Last updated: July 27, 2025

Introduction

Phytonadione, commonly known as vitamin K1, is a pivotal anticoagulant medication used primarily to treat and prevent vitamin K deficiency, which can lead to bleeding disorders. Market dynamics for phytonadione are influenced by factors such as clinical demand, manufacturing trends, regulatory environments, and emergent biosimilar and generic competition. This report provides an in-depth market analysis and strategic price projection framework for phytonadione over the next five years.

Market Overview

Therapeutic and Clinical Landscape

Phytonadione’s primary indication involves reversal of vitamin K antagonist anticoagulation, management of bleeding episodes, and prevention of hemorrhagic disease in newborns. The drug's formulation exists predominantly in injectable and oral forms, with the injectable form being critical in acute settings such as warfarin overdose management.

Despite being an established medication, phytonadione maintains a stable demand profile driven by the widespread use of anticoagulation therapy and neonatal care protocols. The increasing prevalence of conditions necessitating anticoagulation—such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism—acts as a fundamental driver for market stability.

Geographic Market Segmentation

-

North America: The largest regional market, driven by high healthcare expenditure, advanced medical infrastructure, and stringent regulatory oversight.

-

Europe: Similar to North America, with maturity in market penetration and steady demand.

-

Asia-Pacific: Rapidly emerging as a significant growth region due to increasing healthcare access, rising incidences of thrombosis-related conditions, and expanding pharmaceutical manufacturing capabilities.

-

Rest of the World: Notable growth potential, especially in developing economies emphasizing neonatal health and anticoagulation therapy.

Market Size & Historical Data

As of 2022, the global market for phytonadione was valued approximately at USD 250 million, with North America accounting for nearly 60% of sales. The growth rate in recent years has hovered around 3-4% annually, primarily fueled by demographic shifts and expanding indications.

Supply Chain & Manufacturing Trends

Key Producers

Major pharmaceutical firms, including Merck & Co., Pfizer, and generic manufacturers in China and India, dominate the production landscape. Patent expirations and the entry of generic versions have intensified price competition.

Manufacturing Challenges

Ensuring consistent potency and purity levels remains crucial, especially given the delicate nature of vitamin K formulations. Advances in fermentation technology and synthetic manufacturing have improved supply stability and quality standards.

Regulatory Environment

Regulatory agencies like the FDA and EMA maintain strict quality standards. Nevertheless, approval pathways for biosimilars and generics have eased entry and price competition. Recent initiatives focus on seamless registration for such versions, further influencing pricing strategies.

Competitive Landscape

Market contenders are primarily differentiated via formulation innovation, cost efficiency, and distribution reach. The entry of biosimilars and generics has intensified competition, pressuring originator prices and margins. While innovator products tend to command premium pricing due to brand recognition and trust, the proliferation of high-quality generics constrains overall market pricing elasticity.

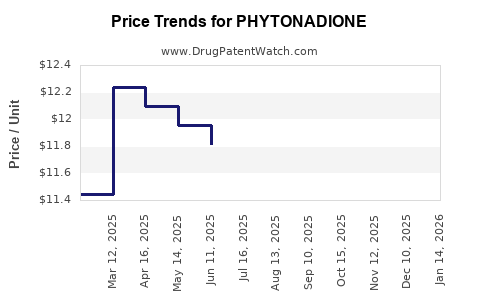

Price Trends and Price Projections (2023–2028)

Current Pricing Dynamics

- Brand Name (e.g., Mephyton): The injectable formulation ranges from USD 15–20 per vial.

- Generic/Store Brands: Prices have decreased, averaging USD 10–12 per vial, with variations based on region and purchase volume.

Forecast Assumptions

- A consistent rise in demand due to aging populations and expanding use in prophylactic neonatal care.

- Increased competition from biosimilars and generics leading to downward pressure, especially in mature markets.

- Manufacturing cost efficiencies and regulatory harmonization reducing production expenses.

- Inflation and logistic costs contributing modest upward pressures.

Projected Price Trends

| Year |

Price Range per Vial (USD) |

Factors Influencing Price |

| 2023 |

10–20 |

Stable demand; ongoing generic competition |

| 2024 |

9–19 |

Increased biosimilar entries; price discounts |

| 2025 |

8–18 |

Market saturation; aggressive pricing strategies |

| 2026 |

8–17 |

Regulatory approvals for biosimilars |

| 2027 |

7–16 |

Further biosimilar proliferation; cost efficiencies |

| 2028 |

7–15 |

Mature market stabilization, demand plateau |

Overall Outlook: Expect a gradual decline in per-vial prices, approximating a 2-4% annual decrease driven by increased generic biosimilar competition, balanced by inflation-adjusted manufacturing efficiencies.

Market Opportunities & Risks

Opportunities

- Emerging Markets: Growing healthcare infrastructure increases demand, favoring local manufacturing and volume-based pricing strategies.

- Formulation Innovations: Development of long-acting or fixed-dose combination versions may command higher prices.

- Regulatory Advances: Faster approval pathways and robust pharmacovigilance expanding market access.

Risks

- Pricing Pressures: Entry of biosimilars and generics diminishes profit margins.

- Regulatory Scrutiny: Stringent quality and safety standards could increase compliance costs.

- Supply Chain Disruptions: Raw material shortages or logistic issues could inflate costs temporarily.

Strategic Recommendations

- Market Differentiation: Focus on manufacturing cost optimization to sustain margins amid price erosion.

- Geography Diversification: Prioritize expansion into emerging markets with high growth potential.

- Formulation Development: Invest in innovative formulations that can command premium pricing.

- Regulatory Engagement: Build proactive strategies ahead of biosimilar approvals.

Key Takeaways

- The phytonadione market remains stable in volume but faces ongoing price erosion driven by increased biosimilar and generic competition.

- The overall market size is projected to grow modestly (~3% annually) largely driven by demographic and clinical factors.

- Prices per vial are anticipated to decline gradually, with a forecasted range of USD 7–20 by 2028, depending on formulation and regional factors.

- Opportunities exist in emerging markets and formulation innovations, although pricing pressures necessitate cost-effective manufacturing strategies.

- Strategic positioning towards supply chain resilience and regulatory agility can mitigate risks and maximize profit margins.

Conclusion

Phytonadione’s entrenched clinical utility ensures sustained demand, but market pricing dynamics are increasingly influenced by competitive pressures and regulatory developments. Forward-looking strategies should emphasize cost efficiency, geographic expansion, and product innovation to maintain profitability amid a gradually declining price landscape.

FAQs

1. What are the primary drivers of demand for phytonadione?

Demand is driven by the need to reverse anticoagulant effects, manage bleeding episodes, and support neonatal health protocols, especially in aging populations and regions with rising thrombotic diseases.

2. How do biosimilar entries impact the phytonadione market?

Biosimilar entrants increase competition, typically leading to lower prices, reduced profit margins for original manufacturers, and greater accessibility, particularly in cost-sensitive markets.

3. What regions are expected to generate the fastest market growth?

The Asia-Pacific region is poised for the fastest growth due to expanding healthcare infrastructure, growing awareness, and increased acceptance of biosimilar and generic formulations.

4. How might regulatory policies influence phytonadione pricing?

Eased approval processes for biosimilars and generic versions can accelerate market entry, intensify price competition, and lower overall prices.

5. What opportunities exist for innovative formulations of phytonadione?

Developing long-acting injections, oral dosage forms with improved bioavailability, or combination therapies could enable premium pricing and expanded indications.

References

[1] Research and Markets. "Global Market Report on Phytonadione." 2022.

[2] IQVIA. "Global Pharmaceutical Market Trends." 2022.

[3] FDA. "Biosimilar Development and Approval Pathways." 2022.

[4] PharmSource. "Manufacturing and Supply Chain Trends in Vitamins." 2021.

[5] World Health Organization. "Neonatal Care and Vitamin K Use." 2021.