Last updated: July 27, 2025

Introduction

Exemestane, marketed under brand names such as Aromasin, is a third-generation aromatase inhibitor primarily used in the treatment of hormone receptor-positive breast cancer in postmenopausal women. Developed by Pfizer, Exemestane has established itself as a critical therapeutic agent within oncological pharmacology, underpinning strategic market developments and financial trajectories in oncology therapeutics.

This analysis explores the evolving market dynamics of Exemestane, including its clinical positioning, competitive landscape, regulatory aspects, and projected financial outlook. Understanding these elements is essential for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers aiming to navigate the complex oncology drug market.

Market Overview and Clinical Context

Exemestane functions by irreversibly inhibiting the aromatase enzyme, thereby reducing estrogen biosynthesis, which is vital in estrogen-dependent breast cancer proliferation. The drug gained FDA approval in 1999 and has since become a cornerstone in adjuvant therapy, particularly for early-stage and metastatic breast cancer in postmenopausal women.

The global breast cancer market is projected to reach USD 28.4 billion by 2027, growing at a CAGR of approximately 4.7% (Grand View Research, 2022). Aromatase inhibitors such as Exemestane, Anastrozole, and Letrozole collectively dominate this market segment, with Exemestane historically capturing a substantial share owing to its efficacy and established safety profile.

Market Dynamics Influencing Exemestane

-

Evolving Clinical Guidelines

Current treatment guidelines from organizations like NCCN recommend aromatase inhibitors as first-line therapy for postmenopausal estrogen receptor-positive breast cancer. The positioning of Exemestane as an effective, cost-efficient option sustains its demand. Moreover, ongoing comparative studies with other AI agents influence prescribing patterns and drive market penetration.

-

Patent Expiry and Generic Competition

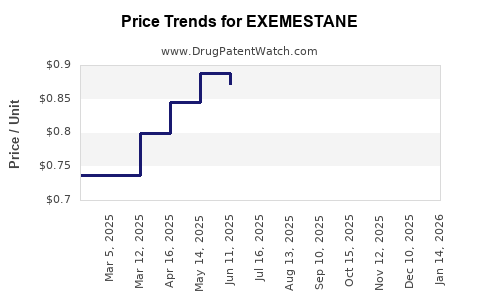

Exemestane's patent protection expired in many jurisdictions around 2014-2016, prompting the entry of generics. This has led to significant price competition, reducing overall revenues for branded formulations but expanding market access due to lower costs. The proliferation of generics typically results in a shift from branded to generic sales, impacting Pfizer’s revenue streams.

-

Emerging Biosimilars and New Therapeutics

Although biosimilars are less relevant for small-molecule drugs like Exemestane, innovations in targeted therapies—such as CDK4/6 inhibitors and PI3K pathway modulators—are transforming treatment paradigms. The combination therapies and newer agents may impact Exemestane's market share in the future.

-

Regulatory Approvals and Expanded Indications

Currently approved for breast cancer, ongoing research explores off-label uses or new indications, which could modulate market size. Regulatory agencies' acceptance of new formulations or combinations can further influence market dynamics.

-

Market Penetration in Emerging Markets

Rising breast cancer prevalence and increasing healthcare infrastructure investment propel markets in Asia-Pacific and Latin America. Exemestane's affordability and existing distribution networks position it favorably in these regions.

Financial Trajectory: Historical and Projected

Historical Revenue Performance

Pfizer reported that Aromasin contributed approximately USD 400-500 million annually until patent expiry, with a declining trend post-generic entry. For instance, in 2016, Pfizer’s breast cancer franchise revenues from Aromasin declined due to generic competition, representing a common pattern for branded oncology drugs post-patent loss.

Current Revenue Sources and Growth Drivers

Most revenue stems from established markets (U.S., Europe, Japan), with revenues stabilized due to generic sales and existing patents. Despite patent expiries, Exemestane maintains therapeutic importance, supporting steady sales through sustained demand in adjuvant therapy regimens.

Future Revenue Outlook

Forecasts suggest a gradual decline in branded Exemestane revenues over the next five years due to generic competition, unless Pfizer or other manufacturers innovate with new formulations or combination therapies. However, revenues from emerging markets are anticipated to grow due to increasing breast cancer incidence, patient accessibility initiatives, and local manufacturing.

Impact of Biosimilars and New Competitors

The entry of biosimilars or new agents could significantly impact Exemestane’s financials. While biosimilars are not directly relevant, market shifts towards oral targeted therapies like CDK4/6 inhibitors (e.g., Palbociclib, Ribociclib) could cannibalize Exemestane’s market share.

Strategic Moves and Investment Opportunities

Pharmaceutical companies may attempt to refresh Exemestane’s market relevance through patent extensions, combination therapy trials, or formulation improvements. Investors should monitor regulatory approvals, pipeline developments, and regional adoption trends for assessments of future financial trajectories.

Market Challenges and Opportunities

Challenges:

- Patent expiration leading to loss of exclusivity and pricing pressures.

- Competition from newer targeted agents that may offer superior efficacy or better side-effect profiles.

- Market saturation in developed regions.

Opportunities:

- Expansion into emerging markets with high unmet medical needs.

- Development of combination therapies enhancing efficacy.

- Optimization of manufacturing and supply chains to reduce costs and improve access.

Regulatory and Policy Considerations

Regulatory agencies such as FDA and EMA continue to influence the classification, approval, and market availability of Exemestane. Policies favoring biosimilars and generics can accelerate market erosion of branded formulations but also promote broader access. Additionally, reimbursement policies and healthcare reforms in major markets influence sales and profitability.

Furthermore, increasing emphasis on personalized medicine may incentivize development of next-generation aromatase inhibitors or companion diagnostics, potentially altering the future landscape for Exemestane.

Key Takeaways

-

Market Position: Exemestane remains a fundamental therapy for hormone receptor-positive breast cancer, with sustained demand amidst patent expiry and generics. Its clinical efficacy secures a stable market but faces competitive challenges.

-

Revenue Trends: While branded revenues have declined post-patent, global expansion into emerging markets offers growth prospects, especially driven by increasing breast cancer incidence.

-

Competitive Landscape: The entrance of biosimilars, newer targeted agents, and combination therapies necessitate strategic innovation from manufacturers to preserve market relevance.

-

Regulatory Impact: Policies promoting affordability and access influence pricing, market share, and future revenue potential.

-

Investment Outlook: Companies that innovate in formulation, explore new indications, or enter emerging markets can mitigate revenue declines associated with generics.

FAQs

1. How does patent expiration affect Exemestane's market sharing?

Patent expiration leads to the entry of generic versions, significantly reducing branded drug revenues due to price competition. While the therapeutic demand persists, market share shifts toward lower-cost generics, impacting overall profitability for original developers.

2. Are there significant clinical advantages of Exemestane over other aromatase inhibitors?

Exemestane is an irreversible aromatase inhibitor, offering comparable efficacy to other AIs like Letrozole and Anastrozole. Some studies suggest differences in side effect profiles, but overall, clinical choice depends on individual patient factors, tolerability, and clinician preference.

3. What role do emerging markets play in Exemestane's future revenues?

Emerging markets are projected to become significant revenue contributors due to rising breast cancer prevalence, increasing healthcare infrastructure, and affordability of generic formulations, enabling broader access.

4. How might combination therapies influence Exemestane's market trajectory?

Combining Exemestane with targeted agents such as CDK4/6 inhibitors can enhance treatment efficacy. Such combinations can prolong market relevance but also introduce competition from newer monotherapies or combination regimens.

5. What are the risks for pharmaceutical companies invested in Exemestane?

Key risks include continued patent erosion, competitive pressures from biosimilars and targeted therapies, regulatory changes, and shifts in clinical guidelines favoring alternative treatments. Strategic innovation and market diversification are essential to mitigate these risks.

References

- Grand View Research. Breast Cancer Treatment Market Size, Share & Trends Analysis Report, 2022.

- National Comprehensive Cancer Network (NCCN). Clinical Practice Guidelines in Oncology: Breast Cancer.

- Pfizer Inc. Annual Reports and Financial Statements.

- MarketsandMarkets. Aromatase Inhibitors Market Analysis, 2022.