Last updated: July 28, 2025

Introduction

Terbinafine, an antifungal medication primarily used to treat dermatophyte infections such as onychomycosis, tinea corporis, and tinea cruris, has gained significant prominence in dermatology. Its unique pharmacological profile, coupled with rising dermatological conditions, positions it as a key player in the antifungal market. This analysis explores the present market dynamics, future growth prospects, competitive landscape, regulatory influences, and financial trajectory of terbinafine.

Market Overview

Global Market Size and Growth Trends

The global antifungal pharmaceuticals market was valued at approximately USD 13.4 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of around 4.8% through 2030[1]. Terbinafine's market share within this segment has expanded due to its efficacy, safety profile, and increasing prevalence of fungal infections.

The antifungal market's expansion is driven by the rising incidence of dermatophytic infections, driven by urbanization, lifestyle changes, immunosuppressive therapies, and aging populations. The dermatophyte segment, notably treated with terbinafine, is expected to be the fastest-growing part of this market.

Regional Dynamics

- North America: Dominant due to high prevalence of fungal infections and advanced healthcare infrastructure. The United States accounts for a significant portion driven by prescription-based demand and over-the-counter availability in some regions.

- Europe: Steady growth attributed to awareness and increased diagnosis rates.

- Asia-Pacific: The fastest-growing region owing to rising fungal infection prevalence, increased healthcare access, and expanding pharmaceutical markets, especially in China and India.

- Latin America & Middle East: Developing markets with emerging demand and increasing healthcare investments.

Market Drivers

Rising Incidence of Dermatophytic Infections

Increasing prevalence of conditions like onychomycosis affects up to 15-25% of the global population, particularly among older adults and diabetics[2], bolstering demand for efficacious treatments like terbinafine.

Enhanced Efficacy and Safety Profile

Compared to older antifungals such as griseofulvin and ketoconazole, terbinafine offers superior efficacy, shorter treatment durations, and a favorable safety profile, making it a preferred choice among clinicians[3].

Patient Preference for Oral Therapies

The shift toward oral medications over topical treatments, due to convenience and improved compliance, has bolstered terbinafine's market share.

Increasing Awareness and Diagnoses

Public and healthcare provider awareness campaigns have contributed to earlier and more frequent diagnosis, augmenting demand for antifungal therapy.

Market Challenges and Constraints

Emerging Antifungal Resistance

Recent studies indicate a growing resistance to azoles[4], prompting increased reliance on terbinafine. Simultaneously, reports of terbinafine resistance threaten to constrict future efficacy.

Regulatory and Patent Landscape

Patent expiries, particularly the loss of exclusivity in major markets, have led to generic proliferation, reducing market prices and profit margins for branded formulations.

Adverse Effect Concerns

Though generally safe, terbinafine has been associated with hepatotoxicity and rare dermatological adverse events, which may restrict its use in certain populations, especially with long-term therapy.

Competitive Landscape

Key Players

Leading pharmaceutical companies such as Johnson & Johnson (Lamisil), Novartis, and Mylan dominate the terbinafine market. Generics manufacturers have increased their presence post-patent expiry, intensifying price competition and reducing barriers for entry.

Formulation Innovations

Recent developments include topical terbinafine formulations, liposomal delivery systems, and combination therapies, aimed at improving efficacy, tolerability, and patient compliance.

Patent and Regulatory Movements

Patent expirations over the past five years have shifted the market towards generics, facilitating price erosion but expanding global access.

Financial Trajectory and Future Outlook

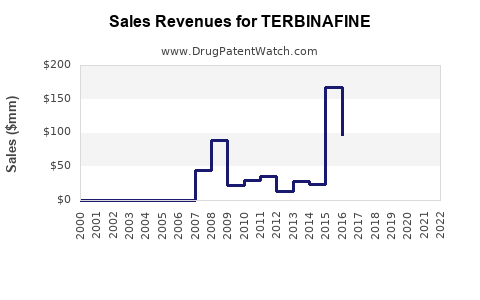

Revenue Prospects

- Branded Market: Despite patent expiries, branded formulations retain significant market share in developed regions due to brand loyalty and perceived quality.

- Generic Market: Cost-sensitive markets predominantly rely on generics, which are likely to dominate the sales volume moving forward.

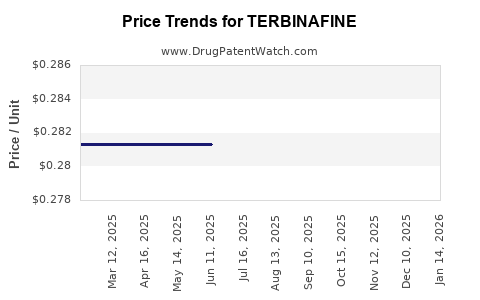

Pricing Dynamics

Price erosion is expected to continue due to increasing generic competition. However, value-based pricing strategies and differentiated formulations can sustain revenue streams for innovative drugs.

Research and Development

Investment in novel delivery systems, combination therapies, and resistance mitigation strategies could lead to incremental revenue streams. Personalized treatment approaches and diagnostic advancements may further expand the market.

Regulatory Pathways

Approval of new indications or formulations in emerging markets can enhance sales. Additionally, regulatory support for biosimilars and all-oral formulations enhances future growth prospects.

Market Entry and Expansion

Emerging economies present lucrative opportunities for expansion due to rising fungal infection prevalence and expanding healthcare infrastructure. Strategic partnerships and licensing can expedite market penetration.

Key Factors Influencing Financial Trajectory

| Factor |

Impact |

| Patent expiries |

Increased generic competition, lower prices |

| Resistance trends |

Potential shift to alternative therapies |

| Regulatory environment |

Accelerating approval processes in emerging markets |

| Innovation in formulations |

Potential for premium pricing and differentiation |

| Healthcare expenditure growth |

Enables market expansion in developing regions |

Regulatory and Ethical Considerations

Regulatory agencies such as the FDA and EMA enforce strict safety monitoring and efficacy requirements for antifungals, influencing market access and labeling. Ethical concerns around resistance management and accessibility influence policies and pricing strategies.

Conclusion

Terbinafine’s market outlook is characterized by strong demand driven by its proven efficacy, safety, and the rising burden of dermatophyte infections. While patent expirations and rising resistance challenge future growth, ongoing innovations, especially in formulations and combination therapies, alongside expanding markets in Asia-Pacific and Latin America, foster a positive financial trajectory. Companies that strategically navigate regulatory landscapes, innovate to meet resistance challenges, and optimize pricing in emerging markets will likely sustain growth and profitability.

Key Takeaways

- The global terbinafine market is projected to grow steadily, supported by rising dermatophyte infections and patient preference for oral antifungals.

- Patent expiries have increased generic competition, exerting downward pressure on prices but broadening access.

- Resistance development and safety concerns necessitate ongoing R&D and innovation.

- Emerging markets account for significant growth opportunities, especially with regulatory support and healthcare infrastructure expansion.

- Collaboration, formulation advancement, and resistance management are critical to sustaining financial performance.

FAQs

1. What are the primary therapeutic uses of terbinafine?

Terbinafine is mainly used to treat dermatophyte infections such as onychomycosis, tinea corporis, and tinea cruris, due to its fungicidal activity against dermatophyte fungi.

2. How has patent expiry affected terbinafine’s market?

Patent expiries have led to the proliferation of generic versions, reducing prices and increasing accessibility but also intensifying competition and pressure on profit margins.

3. What are emerging challenges that could impact terbinafine’s market?

Growing antifungal resistance, safety concerns, and regulatory changes are potential challenges that could limit market growth or necessitate new formulations and treatment strategies.

4. Which regions offer the most growth opportunities?

The Asia-Pacific region, driven by rising infection rates and expanding healthcare infrastructure, offers the most significant growth potential for terbinafine.

5. What innovation prospects exist for terbinafine?

Future innovations include developing topical formulations, liposomal delivery systems, combinations with other antifungals, and personalized treatment approaches to improve efficacy and compliance.

Sources:

[1] MarketsandMarkets, "Antifungal Drugs Market," 2022.

[2] Gupta AK, et al. "Global Onychomycosis Prevalence," J Am Acad Dermatol, 2020.

[3] Elewski BE. "Terbinafine in Onychomycosis," Clin Dermatol, 2019.

[4] Van der Hooft, et al. "Antifungal Resistance Concerns," Mycoses, 2021.