Last updated: July 28, 2025

Introduction

Trifluridine (brand names include Lonsurf when combined with tipiracil) is an antineoplastic nucleoside analogue primarily approved for the treatment of metastatic colorectal cancer and gastric cancer. Its distinctive mechanism involves incorporation into DNA, disrupting replication, and inducing apoptosis in cancer cells. As developments in oncology continue, understanding the evolving market landscape and projected financial trajectory of trifluridine is critical for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Overview and Clinical Context

Initially developed for ophthalmic use as an antiviral agent for herpes simplex virus keratitis, trifluridine's transition into oncology was driven by repurposing efforts. Its combination with tipiracil (Lonsurf) received accelerated approval from the U.S. Food and Drug Administration (FDA) in 2015 for metastatic colorectal adenocarcinoma after failure of standard therapies. The drug’s efficacy was substantiated through multiple clinical trials demonstrating survival benefits and manageable safety profiles.

The global oncological market, driven by increasing cancer incidence and improvements in diagnostic capabilities, anchors the demand for innovative chemotherapeutic regimens, among which trifluridine occupies a niche. Notably, its unique DNA-incorporation mechanism offers benefits over traditional therapies, particularly in resistant disease settings.

Market Dynamics

Driving Factors

-

Rising Prevalence of Colorectal and Gastric Cancers: The global colorectal cancer burden is forecasted to reach over 2 million cases annually by 2030 (globally, as per GLOBOCAN 2020), catalyzing the demand for effective chemotherapies like trifluridine. Gastric cancer also remains prevalent in Asia, further expanding the potential market.

-

Advancements in Molecular Oncology: Precision medicine approaches are increasingly integrating therapies like trifluridine, especially in treatment lines following standard chemotherapy failure. Its incorporation into treatment guidelines enhances uptake among oncologists.

-

Regulatory Approvals in Multiple Regions: Beyond the US, Europe approved Lonsurf in 2016, and markets in Japan and other parts of Asia have followed, broadening geographical reach. Continued regulatory expansions foster market growth.

-

Pipeline Development and New Indications: Ongoing trials evaluating trifluridine for other malignancies (e.g., pancreatic, bladder) could diversify its indications, fueling future revenue.

Challenges

-

Competitive Landscape: The market includes other oral chemotherapeutics, targeted therapies, and immunotherapies offering comparable or superior efficacy.

-

Pricing and Reimbursement Pressures: With the rising emphasis on cost-effectiveness and value-based care, reimbursement policies may influence market penetration and sales revenue.

-

Side Effect Profile: Though generally manageable, hematologic toxicities pose concerns, impacting patient acceptance and adherence.

Market Share and Competitive Edge

Trifluridine’s positioning as an oral, combination-based therapy offers convenience and potential adherence advantages. However, competition from biologics and novel targeted agents, especially immune checkpoint inhibitors, challenges its market share. Despite this, its role as a valuable salvage therapy sustains its relevance.

Financial Trajectory

Historical Revenue Trends

Since its approval, Lonsurf has demonstrated steady revenue growth, with estimated global sales of approximately $500 million in 2022, reflecting a compound annual growth rate (CAGR) of roughly 20% since launch. These figures reflect uptake across key markets—North America, Europe, and Asia.

Forecasting Future Revenue

Projections for the next five years suggest revenues could approach $1 billion annually by 2028, contingent upon several factors.

-

Market Penetration and Expansion: Increased adoption in existing markets and entry into emerging markets will be pivotal. Strategic collaborations and licensing agreements could accelerate this.

-

Indication Expansion: Regulatory approvals for earlier lines of therapy or supplementary indications could significantly boost revenues. Trials demonstrating efficacy in other solid tumors may facilitate this.

-

Generics and Biosimilars: Patent expirations typically lead to price erosion. However, as an oral chemotherapeutic with complex manufacturing, early generic competition is less imminent, allowing sustained premium pricing initially.

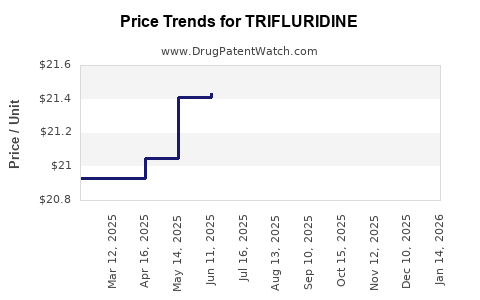

Pricing Dynamics

Current average wholesale prices (AWP) for Lonsurf in the US hover around $13,000 per month per patient. Market access negotiations and cost-containment strategies could influence net pricing, but the drug’s niche efficacy supports a premium positioning in its class.

Investment Potential

Pharmaceutical companies with existing oncology portfolios or those exploring combination regimens incorporating trifluridine are positioned to benefit. Partnerships with biotech firms may enable innovative delivery or extending indications, driving future valuation.

Regulatory and Market Expansion Outlook

The trajectory of trifluridine's adoption hinges on regulatory decisions in emerging markets such as China, India, and Latin America, where cancer prevalence is rising. Regulatory bodies’ willingness to approve based on existing evidence will influence regional revenues.

Emerging data supporting off-label and expanded indications could also catalyze uptake, particularly if supported by guidelines from major oncology societies.

Conclusion

Trifluridine's market and financial outlook remain optimistic, steered by increasing global cancer burdens, strategic regulatory approvals, and ongoing clinical research. Its role as a robust salvage therapy underpins current revenues, with substantial potential for growth through indication expansion and geographical penetration. Nevertheless, competitive forces and healthcare policies necessitate vigilant monitoring to maximize commercial potential.

Key Takeaways

-

The global increased incidence of colorectal and gastric cancers propels sustained demand for trifluridine-based therapies.

-

Current revenues approximate $500 million annually, with projections nearing $1 billion by 2028, driven by market expansion and indication growth.

-

Market growth is contingent upon regulatory approvals in emerging markets, clinical trial success, and competitive positioning against emerging therapies.

-

Pricing strategies, reimbursement policies, and competitive dynamics will influence future profitability and market share.

-

Strategic collaborations and extended indications from ongoing trials can create additional revenue streams, enhancing the drug's long-term financial trajectory.

FAQs

1. What are the primary factors influencing trifluridine’s market growth?

Increasing cancer prevalence, expanding indications, regulatory approvals in new regions, and ongoing clinical research collectively drive growth, while competition and pricing pressures may temper it.

2. How does trifluridine compare to other colorectal cancer therapies?

Trifluridine offers an oral administration route with demonstrated efficacy as a salvage therapy, differentiating it from intravenous options like fluoropyrimidines and targeted therapies, but competition from emerging immuno-oncology agents remains significant.

3. What is the potential for new indications of trifluridine?

Preclinical and clinical trials exploring trifluridine’s effectiveness against other solid tumors could lead to regulatory approvals, broadening its therapeutic landscape and revenue potential.

4. How do patent expirations affect trifluridine’s future revenue outlook?

Patent expiry may introduce generics, leading to price erosion. However, current manufacturing complexities and regulatory data protection could delay generic entry, supporting sustained revenues initially.

5. What strategic moves should companies consider to capitalize on trifluridine’s market?

Investing in clinical trials for expanded indications, securing regulatory approvals in high-growth regions, forming strategic partnerships, and optimizing pricing and reimbursement strategies are essential.

References

[1] GLOBOCAN 2020. Globocan. International Agency for Research on Cancer.

[2] FDA. FDA Approves Lonsurf for Metastatic Colorectal Cancer. 2015.

[3] MarketWatch. Global Oncology Drug Market Report. 2022.

[4] EvaluatePharma. 2022 Oncology Pipeline and Market Data.

[5] European Medicines Agency. Lonsurf approval summary. 2016.