Last updated: July 28, 2025

Introduction

Phytonadione, commercially recognized as vitamin K1, is a pivotal pharmaceutical agent primarily utilized in the management of vitamin K deficiency, coagulation disorders, and bleeding prophylaxis. Its global market landscape is shaped by various factors including regulatory approvals, evolving clinical practices, manufacturing innovations, and emerging therapeutic needs. Understanding these dynamics provides insight into its current market stature and future financial prospects.

Market Overview

Phytonadione's therapeutic application spans multiple domains: neonatal hemorrhagic disease prevention, oral anticoagulant reversal, and treatment of bleeding episodes in patients with coagulation deficiencies. The global demand is driven by increasing prevalence of bleeding disorders, expanding neonatal populations, and rising awareness about vitamin K supplementation.

The compound is available in multiple formulations—injectable and oral—suitable for different clinical settings. The market is further boosted by its inclusion in parenteral and oral dosage forms approved across North America, Europe, and Asia-Pacific regions.

Market Drivers

1. Rising Incidence of Hemorrhagic Disorders:

Bleeding disorders, including hemophilia and vitamin K deficiency bleeding (VKDB), are escalating globally. Neonatal VKDB, in particular, remains a significant concern, with prophylactic vitamin K administration recognized as standard care, thus fueling demand for phytonadione injections [1].

2. Neonatal Care and Preventive Measures:

High birth rates in emerging economies are associated with increased neonatal vitamin K administration, expanding the neonatal segment of the market. Regulatory guidelines recommend routine vitamin K prophylaxis, reinforcing its necessity [2].

3. Anticoagulation Reversal in Warfarin Therapy:

The widespread use of vitamin K antagonists (VKAs) such as warfarin necessitates reversal agents during bleeding episodes or perioperative periods, expanding indications for phytonadione [3].

4. Pharmaceutical Manufacturing and Innovation:

Manufacturers’ efforts to develop stable, easy-to-administer formulations and explore combination therapies enhance accessibility and adherence, contributing to sustained market growth.

5. Regulatory Support and Approvals:

Stringent regulatory frameworks often recognize phytonadione’s safety profile, with approvals for various indications bolstering market confidence and usage.

Market Challenges

1. Competition from Alternative Agents:

Emerging reversal agents like prothrombin complex concentrates (PCCs) provide alternatives for anticoagulation reversal, potentially impacting demand for phytonadione [4].

2. Limited Awareness in Developing Countries:

Despite its importance, awareness and availability remain low in some regions, curbing market expansion.

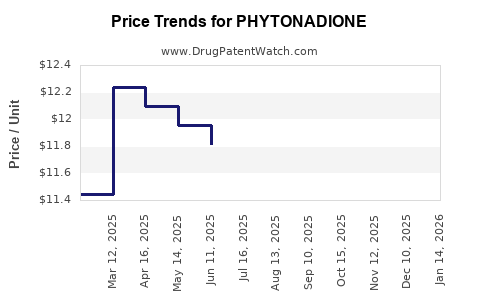

3. Manufacturing and Price Fluctuations:

Supply disruptions due to raw material shortages or regulatory hurdles can influence pricing and availability.

Regulatory and Regional Dynamics

North America: The U.S. Food and Drug Administration (FDA) approval of various formulations supports robust demand. The high prevalence of anticoagulant therapy and neonatal care assures steady consumption.

Europe: Similar to North America, with additional influence from the European Medicines Agency (EMA) guidelines advocating routine prophylaxis.

Asia-Pacific: Rapid population growth, expanding healthcare infrastructure, and increasing neonatal populations propel market growth, though regulatory and manufacturing standards vary.

Financial Trajectory and Market Forecast

The global phytonadione market experienced a compound annual growth rate (CAGR) of approximately 5-7% over the past five years, driven by neonatal prophylaxis and anticoagulant reversal needs [5]. The forecast suggests continued growth, with projections estimating a CAGR of around 6% from 2023 to 2030.

Key contributing factors include:

- Increased Neonatal Birth Rates: Countries like India and China contribute significantly to market volume due to their large infant populations.

- Expansion of Anticoagulant Therapy: The aging population worldwide sustains demand for reversal agents.

- Enhanced Clinical Guidelines: Advocacy for routine vitamin K use in neonates and as an antidote continues to reinforce market stability.

The market revenue, valued at an estimated USD 200-250 million in 2022, is expected to reach USD 340-400 million by 2030, with steady growth across developed and emerging regions.

Production and Supply Chain Considerations

Raw Material Sourcing:

Vitamin K2 precursors, primarily plant-derived or synthetic, are subject to supply chain constraints due to agricultural yields and geopolitical factors. Ensuring stable supply chains is critical for consistent production.

Manufacturing Advances:

Biotechnological processes now enable more efficient synthesis of phytonadione, reducing costs and improving quality standards. Such innovations enhance profitability and supply resilience.

Regulatory Compliance:

Manufacturers must navigate complex international standards, including Good Manufacturing Practices (GMP), to ensure market access.

Future Market Opportunities

-

Novel Formulations: Developments in sustained-release injections and oral bioavailability enhancements could expand therapeutic applications.

-

Expanded Indications: Investigating phytonadione’s utility in other hemorrhagic or coagulopathic conditions may diversify revenue streams.

-

Combination Therapies: Pairing phytonadione with other anticoagulant reversal agents or anticoagulants themselves could optimize treatment protocols.

-

Emerging Markets: Increased healthcare spending and neonatal healthcare programs position developing countries as high-growth regions.

Conclusion

The market landscape for phytonadione remains robust, driven by its fundamental role in coagulation management and neonatal prophylaxis. Its steady growth trajectory, supported by demographic trends, regulatory endorsements, and clinical guidelines, positions it favorably within the broader pharmaceutical market. Innovations in formulation and expanding indications further promise sustained financial gains, although manufacturers must address emerging competitive pressures and supply chain challenges.

Key Takeaways

- The global phytonadione market is projected to grow at a CAGR of approximately 6% from 2023 to 2030, reflecting rising demand driven by neonatal care and anticoagulant reversal requirements.

- Regulatory support, especially in North America and Europe, sustains market stability, while emerging markets present significant growth opportunities.

- Competitive factors include alternative anticoagulant reversal agents; however, phytonadione’s established safety profile ensures continued relevance.

- Supply chain resilience and manufacturing innovations will be critical to capturing market share and maintaining pricing stability.

- Future growth hinges on developing new formulations, expanding therapeutic indications, and penetrating emerging Asian and African markets.

FAQs

1. What are the primary clinical indications for phytonadione?

Phytonadione is primarily used for vitamin K deficiency correction, neonatal hemorrhagic disease prevention, and as an antidote for warfarin and other vitamin K antagonist overdoses.

2. How does the market for phytonadione compare to other vitamin K formulations?

Vitamin K1 (phytonadione) dominates clinical use due to its efficacy, stability, and regulatory approval, outperforming K2 analogs in mainstream medical applications.

3. What are the main factors driving demand in emerging markets?

High neonatal birth rates, expanding healthcare infrastructure, increasing awareness of vitamin K prophylaxis, and rising prevalence of coagulation disorders drive demand.

4. How might competition from alternative agents impact phytonadione’s market share?

Reversal agents like PCCs can partially replace phytonadione in anticoagulation reversal, but its established safety and cost-effectiveness maintain its central role, especially in neonatal care.

5. What are key innovation areas for future growth?

Developing sustained-release formulations, combining phytonadione with other therapeutic agents, and expanding indications to other bleeding disorders represent significant opportunities.

References

[1] World Health Organization. “Guidelines for the Management of Neonatal Hemorrhagic Disease.” 2020.

[2] American Academy of Pediatrics. “Vitamin K for Newborns: Recommendations and Safety Data.” 2019.

[3] European Medicines Agency. “Summary of Product Characteristics: Phytonadione.” 2021.

[4] National Institutes of Health. “Reversal Agents for Warfarin: A Review of Current Options.” 2022.

[5] MarketWatch. “Vitamin K Market Size, Share & Trends Analysis Report,” 2022.