Last updated: July 27, 2025

Introduction

Armodafinil, a wakefulness-promoting agent developed by Cephalon (now part of Teva Pharmaceutical Industries), has positioned itself as a prominent pharmaceutical in the treatment of sleep disorders. Its unique pharmacokinetic profile and broad therapeutic applications are shaping market trends and influencing financial prospects. This analysis explores the current market dynamics, growth drivers, competitive landscape, and financial trajectory of Armodafinil within the evolving pharmaceutical landscape.

Pharmacological Profile and Clinical Indications

Armodafinil is the enantiomer of modafinil, offering prolonged pharmacodynamic effects. Approved by the FDA for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with obstructive sleep apnea, it provides an alternative to traditional stimulants. Its efficacy in promoting wakefulness with a lower abuse potential compared to amphetamines has enhanced its market acceptance. Emerging off-label use cases, including bipolar disorder and ADHD, further expand its clinical scope.

Market Size and Growth Drivers

The global sleep disorder therapeutics market is projected to grow at a CAGR of over 6%, driven by increasing prevalence of sleep-related disorders, rising awareness, and aging populations [1]. Armodafinil's share benefits from this expansion, especially as healthcare providers seek effective, low-abuse wakefulness agents.

Key drivers include:

- Growing Prevalence of Sleep Disorders: Conditions such as narcolepsy and sleep apnea are reaching higher diagnosis rates, bolstered by better awareness and diagnostic tools.

- Shift Toward Non-amphetamine Therapies: Regulatory scrutiny over amphetamine-based stimulants fuels demand for non-stimulant alternatives like Armodafinil.

- Increased Off-Label Use: The off-label application in neuropsychiatric disorders augments market potential, despite regulatory challenges.

- Patent Landscape and Generic Entry: The original patent exclusivity provided a period of market dominance; recent patent expirations and the entrance of generics threaten pricing strategies but also expand accessibility.

Competitive Landscape

Cephalon’s (Teva’s) initial dominance was challenged upon patent expiration in key markets such as the United States around the late 2010s. Generic manufacturers—such as Mylan and Apotex—have introduced lower-cost alternatives, intensifying price competition. Despite this, branded Armodafinil maintains a premium owing to perceived efficacy, quality, and brand recognition.

In addition, companies are pursuing development of novel wakefulness agents and formulations, including extended-release variants and combination therapies, to cater to unmet needs in sleep disorder management.

Regulatory and Patent Dynamics

Patent expirations represent a pivotal inflection point impacting revenue streams. The US patent for Armodafinil expired in 2019, opening the market to generics [2]. Patent litigation and patent thickets around formulations and manufacturing processes continue to influence market entry barriers for competitors. Regulatory pathways for biosimilar and “follow-on” versions further complicate the competitive landscape, shaping future market protection strategies.

Financial Trends and Trajectory

Revenue Performance:

Teva’s Armodafinil sales peaked pre-patent expiration, with estimates surpassing $600 million annually in the US alone [3]. Post-expiry, revenues declined markedly due to generic competition, with current estimates indicating a reduction of approximately 40–50%. Nonetheless, Armodafinil retains a significant market share owing to brand loyalty and physician preference.

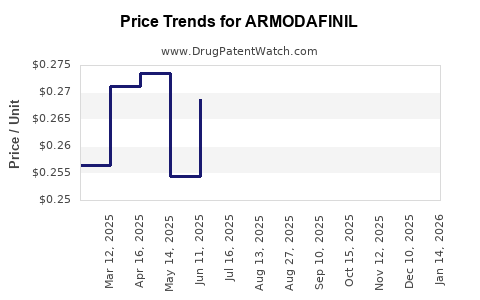

Pricing and Market Penetration:

While initial branded prices hovered around $10–$15 per tablet, the entry of generics has caused prices to fall by up to 70%. Teva and other innovator companies have responded through marketing strategies emphasizing quality and patient compliance, securing niche segments.

Forecasted Revenue Trajectory:

Analyst projections suggest stabilization of revenues via geographic expansion and off-label indications, with key growth avenues including emerging markets such as Asia-Pacific, where sleep disorder awareness is rising. The global wakefulness agent market is expected to grow at a CAGR of approximately 4% between 2023-2030, with Armodafinil poised to capture a substantial share [4].

Research and Development (R&D) Investment

Continued investments focus on novel formulations offering extended release and improved bioavailability, as well as exploring new therapeutic indications. These innovations aim to sustain revenue growth and mitigate generic erosion.

Market Challenges

- Regulatory Scrutiny and Off-Label Use: Increased oversight may limit off-label prescribing, impacting future sales.

- Pricing Pressures: Generics abbreviate the premium market share, challenging profit margins.

- Emerging Alternative Therapies: Newer agents, including non-pharmacologic interventions like light therapy, could redefine treatment paradigms.

- Supply Chain Risks: Manufacturing complexities, especially in active pharmaceutical ingredients (API), influence pricing and availability.

Strategic Outlook

The future of Armodafinil hinges on diversification, geographic expansion, and innovation. Companies may explore combination therapies addressing comorbid conditions, such as depression or anxiety, broadening the therapeutic landscape. Additionally, strategic licensing agreements and patent litigations will shape the competitive and financial landscape.

Key Takeaways

- Market expansion is driven by increasing sleep disorder prevalence and the demand for non-stimulant wakefulness agents.

- Patent expirations have catalyzed generic entry, reducing prices but maintaining niche market segments through branding and quality assurance.

- Future revenue growth depends on geographic expansion, regulatory navigation, and innovation in formulations and indications.

- Competition from emerging therapies and off-label risks necessitate strategic innovation and marketing.

- Investors and stakeholders should monitor patent landscapes, R&D pipelines, and regulatory developments to optimize decision-making.

FAQs

-

What are the main factors affecting Armodafinil's market share post-patent expiration?

Patent expiration led to increased generic competition, causing price reductions and erosion of branded sales. Nevertheless, brand loyalty, quality perceptions, and geographic expansion sustain significant market share for the original product.

-

How does the off-label use of Armodafinil impact its market and regulation?

Off-label use amplifies sales, especially in neuropsychiatric domains, but regulatory agencies scrutinize such practices. This can lead to restricted prescribing and increased legal risks, influencing the strategic focus on evidence-based indications.

-

What are the key growth opportunities for Armodafinil in emerging markets?

Rising diagnostic rates, increasing sleep disorder awareness, and healthcare infrastructure improvements present substantial opportunities. Local licensing, affordability strategies, and targeted marketing are essential to capture these markets.

-

Are there any new formulations or delivery systems in development for Armodafinil?

Yes, R&D efforts include extended-release formulations, combination therapies, and alternative delivery methods to improve patient adherence and broaden therapeutic applications.

-

What competitive threats does the market pose for Armodafinil’s future profitability?

The emergence of novel wakefulness agents, regulatory restrictions, and bioequivalent generics challenge profitability. Additionally, alternative non-pharmacologic treatments and shifts in clinical guidelines could reshape demand.

References

[1] Grand View Research. "Sleep Disorder Therapeutics Market Size, Share & Trends Analysis." (2022).

[2] U.S. Food & Drug Administration. Patent information for Armodafinil. (2019).

[3] Teva Pharmaceutical Industries. Annual Reports and Investor Presentations. (2022).

[4] MarketsandMarkets. "Wakefulness Agents Market by Drug Type, Application, and Region - Global Forecast to 2030." (2023).