Last updated: July 28, 2025

Introduction

Teriflunomide, marketed under the brand name Aubagio, is an oral immunomodulatory drug approved for the treatment of relapsing forms of multiple sclerosis (MS). Since its introduction in 2012 by Sanofi, teriflunomide has established itself as a significant player within the disease-modifying therapies (DMTs) segment for MS. Its unique mechanism of action, safety profile, and market positioning influence its demand, competitive landscape, and financial trajectory. This comprehensive analysis evaluates current market dynamics, growth drivers, challenges, and future prospects shaping the financial outlook of teriflunomide.

Pharmacological Profile and Therapeutic Positioning

Teriflunomide acts by inhibiting dihydroorotate dehydrogenase (DHODH), a key enzyme in pyrimidine synthesis, leading to suppression of rapidly dividing lymphocytes responsible for MS-related inflammation. Its oral administration offers convenience, aligning with patient preferences in chronic disease management. As a first-line oral therapy, teriflunomide competes with other DMTs such as interferons, fingolimod, dimethyl fumarate, and newer agents like monoclonal antibodies (e.g., natalizumab).

The drug's efficacy, safety profile, and route of administration underpin its positioning in the treatment algorithm. It is generally prescribed for relapsing-remitting MS (RRMS), with a focus on long-term disease control and manageable side effects.

Market Dynamics

1. Epidemiology and Patient Population Trends

The increasing global prevalence of MS, estimated at approximately 2.8 million cases worldwide [1], directly fuels demand for DMTs like teriflunomide. The rising awareness, improved diagnostic techniques, and expanding healthcare infrastructure notably in emerging markets contribute to expanding eligible patient pools.

In developed countries, early diagnosis and broader treatment access have boosted the adoption of oral DMTs, including teriflunomide. Conversely, in regions with limited healthcare access, growth remains modest but gradually accelerates with infrastructure improvements.

2. Competitive Landscape and Therapeutic Options

Teriflunomide's market share faces competition from:

-

Other Oral DMTs: Dimethyl fumarate (Tecfidera), fingolimod (Gilenya), and cladribine (Mavenclad) are direct competitors offering similar efficacy profiles. The convenience of oral administration positions all these drugs favorably compared to injectable therapies.

-

Injectable DMTs: Interferon-beta and glatiramer acetate remain standard in some markets, but their low adherence rates make oral options more attractive.

-

Monoclonal Antibodies: With higher efficacy but increased safety monitoring, drugs like natalizumab and ocrelizumab are reserved for more aggressive or resistant cases. Their market share affects that of first-line agents, including teriflunomide.

Market penetration is also influenced by patent status, licensing agreements, and regulatory approvals. Sanofi maintains exclusivity on Aubagio until approximately 2023-2024, after which biosimilars may enter the market, impacting pricing and sales.

3. Regulatory and Pricing Environment

Globally, regulatory agencies like the USFDA, EMA, and other regional bodies have approved teriflunomide based on robust clinical trial data demonstrating its efficacy and safety. However, pricing strategies differ widely:

-

In the US, high list prices for DMTs generally translate into significant revenues, often supported by insurance reimbursement policies.

-

In Europe and emerging markets, pricing is negotiated based on health technology assessments and value-based agreements.

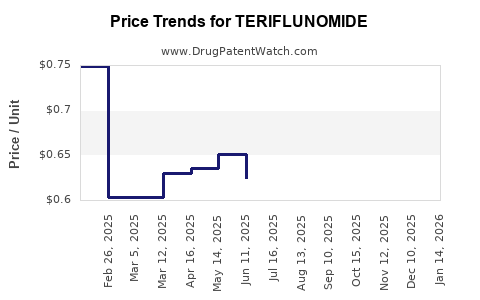

Patent expirations and biosimilar entry can lead to price erosion, impacting long-term revenue potential. Additionally, health policies favoring cost-effective therapies influence formulary decisions, sometimes restricting access to newer, more expensive agents over established drugs like teriflunomide.

4. Safety and Tolerability Profile

Teriflunomide's safety profile is characterized by risks of hepatotoxicity, teratogenicity, and leukopenia. Such adverse events necessitate regular monitoring, which influences prescribing behavior.

Notably, teriflunomide’s teratogenic potential limits its use among women of childbearing potential, requiring effective contraception and planning. These safety considerations impact market size, especially in markets with stringent regulatory requirements.

5. Adoption Trends and Prescriber Preferences

Physician and patient preferences are shifting toward oral DMTs due to convenience and adherence benefits. Real-world studies indicate high persistence rates with teriflunomide, partly due to favorable tolerability and ease of use.

However, concerns over specific adverse effects and availability of newer agents with superior efficacy influence long-term prescription trends. Education campaigns and clinical guidelines shape these preferences, impacting demand trajectories.

Financial Trajectory and Revenue Forecast

Historical and Current Revenue Performance

Since its launch in 2012, teriflunomide has contributed significantly to Sanofi’s MS portfolio. Its global sales peaked around USD 600-700 million annually before facing price competition and patent expiry risks.

Growth spurts occurred during initial market entry, driven by unmet medical needs and limited competition. Subsequent years reflected stabilization rather than strong growth, influenced by market saturation and emerging competition.

Future Revenue Drivers

-

Patent Expiry and Biosimilar Competition: The approaching patent cliffs around the mid-2020s may precipitate revenue declines unless offset by biosimilar entries or formulation innovations.

-

Emerging Markets Expansion: Increased penetration in Asia-Pacific, Latin America, and Middle East can provide incremental revenues due to expanding healthcare access and insurance coverage.

-

Line Extension and Combination Therapies: Development of fixed-dose combinations (e.g., with other oral DMTs) or new formulations could sustain or boost revenue streams.

-

Pricing and Reimbursement Policies: Favorable negotiations and value-based pricing could preserve margins. Conversely, price erosion from biosimilars or cost containment measures may reduce profitability.

Projected Growth Outlook

Analysts estimate a compounded annual growth rate (CAGR) of approximately 2-4% for teriflunomide revenues through the next five years, assuming no significant market disruptions. The growth hinges on:

- The rate of biosimilar market entry.

- Regional expansion efforts.

- Post-patent strategies such as lifecycle management.

In totality, the drug is expected to maintain a stable, if modest, contribution to Sanofi’s MS portfolio, subject to market and regulatory variables.

Market Challenges and Opportunities

Challenges

-

Patent Expiration: The imminent patent cliff could significantly diminish revenue streams, requiring strategic response from Sanofi.

-

Competitive Efficacy: Higher-efficacy treatments may eclipse teriflunomide, especially for aggressive MS cases.

-

Safety Concerns: Managing teratogenic risks poses market access hurdles in reproductive-age women, limiting its applicability.

-

Pricing Pressures: Cost-containment measures in public healthcare systems may restrict reimbursements, impacting profitability.

Opportunities

-

Market Expansion: Increased healthcare infrastructure investments in emerging markets offer growth potential.

-

Regulatory Approvals in New Indications: Research into secondary progressive MS or combination therapies could broaden the drug’s indications.

-

Digital Health Integration: Usage of real-world data and adherence monitoring tools can enhance patient outcomes and support commercialization efforts.

-

Lifecycle Management: Formulation improvements and combination strategies sustain product relevance.

Conclusion

Teriflunomide’s market and financial outlook hinges on navigating patent expiry, competitive pressures, safety considerations, and regional expansion strategies. While its established efficacy and oral administration confer a competitive edge, future success depends on innovative lifecycle management, precision marketing, and adaptive regulatory strategies.

The trajectory suggests a shift from rapid growth to stabilization with nuanced opportunities for revenue preservation and incremental expansion. Stakeholders should focus on emerging markets, lifecycle extension, and addressing safety concerns to optimize long-term value.

Key Takeaways

-

Market Position: Teriflunomide remains a key first-line oral DMT for RRMS but faces intensified competition from newer agents with higher efficacy.

-

Revenue Sustainability: Patent expirations, biosimilar entry, and competitive pricing pressures are likely to temper past growth, requiring strategic adaptation.

-

Growth Opportunities: Expansion into emerging markets and potential label extensions offer avenues for revenue growth.

-

Challenges: Safety profiles and regulatory hurdles, particularly regarding reproductive risks, influence market access and prescribing patterns.

-

Strategic Focus: Lifecycle management, innovation in formulations, and regional market expansion are critical to maintaining a robust financial trajectory.

FAQs

1. When will biosimilars or generics for teriflunomide likely enter the market, and how will they impact revenues?

Patent protections for Aubagio are expected to expire around 2023-2024, after which biosimilars or generics may enter, potentially leading to significant price erosion and revenue decline. Strategic planning around lifecycle management and biosimilar partnerships will be essential to mitigate impacts.

2. How does teriflunomide compare to newer MS therapies in terms of efficacy?

While teriflunomide offers favorable safety and convenience, higher-efficacy drugs like alemtuzumab and ocrelizumab demonstrate superior reduction in relapse rates and disability progression. However, their safety profiles and administration routes limit their comparability.

3. What role do regulatory agencies play in the market dynamics of teriflunomide?

Regulatory decisions regarding approvals, safety warnings, and post-market surveillance directly influence market access, prescribing, and reimbursement landscapes, thereby impacting revenue trajectories.

4. Are there ongoing clinical trials that could extend teriflunomide's indications?

Yes, research exploring teriflunomide in secondary progressive MS and combination therapies is ongoing, which could potentially broaden its indications and market share.

5. How does regional variation influence the financial performance of teriflunomide?

Healthcare infrastructure, regulatory policies, and pricing negotiations vary regionally. Developed markets like the US and Europe offer higher revenue potential due to established reimbursement pathways, while emerging markets present growth opportunities under evolving healthcare systems.

Sources:

[1] Multiple Sclerosis International Federation, 2022 Report.