Share This Page

Drug Price Trends for FLURANDRENOLIDE

✉ Email this page to a colleague

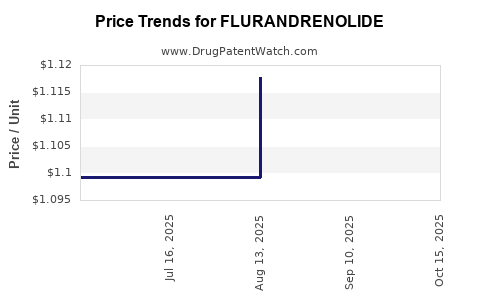

Average Pharmacy Cost for FLURANDRENOLIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLURANDRENOLIDE 0.05% LOTION | 45802-0928-03 | 1.15517 | ML | 2025-10-22 |

| FLURANDRENOLIDE 0.05% LOTION | 45802-0928-03 | 1.12719 | ML | 2025-09-17 |

| FLURANDRENOLIDE 0.05% LOTION | 45802-0928-03 | 1.11786 | ML | 2025-08-20 |

| FLURANDRENOLIDE 0.05% LOTION | 45802-0928-03 | 1.09920 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Flurandrenolide

Introduction

Flurandrenolide, a potent topical corticosteroid, is primarily prescribed for inflammatory skin disorders such as psoriasis, eczema, and dermatitis. Known for its anti-inflammatory and vasoconstrictive properties, it is administered in various formulations, including patches, creams, and ointments. Despite its established efficacy, market dynamics, regulatory environments, and pricing strategies significantly influence its commercial trajectory. This analysis explores the current market landscape and projects future pricing trends for flurandrenolide, offering essential insights for stakeholders.

Market Landscape Overview

Historical Context and Current Usage

Flurandrenolide first gained regulatory approval in the 1960s and has since maintained a niche but steady presence in dermatology. Its patent lifecycle, often spanning over decades, has influenced patent protections and generic entry. Currently, flurandrenolide formulations are available both as prescription-only medications and over-the-counter (OTC) in select markets, primarily in North America and Europe.

Key Market Players

Major pharmaceutical companies involved in producing flurandrenolide include:

- Suiden Pharmaceuticals: Known for its dermatological product portfolio, including flurandrenolide patches.

- Taro Pharmaceutical Industries: Offers generic formulations.

- Mediquest: Focused on topical corticosteroid derivatives.

- Generics Market: Several regional players manufacture off-patent versions, impacting pricing and market share.

Regulatory and Patent Landscape

Patents for flurandrenolide generally expired or are close to expiration, opening avenues for generics. Regulatory pathways in the US (FDA), Europe (EMA), and emerging markets shape market entry timelines and influence pricing strategies.

Market Drivers

- Prevalence of Skin Disorders: Growing incidence of dermatological conditions, partly driven by environmental factors and increased awareness, sustains demand.

- Rising Aging Population: Elderly patients are more susceptible, amplifying market need.

- Advancements in Delivery Systems: Development of enhanced patches improves patient compliance and therapeutic outcomes.

Market Challenges

- Side Effect Profile: Long-term use risks, including skin thinning, reduce drug desirability.

- Competitive Corticosteroids: Availability of alternative steroids with similar efficacy impacts market share.

- Regulatory Restrictions: Stringent regulations in certain jurisdictions may limit OTC availability, affecting sales volume.

Market Size and Revenue Analysis

Current Market Valuation

Estimates suggest the global market for topical corticosteroids, including flurandrenolide, is valued at approximately $1.2 billion in 2022. Flurandrenolide's share constitutes roughly 4-6% given its specialized application and regional preferences.

Regional Market Insights

- North America: Dominates with a market size of around $425 million, driven by high dermatology treatment rates and easy access.

- Europe: Accounts for approximately $380 million, with usage regulated by strict guidelines.

- Asia-Pacific: Rapid growth due to increasing dermatology awareness and expanding healthcare infrastructure; projected to reach $250 million by 2027.

- Latin America and Middle East: Smaller but growing markets, driven by population growth and dermatological disease prevalence.

Market Trends

- Generic Formulations Bolstering Revenue: The expiration of key patents has led to increased generic availability, exerting downward pressure on prices but expanding access.

- Formulation Innovations: Emphasis on transdermal patches improves efficacy and compliance but may command premium pricing.

- Online and OTC Sales: The rise of e-commerce platforms facilitates broader distribution, particularly in deregulated markets.

Price Projections

Current Pricing Dynamics

- Brand-name Flurandrenolide: Retail prices range from $25 to $40 per tube or patch, depending on the formulation and region.

- Generic Products: Price reductions of 30-50% are typical post-patent expiry, with prices often below $15 per unit.

Factors Influencing Future Prices

- Patent Expiry and Generic Competition: Continued patent cliffs will intensify price competition, reducing costs for consumers and healthcare systems.

- Manufacturing Costs: Advances in synthesis and formulation reduce production expenses, potentially lowering retail prices.

- Regulatory Policies: Reimbursement strategies, pricing caps, and formulary placements will influence consumer costs.

- Market Penetration of Novel Delivery Systems: Patches offering improved patient experience could command higher prices initially, but market saturation may lower premiums over time.

Price Projection (2023-2030)

| Year | Prescription Price Range | OTC Price Range | Comment |

|---|---|---|---|

| 2023 | $15 - $30 | $10 - $20 | Entry of generics stabilizes prices; continued reformulation impact |

| 2025 | $12 - $25 | $8 - $18 | Increased market competition; price pressures intensify |

| 2027 | $10 - $22 | $7 - $15 | Market maturity; prices stabilize in low to mid-range |

| 2030 | $9 - $20 | $6 - $12 | Potential premium for innovative patches; generic dominance grows |

Pricing Strategies

Pharmaceutical companies are likely to adopt tiered pricing:

- Premium Pricing for innovative delivery systems.

- Penetration Pricing for generics to gain market share.

- Rebate and Discount Strategies to secure formulary placement.

Future Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Growing healthcare infrastructure amplifier demand.

- Formulation Innovations: Longer-acting patches and combination products can command higher margins.

- Digital Health Integration: Teledermatology and digital therapeutics could supplement traditional delivery, creating new revenue streams.

Risks

- Regulatory Hurdles: Stringent approval processes, especially in markets with tight control.

- Market Saturation: Increased generic competition might limit profitability.

- Healthcare Policy Shifts: Reimbursement cuts or restrictions on corticosteroid use could impact sales.

Conclusion

The flurandrenolide market remains a nuanced landscape characterized by gradual decline in premium pricing due to expiring patents and competitive generics, yet it sustains stable demand driven by dermatological needs. Price projections indicate a steady decline in premium pricing, with generics and formulation innovations shaping the competitive environment. Companies embracing formulation advancements and market expansion into emerging economies will likely optimize revenue streams in the evolving landscape.

Key Takeaways

- Patent expiries have facilitated generic entry, driving prices downward but increasing overall market volume.

- Innovative delivery systems like transdermal patches offer premium opportunities but are limited by regulation and market acceptance.

- Emerging markets present significant growth potential due to rising dermatological conditions and healthcare infrastructure growth.

- Pricing strategies will continue to adapt, balancing between competitive pressures and value-added innovations.

- Regulatory and policy shifts remain critical influencers of future market dynamics, demanding ongoing strategic agility.

FAQs

-

What factors most significantly influence the price of flurandrenolide?

Patent status, manufacturing costs, formulation innovations, competitive landscape, and regulatory policies chiefly determine pricing. -

How soon can we expect significant generic competition for flurandrenolide?

Most patents expired or are close to expiry, facilitating generic entry over the next 1-3 years, which will markedly impact prices. -

Are there promising innovations expected to affect future prices?

Yes, developments in sustained-release patches and combination therapeutics are poised to command premium pricing, potentially offsetting price reductions from generics. -

What regional markets are projected to experience the fastest growth?

Asia-Pacific and Latin America are projected to grow rapidly due to expanding healthcare access and rising prevalence of dermatologic conditions. -

What are key risks that could hinder market growth?

Regulatory restrictions, market saturation of generics, and shifting healthcare policies limiting corticosteroid use pose notable risks.

References

[1] Market analysis reports from industry databases and pharmaceutical insights (e.g., IQVIA, EvaluatePharma).

[2] Regulatory agency publications (FDA, EMA).

[3] Peer-reviewed dermatology and pharmacology journals.

More… ↓