Last updated: July 28, 2025

Introduction

Flurandrenolide is a potent topical corticosteroid primarily used to treat inflammatory skin conditions such as eczema, psoriasis, and dermatitis. Despite its established medical utility, the drug's market trajectory is influenced by evolving clinical practices, regulatory considerations, and competitive landscape dynamics. As a semi-synthetic corticosteroid, flurandrenolide contributes significantly to dermatological pharmaceutics, but its market growth prospects are subject to variable factors, including patent status, formulation innovations, and regulatory approvals across geographies.

Market Overview and Therapeutic Landscape

The global dermatological therapeutics market, valued at approximately USD 22 billion in 2022, continues to expand driven by increasing prevalence of skin conditions, advancements in drug delivery technology, and rising awareness among clinicians and patients [1]. Topical corticosteroids, including flurandrenolide, constitute a key segment, owing to their efficacy, affordability, and extensive clinical use.

Flurandrenolide's profile as a medium to high potency corticosteroid situates it favorably for managing moderate to severe dermatological conditions. While topical steroids are generally available over-the-counter in some regions, prescription-based formulations like flurandrenolide tend to command premium pricing, especially where formulation improvements or specialized delivery systems are involved.

Market Drivers

1. Rising Incidence of Skin Diseases:

The global burden of dermatological diseases is surging, with psoriasis affecting approximately 125 million people globally and eczema impacting over 10% of the population in developed countries [2]. This trend bolsters demand for corticosteroids, including flurandrenolide, especially in regions with growing healthcare infrastructure.

2. Advancements in Formulation Technology:

Innovations such as controlled-release patches, enhanced penetration formulations, and combination therapies are expanding the utility of topical corticosteroids. Flurandrenolide formulations, especially in adhesive patches or layered topical systems, can enhance therapeutic efficacy and patient adherence, fueling market demand.

3. Increasing Aesthetic and Atopic Skin Conditions Prevalence:

The societal shift toward skin health and appearance, coupled with the rise in atopic dermatitis cases, sustains demand for effective anti-inflammatory treatments.

4. Regulatory Support and Approvals:

Regulatory bodies such as the FDA and EMA have streamlined approval pathways for dermatological drugs, encouraging the development and commercialization of new formulations based on existing corticosteroids like flurandrenolide.

Market Challenges and Constraints

1. Patent Expiry and Generic Competition:

Many formulations of corticosteroids like flurandrenolide face patent expiration, leading to intense price competition and eroding profit margins. The rise of generics limits exclusivity and compels manufacturers to innovate or differentiate through novel delivery systems.

2. Safety Concerns and Side Effect Profile:

Long-term or high-potency corticosteroid use is associated with skin atrophy, striae, and systemic absorption risks. Increased awareness and regulatory restrictions on potent topical steroids in certain jurisdictions temper growth prospects.

3. Competition from Alternative Therapies:

The emergence of biological agents and immunomodulators for complex dermatological conditions, such as psoriasis, poses a challenge to the traditional corticosteroid market segment. While biologics dominate severe cases, corticosteroids like flurandrenolide remain first-line options for many mild to moderate diseases.

Regulatory and Patent Landscape

Patent Outlook:

The original patent covering flurandrenolide formulations typically expired or is nearing expiration in key markets, leading to increased generic manufacturing. Patent cliff impacts revenue, compelling innovator companies to explore formulation patents or combination products to maintain competitive advantages [3].

Regulatory Variability:

Regional differences significantly influence market trajectory. Developed regions like North America and Europe have stringent regulatory frameworks favoring high safety standards, while emerging markets may experience faster approval timelines but limited post-market surveillance capabilities.

Financial Trajectory Analysis

Revenue Projections:

Given the current patent landscape, global sales of flurandrenolide are expected to plateau in the short term due to generic competition. However, targeted formulations—such as medicated patches or combination creams—could sustain premium pricing, driving revenues.

The market size for potent topical corticosteroids is forecasted to grow at a CAGR of approximately 2.5% from 2023 to 2030, influenced by demographics and formulation innovations [4].

Investment and R&D Outlook:

Pharmaceutical companies are likely to allocate R&D funds toward developing novel delivery systems for flurandrenolide to extend patent life and improve safety profiles. Investment in combination therapies (e.g., corticosteroid + calcineurin inhibitors) also presents a strategic avenue.

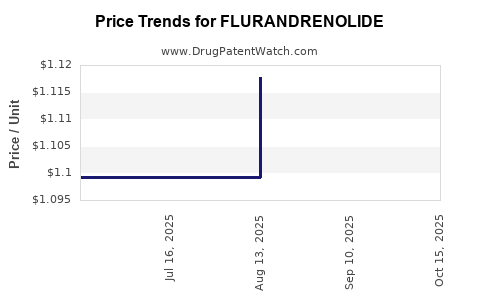

Pricing Strategy and Market Penetration:

Post-patent expiration, generic competition exerts downward pressure on prices; thus, diversification via branded reformulations, regional licensing agreements, and marketing campaigns are crucial to sustain revenue streams.

Future Growth Opportunities

-

Development of Bi-layer and Transdermal Systems:

Advancing transdermal patches can open therapeutic niches, especially for patients requiring localized, controlled release corticosteroid therapy.

-

Expansion into Emerging Markets:

Enhanced access and affordability initiatives could expand flurandrenolide’s adoption in Asia-Pacific, Latin America, and Africa, where dermatological treatment demand is rising.

-

Combination Products:

Formulations combining flurandrenolide with antifungal or antibacterial agents could address broader dermatological indications and command premium pricing.

-

Regulatory Incentives for New Indications:

Seeking approval for new indications or pediatric formulations may extend the product lifecycle and market scope.

Key Takeaways

- Patent expirations have introduced significant generic competition, constraining growth but incentivizing innovation in formulations and delivery systems.

- Rising worldwide prevalence of skin conditions sustains long-term demand, especially in emerging markets.

- Technological advancements, particularly in controlled-release patches and combination therapies, represent strategic growth avenues.

- Safety concerns and regulatory restrictions necessitate ongoing formulation refinements and safety surveillance.

- Collaborations and licensing agreements across regions can facilitate market expansion and revenue diversification.

FAQs

Q1. What is the current patent status of flurandrenolide?

A1. Most patents covering original formulations of flurandrenolide have expired or are nearing expiration, leading to increased generic competition. Companies are now focusing on developing novel formulations and delivery systems to prolong market exclusivity.

Q2. Which regions represent the most promising markets for flurandrenolide?

A2. North America and Europe remain mature markets, but significant growth potential exists in Asia-Pacific and Latin America, driven by rising skin disease prevalence and expanding healthcare infrastructure.

Q3. How does formulation innovation impact the financial trajectory of flurandrenolide?

A3. Innovative formulations such as medicated patches or combination creams can command higher prices, mitigate generic rivalry, and extend product lifecycle, positively influencing revenue.

Q4. What are the main challenges faced by manufacturers of flurandrenolide?

A4. Challenges include patent expiration leading to commoditization, safety concerns limiting potency use, and competition from biologics for severe dermatological conditions.

Q5. How might regulatory trends affect the future market for flurandrenolide?

A5. Stricter safety and efficacy standards may delay approvals or restrict use, pushing companies toward developing safer, more effective formulations to meet evolving regulatory requirements.

References

- MarketsandMarkets. "Dermatological Therapeutics Market by Drug Class, Disease, and Region – Global Forecast to 2027."

- World psoriasis burden estimates. Journal of Investigative Dermatology, 2021.

- U.S. Patent Office. "Patent Landscape for Topical Corticosteroids," 2022.

- Grand View Research. "Topical Corticosteroids Market Size, Share & Trends Analysis," 2022.