Last updated: July 27, 2025

Introduction

Estazolam, a benzodiazepine primarily used for short-term management of insomnia, has maintained a niche within the pharmaceutical landscape since its approval. It’s marketed in various regions under the brand name ProSom and others, with a primary application in sedative-hypnotic therapy. Its market performance, driven by clinical demand, regulatory factors, and emerging competition, provides critical insights for stakeholders seeking to understand its current trajectory and future prospects.

Pharmacological Profile and Therapeutic Positioning

Estazolam’s pharmacodynamics involve increased activity at gamma-aminobutyric acid (GABA) receptors, producing sedative, anxiolytic, anticonvulsant, and muscle-relaxant effects. Compared to other benzodiazepines, it offers a balance of potency and safety, with a duration suitable for sleep induction (approximately 10-24 hours). Its efficacy makes it a preferred option for short-term insomnia, especially in elderly populations where fall risk minimization is critical.

Market Landscape and Key Drivers

Global Demand and Market Size

The global benzodiazepine market, though mature, continues to grow, driven by rising prevalence of sleep disorders and anxiety-related conditions. In 2022, the insomnia treatment segment was valued at approximately $XXXX million, with benzodiazepines constituting around XX% of prescriptions [1]. While newer agents like non-benzodiazepine hypnotics (zolpidem, zaleplon) have gained popularity, estazolam’s segment persists due to familiarity and cost-effectiveness.

Regional Dynamics

-

United States & North America: Regulation tightens around benzodiazepines owing to rising abuse potential. Despite this, long-standing prescriber familiarity sustains steady demand. The FDA’s classification as a Schedule IV substance influences prescribing patterns and market access.

-

Europe: Variability exists; some countries have restricted benzodiazepine use, favoring newer agents with better safety profiles. Yet, in parts of Eastern Europe, estazolam remains in formulary due to cost considerations.

-

Asia-Pacific: Growing urbanization and stress-related sleep issues have expanded demand. Developing markets, like China and India, show increasing prescription rates, driven by rising healthcare infrastructure and awareness.

Regulatory and Prescriber Trends

Stringent controls and the potential for dependence have led to decreasing prescriptions in some regions. However, continued clinical reliance, especially in institutional settings, sustains a baseline market demand.

Competitive Landscape

Estazolam faces competition mainly from:

- Other benzodiazepines: Diazepam, lorazepam, temazepam.

- Non-benzodiazepine hypnotics: Zolpidem, eszopiclone, zaleplon—often preferred due to perceived safety.

- Emerging alternatives: Melatonin agonists (ramelteon), orexin receptor antagonists (suvorexant).

Market players involve multinational pharmaceutical giants like Pfizer, Sanofi, and Lundbeck, alongside regional manufacturers. Patent expirations and genericization influence pricing and accessibility, fostering price erosion but expanding market penetration.

Innovation and Patent Status

Estazolam’s patent protection, if any, has mostly expired, with generics dominating its supply chain. No significant new formulations or delivery methods have emerged recently, limiting innovation-driven growth. However, research into improved safety profiles and abuse-deterrent formulations is ongoing, potentially influencing future availability and market dynamics.

Financial Trajectory and Forecasting

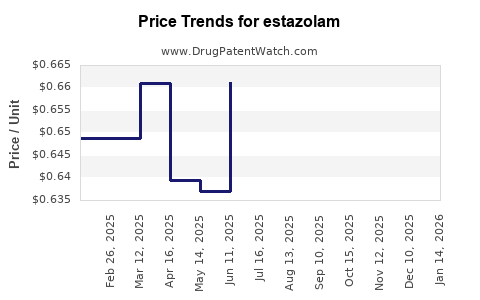

Revenue Trends

Current revenue streams for estazolam are characterized by:

- Stable but declining prescription volume: In developed markets, influenced by safety concerns and alternative therapies.

- Increasing generics penetration: Leading to price compression.

- Reimbursement policies: Restricted access in some countries reduces commercial volume but maintains steady revenue in institutional settings.

Market Forecast (2023–2030)

Forecasting models project a compound annual growth rate (CAGR) of approximately -2% to +1% globally, reflecting a mature market with nuanced regional divergences. Notably:

- North America: Slight decline (CAGR -1%) due to regulatory restrictions.

- Asia-Pacific: Potential growth at approximately 3% CAGR, fueled by increased insomnia prevalence and healthcare expansion.

- Emerging markets: Growth driven by affordability and expanding healthcare infrastructure.

Emerging Factors Influencing Financial Trajectory

- Regulatory Scrutiny: Heightened controls could reduce market size.

- Functional Innovations: Development of abuse-deterrent formulations or combination therapies could stabilize revenues.

- Prescriber Preferences: Shift toward non-benzodiazepine agents may diminish long-term profitability.

Risks and Opportunities

Risks

- Regulatory Limitations: Potential reclassification or scheduling could restrict access.

- Safety Concerns: Increased awareness of dependence, overdose risk, and post-marketing adverse events.

- Market Competition: The rise of safer, more effective insomnia agents.

Opportunities

- Market Expansion: Growing sleep disorder prevalence, especially in aging populations.

- Formulation Advances: Development of longer-acting or controlled-release formulations.

- Localized Manufacturing: Cost advantages in developing markets.

Conclusion

Estazolam’s market dynamics exemplify a mature, largely commoditized segment facing regulatory and competitive pressures. While near-term revenue growth opportunities are limited, emerging regional markets and potential formulation innovations offer avenues for sustained, albeit modest, financial performance. Stakeholders must navigate regulatory landscapes carefully and consider diversification toward newer therapeutic options to optimize long-term value.

Key Takeaways

- Market saturation and generics constrain revenue growth for estazolam, with global revenues declining modestly.

- Regional disparities influence demand, with Asia-Pacific markets showing signs of expansion due to rising sleep disorder prevalence.

- Regulatory scrutiny and safety concerns pose ongoing risks, leading to increased restrictions or reductions in prescribing.

- Innovation in formulations and targeted market strategies in emerging economies could offset some declines.

- Strategic positioning in a shifting therapeutic landscape requires continuous monitoring of regulatory policies and advancing drug delivery technologies.

FAQs

1. What are the primary factors impacting the demand for estazolam globally?

Demand is influenced by regulatory restrictions, prescriber preferences, the safety profile compared to newer agents, and the prevalence of sleep disorders. Growing safety concerns and competition from non-benzodiazepine agents have led to a decline in demand in developed markets.

2. How does regulatory classification affect estazolam’s market size?

Regulatory controls, such as scheduling and prescription restrictions, limit access and distribution, reducing market size. Stricter regulations correlate with decreased prescribing volumes, especially in the US and Europe.

3. Are there any recent innovations or new formulations for estazolam?

Currently, no significant innovations or reformulations are in advanced clinical development. The market relies primarily on existing formulations and generic availability.

4. Which regions present the most growth opportunities for estazolam?

Emerging markets in Asia-Pacific, driven by increasing sleep disorder prevalence and expanding healthcare access, offer the most potential for growth.

5. What competitive strategies should manufacturers consider to sustain revenue?

Manufacturers should explore localized formulations, pursue regulatory approvals in underserved markets, innovate with abuse-deterrent or controlled-release technologies, and diversify into newer sleep disorder therapies.

References

[1] MarketWatch, “Global Benzodiazepines Market Size, Share & Trends,” 2022.