Last updated: July 27, 2025

Introduction

Irbesartan, an angiotensin II receptor blocker (ARB), is widely prescribed for hypertension management and diabetic nephropathy. Since its approval by the FDA in 2000, Irbesartan has carved a significant niche within cardiovascular and renal disease therapeutics. As the global burden of hypertension and diabetic complications escalates, understanding the commercial landscape for Irbesartan is vital for stakeholders in the pharmaceutical industry. This article offers a comprehensive market analysis and sales forecast, emphasizing current trends, competitive positioning, and future growth opportunities.

Market Overview

Global Demand Dynamics

Hypertension affects roughly 1.3 billion adults worldwide, with an increasing prevalence driven by aging populations, sedentary lifestyles, and obesity [1]. Diagnostic and treatment rates have improved, bolstering demand for ARBs like Irbesartan. Additionally, diabetic nephropathy—a leading cause of end-stage renal disease—accounts for approximately 40% of dialysis cases globally, further expanding Irbesartan’s therapeutic applications [2].

Therapeutic Positioning

Irbesartan is classified as a second-generation ARB, distinguished by its high selectivity for the angiotensin II type 1 receptor, resulting in effective blood pressure reduction with a favorable side-effect profile. Its patent expired in key markets around 2017–2018, paving the way for generic competition, which significantly impacted pricing and market share.

Regulatory and Patent Landscape

Initially secured through patent protection, Irbesartan's exclusivity ended in major jurisdictions by 2018, prompting multiple generics to enter the market. The consequent price erosion has increased access but also intensified competition among manufacturers.

Market Segmentation and Geographic Distribution

By Indication

- Hypertension: The primary therapeutic indication, accounting for roughly 65-70% of sales.

- Diabetic nephropathy: Estimated to contribute 20-25%, owing to increased diagnosis and guidelines recommending ARBs for renal protection.

- Other uses: Heart failure and stroke prevention constitute minor segments.

By Geography

- North America: Largest market, driven by high hypertension prevalence, aging demographics, and widespread insurance coverage.

- Europe: Slightly slower growth due to already high drug penetration but benefits from robust healthcare systems.

- Asia-Pacific: Fastest growth rate, fueled by burgeoning hypertensive and diabetic populations alongside expanding healthcare infrastructure.

- Latin America and Middle East: Growing markets due to improving access and increased awareness.

Competitive Landscape

Major Players

- Pfizer: As the originator of Irbesartan, Pfizer held dominant market share during patent years.

- Generics Manufacturers: Post-patent expiration, key players like Sun Pharmaceutical, Mylan, and Teva quickly gained share.

- Branded Generics and Value Brands: These contested segments on price and perceived quality.

Market Entry Barriers

- Patent expiration reduced barriers, favoring widespread generic adoption.

- Manufacturing quality standards and distributor networks influence market penetration.

Pricing and Reimbursement

- Pricing strategies have become heavily drug-cost sensitive.

- Insurance reimbursement policies influence sales, especially in the U.S., where formulary placement is critical.

Market Trends and Drivers

- Increased Awareness and Diagnosis: Heightened diagnosis rates of hypertension and diabetic nephropathy drive demand.

- Guideline Recommendations: Clinical practice guidelines favor ARBs, including Irbesartan, as first-line therapy for certain populations.

- Cost-Effectiveness of Generics: Price reductions post-patent expiration have expanded patient access.

- Polypharmacy and Combination Therapies: Growing trends towards fixed-dose combinations (e.g., Irbesartan/Hydrochlorothiazide) enhance adherence and sales.

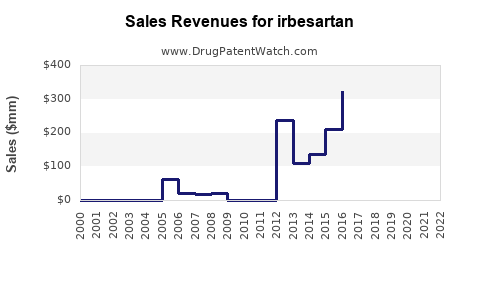

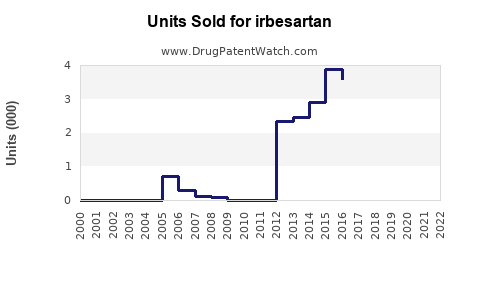

Sales Projections (2023–2030)

Methodology

Forecasts incorporate epidemiological trends, patent expiration impacts, generic market penetration, pricing dynamics, and regional healthcare infrastructure developments. The analysis also factors in emerging biosimilar entries and physician prescribing behaviors.

Revenue Outlook

- 2023 Baseline: Estimated global sales at approximately USD 1.2 billion, predominantly driven by generic sales in established markets.

- 2025 Projection: Growth stabilizes around USD 1.4 billion, with increases in emerging markets and widened indications.

- 2030 Forecast: Potential sales reach USD 1.8–2.0 billion, contingent on further geographic expansion, formulation innovations, and multi-indication utilization.

Regional Outlook

- North America: Continual moderate growth owing to mature market saturation.

- Europe: Steady increase driven by aging populations and healthcare reforms.

- Asia-Pacific: The most significant growth, potentially doubling by 2030 as healthcare access improves and awareness rises.

- Emerging Markets: Rapid adoption, lower price points, and expanding insurance coverage will underpin growth.

Market Challenges and Risks

- Price Erosion: Generics dominate, exerting downward pressure on prices.

- Regulatory Changes: Stringent approval pathways for new formulations or biosimilars.

- Competitive Substitutes: Increased use of other ARBs and ACE inhibitors.

- Market Saturation: Mature markets nearing saturation limit growth potential.

Opportunities for Growth

- Fixed-Dose Combinations: Developing Irbesartan-based combination drugs could capture new segments.

- Expanded Indications: Evidence supporting use in additional cardiovascular and renal conditions.

- Biosimilars and Biobetters: Potential entry of innovative versions may influence pricing and market share.

- Emerging Markets Expansion: Customized strategies to tap into underpenetrated regions.

Conclusion

Irbesartan remains a vital antihypertensive and nephroprotective agent, with a resilient market post-patent expiration driven primarily by generics. The global landscape is characterized by regional disparities, with high growth potential in Asia-Pacific and developing economies. Future sales will hinge on formulary dynamics, healthcare infrastructure development, and ongoing clinical research validating expanded indications.

Key Takeaways

- The Irbesartan market is transitioning from patent-protected dominance to a predominantly generic-driven landscape, resulting in volume-driven growth.

- Emerging markets present significant expansion opportunities, especially as healthcare access improves.

- Pricing strategies and formulary placements will remain critical to market share maintenance and growth.

- Fixed-dose combinations and novel formulations could enhance adherence and sustain sales.

- Continued epidemiological trends favoring hypertension and diabetic nephropathy guarantee demand, albeit with competitive pressures.

FAQs

Q1: How has patent expiration impacted Irbesartan’s market sales?

A1: Patent expiration in 2017–2018 led to a surge in generic entries, substantially reducing prices and sales revenues for the originator Pfizer. Despite volume increases, overall sales saw a decline due to price erosion, but the drug remained a key contender in global hypertension management.

Q2: Which regions are expected to drive Irbesartan sales growth over the next decade?

A2: The Asia-Pacific region is projected to experience the fastest growth, driven by increasing hypertension prevalence, expanding healthcare access, and greater adoption of ARBs. Emerging markets in Latin America, the Middle East, and Africa will also contribute notably to global sales.

Q3: What role do combination therapies play in Irbesartan’s future market prospects?

A3: Fixed-dose combinations (FDCs), such as Irbesartan with hydrochlorothiazide, enhance patient adherence and expand therapeutic options. These formulations are gaining popularity, especially in markets favoring simplified regimens, thereby supporting sales growth.

Q4: How do regulatory dynamics influence Irbesartan’s market?

A4: Strict approval processes and changing guidelines influence market access. Biosimilar and generic approvals are streamlined in some regions, facilitating competition. Ongoing patent litigation and regulatory standards shape the strategic landscape.

Q5: Are there any emerging innovations that could threaten Irbesartan’s dominance?

A5: Yes. The development of next-generation ARBs with improved efficacy or safety profiles, and biosimilar molecules, could alter market dynamics. Nonetheless, the established safety profile and clinical familiarity give Irbesartan a solid foundation for continued use.

References

[1] World Health Organization. “Hypertension Fact Sheet,” 2022.

[2] International Diabetes Federation. “Diabetic Kidney Disease and Its Global Impact,” 2021.