Last updated: July 28, 2025

Introduction

Estazolam is a benzodiazepine primarily prescribed for the short-term treatment of insomnia and related sleep disorders. Its tranquilizing, sedative, anxiolytic, amnestic, anticonvulsant, and muscle-relaxant properties have led to widespread medical use. However, due to its potential for dependence, abuse, and adverse effects, its regulatory status and market dynamics are critically influenced by shifts in pharmaceutical policies, user demand, and emerging alternatives.

This analysis assesses the current market landscape for estazolam, evaluates factors influencing its pricing, and provides forecasts grounded in market trends and regulatory insights.

Market Overview

Regulatory Status and Distribution

Estazolam is classified as a Schedule IV controlled substance in the United States under the DEA framework, reflecting moderate dependency risk. Similar classifications exist globally, which restrains its distribution channels and influences market size. Its use is generally limited to specialty pharmacies, hospitals, and licensed prescribers.

Prevalence of Use

The demand for benzodiazepines, including estazolam, has experienced fluctuations driven by increased awareness of dependency issues, safety concerns, and alternative therapies. According to the National Institute on Drug Abuse, benzodiazepine prescriptions peaked in the early 2010s but declined slightly thereafter, as clinicians transitioned toward newer agents like non-benzodiazepine sleep aids (e.g., zolpidem, eszopiclone) [1].

Market Players

Major manufacturers include Pfizer and Teva, with generic formulations constituting the majority of the supply. The generic market dominates due to patent expirations, leading to constrained pricing power for brand-name estazolam products.

Supply Chain Dynamics

The production of estazolam involves complex synthesis routes, often subject to stringent API (Active Pharmaceutical Ingredient) manufacturing standards to meet regulatory compliance, which impacts supply stability and costs.

Price Determinants

Regulatory Constraints

- Controlled Substance Status: Imposes distribution restrictions, influencing the feasibility and cost for manufacturers, which, in turn, affects retail prices.

- Patent and Exclusivity: Absence of patent protections post-expiration allows generic competition, generally lowering prices over time.

Competition and Market Saturation

- Generic Competition: With multiple manufacturers producing generic estazolam, price competition tends to be fierce, exerting downward pressure on prices.

- Alternative Therapies: Increasing preference for non-benzodiazepine sleep aids reduces demand, impacting market pricing and volume.

Manufacturing and Compliance Costs

- Regulatory compliance increases production costs, which are partially transferred to the consumer.

- Supply chain disruptions, such as API shortages, can drive prices upward temporarily.

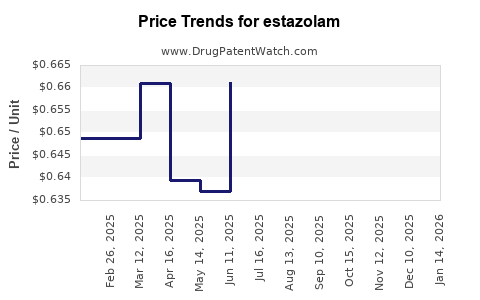

Pricing Trends

Currently, estazolam’s price in the U.S. ranges broadly, with retail costs for a 30-day supply (30 tablets of 1 mg or 2 mg) typically between $10 and $40, predominantly for generic versions [2].

Market Projections (2023-2028)

Short-Term Outlook (2023–2025)

- Demand Trends: Continued decline owing to rising awareness about dependency risks and the introduction of alternative therapies.

- Pricing Dynamics: Slight decrease or stabilization expected, driven by intense generic competition and regulatory limitations. Premium pricing is unlikely unless new formulations or delivery systems are approved.

- Supply Factors: Stable supply due to multiple manufacturers, though periodic API shortages could influence prices temporarily.

Medium to Long-Term Outlook (2026–2028)

- Market Contraction: Further reduction in prescribing rates as non-benzodiazepine alternatives gain popularity.

- Price Stabilization: Prices may plateau or experience marginal decreases, especially if industry consolidation or patent protections are reintroduced for specific formulations or combination products.

- Regulatory Changes: Potential scheduling adjustments or reclassification could alter demand and pricing—further reducing market scope.

Influencing Factors

- Growing regulatory scrutiny and efforts to mitigate abuse (e.g., REMS programs) might increase distribution costs, stabilizing or marginally elevating prices.

- Advances in sleep medicine and personalized treatment protocols could diminish reliance on sedative benzodiazepines, further suppressing market prices.

Regional Variations

- United States: Stringently regulated, with drugs like estazolam facing declining prescriptions.

- Europe: Similar trends, with prescription authority shifting towards newer agents.

- Emerging Markets: Potential for growth due to less restrictive regulations, but quality and supply issues may impact pricing.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production, explore alternative delivery systems, or develop combination therapies to sustain profitability.

- Distributors and Pharmacies: Monitor regulatory shifts and supply chain reliability to manage inventory and pricing.

- Investors: Given the declining demand and intense price competition, estazolam’s market attractiveness diminishes, favoring companies diversifying into newer, safer therapeutics.

Key Takeaways

- Market Decline: The estazolam market is contracting due to regulatory restrictions, growing awareness of dependency, and the advent of safer alternatives.

- Pricing Pressure: Generic competition keeps prices low, with retail costs ranging from $10 to $40 for a 30-day course.

- Future Trends: Prices are expected to stabilize or slightly decline over the next five years, influenced by declining demand and regulatory shifts.

- Strategic Focus: Stakeholders should prioritize cost management, regulatory compliance, and diversification into alternative therapies.

- Regional Opportunities: Emerging markets may present growth opportunities, albeit with quality and supply chain considerations.

Frequently Asked Questions (FAQs)

1. What factors primarily influence the price of estazolam?

Price determinants include regulatory restrictions, generic competition, manufacturing costs, and demand trends. Prescription volume declines and increased regulation tend to lower prices, whereas supply disruptions can temporarily increase costs.

2. How does regulatory classification affect estazolam market pricing?

As a Schedule IV drug in the U.S., restrictive distribution channels and compliance costs limit pricing power, contributing to relatively low retail prices compared to non-controlled substances.

3. Are there upcoming regulatory changes that could impact estazolam pricing?

Potential reclassification or stricter controls aimed at reducing abuse could further restrict supply, possibly increasing costs in the short term, but generally lead to continued market decline.

4. Will new formulations or delivery systems influence future prices?

Innovation in delivery methods, such as extended-release formulations, could command premium pricing if approved, but current trends favor decline due to shifting prescribing practices.

5. What is the outlook for generic manufacturers of estazolam?

Market saturation and declining demand compress margins, emphasizing cost efficiency. Opportunities are limited unless innovations or niche formulations emerge.

References

[1] National Institute on Drug Abuse. "Benzodiazepines." 2022.

[2] GoodRx. "Estazolam prices and comparison." 2023.