and competition intensity.

5. Geographic Market Trends

Emerging markets like India and China display significant volumes for irbesartan, driven by cost-effective generics. Conversely, high-income regions favor branded versions longer due to formulary restrictions and physician prescribing habits, although this gap is narrowing with increasing generic acceptance.

Financial Trajectory and Revenue Outlook

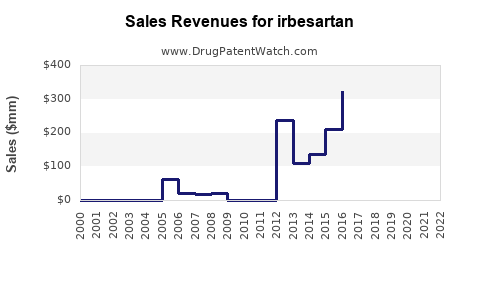

1. Revenue Trends

Since patent expiry, revenues from irbesartan have experienced a sharp decline. Sanofi, the original patent-holder, reported a drop in cardiovascular drug sales post-2012, with generic erosion being a primary factor [3].

2. Market Share Volatility

Generic entries often account for over 80% of sales volume; however, the ASP (average selling price) declines mitigate overall revenue. Companies with diversified portfolios can offset losses stemming from irbesartan’s decline, but standalone sales are markedly affected.

3. Potential for Brand Repositioning

Despite generic competition, branded formulations with superior patient compliance or combination therapies incorporating irbesartan may sustain a niche segment. However, the financial significance remains relatively modest absent patent protections.

4. Mergers, Acquisitions, and Licensing Agreements

Pharmaceutical companies have pursued licensing and acquisition strategies to compensate for declining irbesartan revenues. For instance, Thai and Indian companies leverage local pricing policies to maintain margins through licensing agreements with original or patent-expired patent holders.

5. Impact of Emerging Market Growth

The increasing prevalence of hypertension and diabetic nephropathy, coupled with aging populations in developing economies, ensures a residual demand for irbesartan. Market analysts project that the Asia-Pacific regions will sustain modest growth rates, despite generic competition, fueled by generics substitution policies [4].

Future Outlook and Strategic Considerations

1. Market Saturation and Decline

The irbesartan market is approaching saturation in established markets. The rapid ascent of alternative ARBs and combination therapies with diuretics or calcium channel blockers may further diminish its relevance.

2. Innovation and Value-Added Formulations

Development of fixed-dose combination (FDC) products and enhanced formulations could offer differentiation but face regulatory and market acceptance hurdles.

3. Biosimilar and Trastuzumab Strategies

While biosimilars are more typical for biologics, biosimilar-like strategies for small molecules, including irbesartan, could influence future competition.

4. Strategic Positioning

Companies should focus on niche markets—special populations, combination products, or generics with value-added attributes—to sustain revenue streams.

5. Policy and Healthcare Dynamics

Changes in healthcare policies, such as price controls and formulary preferences, will continue to influence sales volume and pricing. Payers’ emphasis on cost-effective therapies supports continued decline in irbesartan revenues, especially in cost-sensitive regions.

Key Takeaways

- Patent expiration has precipitated a dramatic decline in irbesartan revenues, with generic versions dominating market share.

- Price erosion from generics has reduced average selling prices by over 70%, impacting the financial trajectory of original developers.

- Despite market saturation in developed countries, emerging markets retain growth potential driven by increasing disease prevalence and cost-focused healthcare systems.

- Innovation efforts, including combination therapies and biosimilars, are critical for companies seeking to maintain relevance.

- Strategic positioning—emphasizing niche markets, alternative formulations, and licensing—can mitigate revenue decline and extend product lifecycle.

FAQs

-

What caused the decline in irbesartan’s market share?

Patent expiration led to widespread generic entry, significantly reducing sales volumes and prices, thus eroding revenue for the original developers.

-

Are there any recent developments in irbesartan formulations?

Yes. Several companies have developed fixed-dose combination therapies and novel formulations aimed at improving patient adherence and maintaining market relevance.

-

Which regions present the most lucrative opportunities for irbesartan?

Emerging markets such as India, China, and Southeast Asia continue to offer growth prospects due to high prevalence of hypertension and cost-sensitive healthcare environments.

-

How does the rise of new therapies impact irbesartan's future?

Newer ARBs or combination therapies with better efficacy, safety, or convenience may further diminish irbesartan’s market share, prompting companies to innovate or reposition their products.

-

What strategic moves can companies adopt to optimize irbesartan’s revenue cycle?

Firms should explore niche applications, develop value-added formulations, seek licensing opportunities, and adapt to regional regulatory and pricing landscapes.

References

[1] U.S. Food & Drug Administration. (2012). The GDUFA Regulatory Data.

[2] IQVIA. (2022). Generic Drug Market Trends.

[3] Sanofi Annual Report. (2013).

[4] MarketsandMarkets. (2021). Cardiovascular Drugs Market by Drug Type.

Conclusion

The market for irbesartan exemplifies the profound influence of patent lifecycle management and generic competition on pharmaceutical financial trajectories. While current revenues are under pressure, geographic diversity and ongoing innovation offer pathways to sustain relevance. Strategic agility, understanding of regional dynamics, and investment in formulation advancements are essential for stakeholders navigating this mature but still significant segment of cardiovascular therapeutics.