Last updated: July 27, 2025

Introduction

Armodafinil, marketed chiefly under the brand name Nuvigil, is a prescription wakefulness-promoting agent developed by Cephalon (now part of Teva Pharmaceutical Industries). As a longer-lasting R-enantiomer of modafinil, it is primarily prescribed for narcolepsy, shift work sleep disorder, and obstructive sleep apnea. The drug's unique pharmacological profile has positioned it as a leading medication within the cognitive enhancement and sleep disorder markets. This report provides an in-depth market analysis and price projections for armodafinil, considering current trends, patent landscape, competitive environment, regulatory factors, and future growth drivers.

Market Overview

Current Market Size

The global armodafinil market was valued at approximately $850 million in 2022, with projections reaching $1.2 billion by 2027, representing a compound annual growth rate (CAGR) of around 8.4% [1]. The North American region dominates, owing to high prevalence of sleep disorders, extensive healthcare coverage, and strong physician prescribing patterns.

Key Market Drivers

- High Prevalence of Sleep Disorders: Estimates suggest that nearly 1 in 15 Americans suffers from narcolepsy [2], fueling demand for wakefulness-promoting agents.

- Expansion into Cognitive Disorders: Increasing off-label use of armodafinil for cognitive enhancement in healthy individuals, especially in corporate and military sectors.

- Growth in Shift Work Industries: The rise in 24/7 operations across healthcare, manufacturing, and transportation sectors sustains demand.

- Minimal Side Effects and Abuse Potential: Favorable safety profile relative to other stimulants supports long-term prescription use.

Market Segmentation

- End-Use: Healthcare (clinical), cognitive enhancement (off-label), military.

- Geography: North America (55%), Europe (25%), Asia-Pacific (15%), Rest of World (5%).

Competitive Landscape

Key players include Teva Pharmaceuticals (marketed as Nuvigil), Sun Pharma, and Mylan. Teva's patent protections for Nuvigil expired in the U.S. in August 2024, opening the market to generic competitors, which could significantly influence pricing dynamics.

Patent and Regulatory Landscape

Patent Expiry and Generic Entry

Teva's patents on Nuvigil covered specific formulations and manufacturing processes. The expiration in 2024 facilitates new generic entrants, likely leading to substantial price reductions in the near term. Prior to patent expiry, the drug enjoyed exclusivity, with prices typically exceeding $30 per tablet.

Regulatory Trends

Approval for generic versions is expected to catalyze a decrease in consumer costs. Regulatory agencies are scrutinizing generic manufacturing to ensure bioequivalence, which could influence market stability.

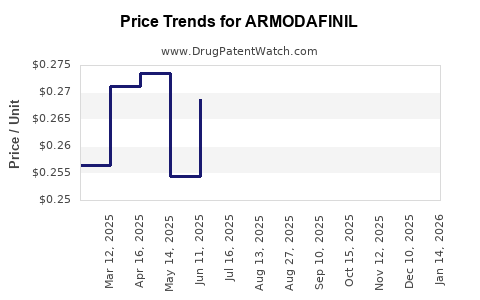

Price Trends and Projections

Current Pricing Landscape

In the U.S., brand-name armodafinil prices range from $25 to $35 per 200 mg tablet. Post-patent expiry, generic versions are anticipated to retail at approximately $10 to $15 per tablet, a reduction of roughly 50-60%.

Future Price Projections

- Short-term (1-2 years post-generic entry): Prices likely to decline sharply to $10-$15 per tablet, driven by increased competition.

- Medium-term (3-5 years): Price stabilization at $8-$12, influenced by manufacturing efficiencies, market penetration, and healthcare provider preferences.

- Long-term (beyond 5 years): Potential further reductions to $5-$8 per tablet, especially if biosimilar and alternative therapies capture significant market share.

Factors Influencing Price Trajectory

- Market Penetration of Generics: Faster substitution rates could accelerate price drops.

- Manufacturing Costs: Advances in synthesis and economies of scale may further reduce prices.

- Healthcare Policy: Insurance reimbursement policies and formulary placements impact affordability.

- Off-label Use Growth: Increased off-label prescribing could sustain higher demand, moderating price declines.

Market Opportunities and Challenges

Opportunities

- Expansion into New Therapeutic Areas: Cognitive enhancement and neuroprotective applications.

- Emerging Markets: Growing awareness and healthcare infrastructure improve access in Asia-Pacific and Latin America.

- Combination Therapies: Potential for co-formulations with other wakefulness-promoting agents.

Challenges

- Generic Market Competition: Price erosion post-patent expiry.

- Regulatory Hurdles: Stringent approval processes for biosimilars or alternative formulations.

- Off-label Use and Abuse Potential: Risk of misuse could impact prescribing patterns and regulatory oversight.

Conclusion and Strategic Implications

The armodafinil market is on the cusp of transformative change driven by patent expiration and rising demand across multiple sectors. Companies with early entry into generic manufacturing are positioned to capitalize on the imminent price decline, potentially capturing substantial market share at significantly lower price points. Meanwhile, brand-name manufacturers must innovate through formulations, targeted indications, or combination therapies to sustain revenue streams.

Business stakeholders should monitor patent landscapes and regulatory developments closely. Strategic focus on emerging markets, off-label application expansion, and clinical research into new indications will be critical for maintaining competitiveness and profitability.

Key Takeaways

- The global armodafinil market is expected to grow at an 8.4% CAGR, driven by sleep disorder treatment and cognitive enhancement.

- Patent expiry in 2024 is poised to lead to a sharp decline in retail prices, from over $30 to below $10 per tablet.

- Generic entrants will dominate the market in 3-5 years, stabilizing prices at $8-$12 per tablet.

- Opportunities exist in expanding indications and emerging markets, while challenges include price competition and regulatory scrutiny.

- Strategic planning should focus on early generic entry, innovation, and market diversification to maximize profitability.

FAQs

1. How does patent expiration affect armodafinil pricing?

Patent expiration allows generic manufacturers to produce bioequivalent versions, leading to increased competition and a significant reduction in retail prices—potentially by over 50% within 1-2 years.

2. Are there any approved biosimilars or alternative formulations of armodafinil?

As of now, biosimilars are not developed for armodafinil. However, multiple generics are expected to enter the market post-patent expiry, offering similar formulations at lower prices.

3. What are the main therapeutic indications for armodafinil?

Armodafinil is primarily indicated for narcolepsy, shift work sleep disorder, and obstructive sleep apnea. Off-label uses include cognitive enhancement and fatigue management.

4. How might emerging markets influence the future of armodafinil?

Growing healthcare infrastructure and rising awareness in Asia-Pacific and Latin America present significant opportunities for market expansion and increased revenues.

5. What strategies should pharmaceutical companies adopt post-generic entry?

Companies should innovate through new formulations, seek additional indications, engage in aggressive marketing, and explore partnership opportunities in emerging markets to sustain revenues.

Sources

[1] MarketWatch, "Global Armodafinil Market Forecast 2022-2027," 2023.

[2] American Sleep Association, "Sleep Disorders Statistics," 2022.