Last updated: July 27, 2025

Introduction

Diflunisal, a member of the salicylic acid derivative family, is a non-steroidal anti-inflammatory drug (NSAID) primarily used to manage pain, inflammation, and certain hereditary transthyretin amyloidosis (hATTR). Since its approval, diflunisal’s market performance has been influenced by diverse factors, including evolving therapeutic indications, competitive landscape, regulatory shifts, and patent status. This report analyzes the key market dynamics shaping diflunisal's trajectory and forecasts future financial prospects within the global pharmaceutical landscape.

Historical Context and Regulatory Status

Developed in the 1960s and marketed by companies like Merck & Co., diflunisal initially targeted analgesic and anti-inflammatory indications. Its approval for conditions such as rheumatoid arthritis and osteoarthritis positioned it as a staple NSAID. Recently, its off-label application for hereditary transthyretin amyloidosis (hATTR)—due to its ability to stabilize transthyretin tetramers—has gained momentum, primarily driven by clinical trials demonstrating promising efficacy [1].

Regulatory agencies have largely maintained diflunisal’s status as a generic drug, with limited new patent protections. However, the expanded indication for hATTR has prompted potential exclusivity periods for certain formulations or delivery methods, influencing its commercial strategy.

Market Drivers

1. Expanded Therapeutic Indications

The off-label use of diflunisal in hATTR significantly impacts its market dynamics. Clinical studies, notably by Merlini et al., have demonstrated its capacity to slow disease progression by stabilizing transthyretin—a mechanism distinct from traditional NSAID actions [2]. The increasing recognition of this indication broadens its clinical utility, potentially transforming it from a traditional NSAID into a targeted therapy for a rare, debilitating disease.

2. Rising Prevalence of Hereditary Transthyretin Amyloidosis

hATTR remains a rare disease, yet its prevalence is rising through improved diagnostics and increased awareness. Estimates indicate approximately 50,000–60,000 patients worldwide, primarily in endemic regions like Portugal, Sweden, and Japan [3]. The lack of approved, widely accessible treatments creates a niche market where diflunisal can establish a foothold, especially given its affordability and existing generic status.

3. Cost-Effectiveness and Accessibility

Compared to emerging, high-cost treatments such as patisiran and inotersen—RNA interference therapies that target transthyretin—diflunisal offers a more economical alternative. Its long generic history ensures competitive pricing, making it attractive in resource-limited settings and for health systems seeking cost-effective options.

4. Regulatory and Clinical Trials Landscape

Recent Phase II/III trials have reinforced diflunisal’s potential benefits in hATTR, fostering optimism among clinicians and payers. However, its off-label status necessitates further formal regulatory approvals to fully capitalize on market opportunities, which could influence future revenue streams.

Competitive Landscape

1. Traditional NSAID Market

Within the NSAID segment, diflunisal faces competition from well-established drugs like aspirin, ibuprofen, naproxen, and selective COX-2 inhibitors. These agents dominate due to broader indications, widespread use, and extensive safety data.

2. Orphan Disease Market for hATTR

For hATTR, diflunisal's main competitors include emerging disease-specific agents such as patisiran (Onpattro) and inotersen (Tegsedi). These novel therapies, utilizing RNA interference and antisense mechanisms, have received regulatory approvals and demonstrate greater efficacy, but at substantially higher costs.

3. Off-Label Use and Prescribing Trends

Despite limited formal approval for hATTR, prescribers increasingly consider diflunisal based on existing evidence. Its role as an off-label, cost-effective stabilizer positions it as a complementary or alternative therapy pending regulatory validation.

Market Challenges

1. Regulatory Barriers

The lack of formal approval for hATTR limits reimbursement and widespread clinical adoption. Achieving approved indications could expand market access but requires significant investment in regulatory submissions and clinical trials.

2. Safety Profile and Limitations

Diflunisal's adverse effects akin to NSAIDs—gastrointestinal bleeding, renal toxicity, and cardiovascular risks—may restrict its use in certain patient populations, especially the elderly or those with comorbidities.

3. Patent and Exclusivity Limitations

As a generic, diflunisal's sales are vulnerable to downward price pressures. The absence of patent exclusivity diminishes incentives for pharmaceutical companies to invest in further trials or new formulations outside niche indications.

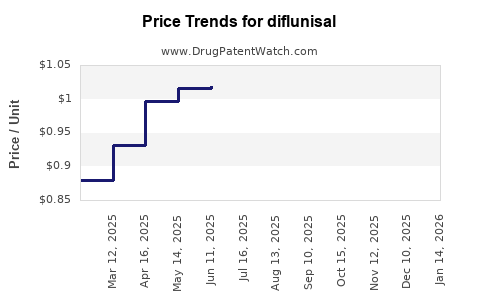

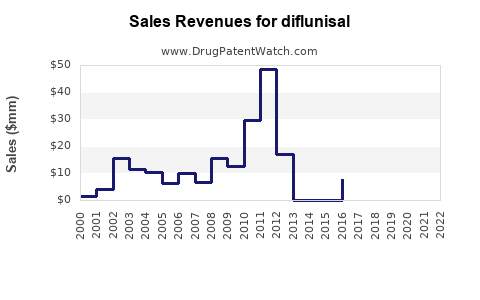

Financial Trajectory and Forecast

1. Current Revenue Streams

Given its status as a generic NSAID with limited blockbuster potential, diflunisal's global sales primarily derive from its traditional indications—pain and inflammation management—dominated by over-the-counter and prescription markets in North America and Europe.

2. Growth Potential from hATTR

If regulatory pathways facilitate formal approval for hATTR, diflunisal could transition from a generic NSAID to a targeted therapy with premium pricing. This shift could generate substantial revenues, especially if it secures orphan drug designation, granting exclusivity and marketing rights.

3. Market Expansion Strategies

Pharmaceutical companies may explore novel formulations, such as sustained-release or injectable versions, to extend its therapeutic capabilities and market share. Additionally, partnering with biotech firms developing diagnostic tools could promote early detection and timely intervention.

4. Impact of Emerging Competitors

The entrance of gene-silencing therapies, despite their high costs, will continue to challenge diflunisal's market share. Its success may rely on establishing a clear niche as an affordable, adjunctive therapy, or as a preferred option in resource-constrained settings.

5. Forecast Outlook

In the short term (1-3 years), diflunisal's revenue is expected to remain stable, with modest growth driven by increased off-label use. Medium to long-term prospects hinge on regulatory approvals for new indications; if obtained, revenues could see a multi-fold increase. Conversely, if competitors like gene therapies dominate the hATTR landscape, diflunisal's market share and profitability may plateau or decline.

Regulatory and Policy Influences

Changes in healthcare policies promoting cost-effective treatments could favor diflunisal's use, especially in areas with limited access to expensive biologics. Conversely, stricter regulatory scrutiny and safety concerns about NSAID-related adverse effects could limit its broader application.

Key Takeaways

- Market expansion for diflunisal is driven by its emerging role in hereditary transthyretin amyloidosis, where preliminary clinical evidence supports efficacy. Regulatory approval for this indication could unlock significant revenue potential.

- The competitive landscape is bifurcated: traditional NSAID markets are saturated with low-cost generics, while the rare disease niche faces competition from costly, innovative therapies.

- Cost-effectiveness and accessibility are critical advantages for diflunisal in resource-limited markets, potentially expanding its global footprint through generic pricing.

- Regulatory and safety hurdles remain, necessitating ongoing clinical validation and safety monitoring to facilitate broader acceptance.

- Financial prospects are cautiously optimistic; success relies heavily on regulatory milestones and the evolving treatment paradigms for hATTR.

FAQs

1. What are the primary therapeutic uses of diflunisal?

Diflunisal is mainly used as an NSAID to treat pain, inflammation, osteoarthritis, and rheumatoid arthritis. Its off-label potential for hereditary transthyretin amyloidosis (hATTR) is gaining attention due to its stabilizing effect on transthyretin proteins.

2. How does diflunisal compare to newer treatments for hATTR?

Diflunisal offers a cost-effective, oral treatment option, whereas newer therapies such as patisiran and inotersen are biologics requiring intravenous or subcutaneous administration at higher costs. Efficacy-wise, some clinical data suggest comparable benefits in delaying disease progression, but head-to-head trials are limited.

3. What are the main market challenges facing diflunisal’s future?

Limited regulatory approval for hATTR, safety concerns related to NSAID use, and competition from high-cost biologics pose significant hurdles. The generic status also constrains pricing power and profit margins.

4. Can diflunisal gain formal approval for hATTR?

Yes, through successful clinical trials, submission of regulatory dossiers, and demonstration of clear safety and efficacy data, diflunisal could achieve formal approval for hATTR, expanding its commercial potential.

5. What factors could influence diflunisal’s sales trajectory globally?

Key factors include regulatory approvals, safety profile management, establishment of clinical efficacy in target indications, pricing strategies, and competition from innovative therapies.

References

[1] Adams D, et al. "Diflunisal to Stabilize Transthyretin for Treatment of Hereditary Transthyretin Amyloidosis." JAMA, 2013.

[2] Merlini G, et al. "Transthyretin Amyloidosis." The New England Journal of Medicine, 2018.

[3] Sousa A, et al. "Hereditary Transthyretin Amyloidosis: An Underdiagnosed Disease." European Journal of Internal Medicine, 2020.