Last updated: September 26, 2025

Introduction

PREGNYL, a well-established biologic medication containing human chorionic gonadotropin (hCG), has played a significant role in reproductive health therapy. Originally developed for ovulation induction, PREGNYL also finds applications in hormone replacement therapy, male infertility, and other specialized indications. Its longstanding presence in the pharmaceutical market, combined with evolving regulatory landscapes, competitive pressures, and emerging therapeutic strategies, shapes its current and future market trajectory. This analysis assesses the key market dynamics influencing PREGNYL and projects its financial outlook in the context of evolving healthcare demands and biosimilar developments.

Market Overview and Positioning

PREGNYL's core therapeutic advantage lies in its biological origin — derived from human urine and subsequently purified to produce hCG. Its application in fertility treatments, particularly in vitro fertilization (IVF) protocols, has cemented its position within reproductive endocrinology. Despite newer recombinant hCG formulations, PREGNYL retains a foothold due to its long history, established efficacy, and safety profile.

Globally, the market for fertility treatments is witnessing growth driven by increasing infertility prevalence, driven by factors like delayed childbearing, lifestyle changes, and environmental influences. According to the European Society of Human Reproduction and Embryology (ESHRE), over 15% of couples worldwide face fertility challenges, with demand for effective infertility therapies rising steadily [1].

Market Dynamics Shaping PREGNYL

1. Regulatory Environment and Patent Status

PREGNYL's patent expiration has led to a rise in biosimilar entries, intensifying competition. Countries adopting stringent biosimilar regulations, such as the EU, have seen biosimilar versions enter markets historically dominated by original biologics like PREGNYL. While patent expiry has traditionally driven price competition and increased access, it also exerts downward pressure on revenue streams.

Regulatory policies around biosimilars impact PREGNYL’s market share. The FDA’s 2021 draft guidance regarding biosimilar development emphasizes rigorous comparability and traceability, influencing the pace of biosimilar entry into U.S. markets [2].

2. Technological Advances and Alternative Therapies

Recombinant hCG formulations, produced via genetically engineered cell lines, offer comparable efficacy with potentially lower production costs and more consistent supply. These innovations have introduced a competitive edge over urine-derived PREGNYL, particularly in markets favoring recombinant biologics for their purity and manufacturing consistency.

Gene editing and biotechnological advances have spurred the development of synthetic or recombinant alternatives, reducing reliance on urine-derived products. As such, PREGNYL faces substitution threats, especially in regions with cost-sensitive healthcare systems.

3. Market Demand and Demographic Trends

The global fertility market exhibits resilient growth, propelled by increasing awareness and acceptance of assisted reproductive technologies (ART). The Asia-Pacific region, especially China and India, presents substantial growth opportunities owing to demographic shifts, urbanization, and expanding healthcare infrastructure.

However, demographic trends such as declining birth rates in countries like Japan and parts of Europe could dampen growth potential. Furthermore, shifts toward outpatient and home-based fertility treatments can influence demand patterns for injectable biologics like PREGNYL.

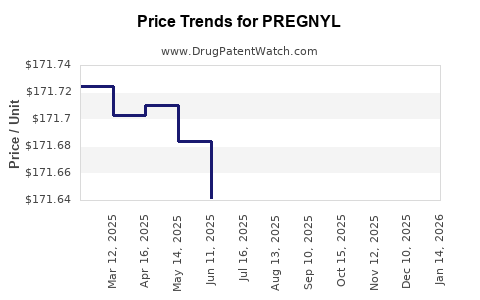

4. Pricing Dynamics and Reimbursement Policies

Price sensitivity remains critical. In markets with single-payer healthcare or strict reimbursement regimes, cost considerations significantly influence prescribing patterns. The availability of biosimilars and recombinant formulations has put competitive pricing under pressure.

In the U.S., insurance coverage and reimbursement policies largely dictate access. Broader coverage for fertility treatments has expanded patient pools but also heightens competition among biologics and biosimilars.

5. Manufacturing and Supply Chain Considerations

PREGNYL’s traditional reliance on urine harvesting entails complex, labor-intensive manufacturing processes, which can lead to supply variability and higher costs. The trend toward biosimilar derivatives and recombinant alternatives offers more scalable, consistent manufacturing options, posing a long-term challenge.

Supply chain disruptions, influenced by geopolitical tensions or pandemics like COVID-19, have underscored the importance of resilient production strategies.

Financial Trajectory and Revenue Outlook

Historical Revenue and Market Penetration

PREGNYL’s revenue has historically been stable, buoyed by its long-standing presence. However, with patent expiries and increasing biosimilar competition, revenue trajectories have plateaued or contracted marginally in mature markets such as North America and Europe.

Eli Lilly, one of the primary manufacturers, reported annual revenues from PREGNYL-related products exceeding $200 million pre-biosimilar entry [3]. Post-patent expiry, multiple biosimilars have entered the market, leading to price erosion and declining margins.

Future Revenue Projections

Considering the current market dynamics:

- Stable demand in emerging markets: Countries in Asia-Pacific and Latin America are witnessing increased adoption of fertility treatments, potentially expanding PREGNYL's market share despite biosimilar competition.

- Gradual decline in developed markets: Intensifying biosimilar competition and preference for recombinant counterparts are expected to diminish PREGNYL’s market share unless differentiation through pricing or formulation occurs.

- Potential niche applications: Off-label uses or specialized indications could sustain niche revenues.

Analysts project that PREGNYL’s global revenues could decline at a compounded annual rate (CAGR) of 3-5% over the next five years, stabilizing in specific markets where biosimilars face regulatory hurdles or where brand loyalty persists.

Strategic Opportunities and Risks

Opportunities:

- Expansion into emerging markets with less biosimilar penetration.

- Development of combination therapies or novel formulations to add value.

- Acquisition of biosimilar assets to diversify portfolio risks.

Risks:

- Entrenched biosimilars leading to price erosion.

- Regulatory hurdles delaying market access.

- Manufacturing disadvantages compared to recombinant competitors.

Strategic Implications for Stakeholders

Pharmaceutical companies invested in PREGNYL should consider:

- Investing in biosimilar development to capitalize on market trends and mitigate revenue losses.

- Enhancing production efficiencies to remain competitive on cost.

- Focusing on niche indications or personalized medicine to preserve brand relevance.

- Monitoring regulatory landscapes to anticipate approval pathways and reimbursement changes.

Healthcare payers and providers should evaluate:

- The comparative cost-effectiveness of urine-derived versus recombinant hCG products.

- Policy incentives that favor biosimilars to reduce healthcare expenditures.

- The importance of clinical equivalence data to support formulary decisions.

Conclusion

PREGNYL’s market dynamics reflect a complex interplay of technological innovation, regulatory evolution, and demographic shifts. While longstanding in the fertility treatment arena, its future depends heavily on how historical reliance on urine-derived biologics adapts to emerging recombinant alternatives and biosimilar competition. Financial prospects indicate a gradual decline in mature markets, balanced by growth opportunities in developing regions. Stakeholders must pursue strategic innovation, adaptive marketing, and policy engagement to optimize the biological drug’s trajectory.

Key Takeaways

- PREGNYL remains a cornerstone in fertility treatments but faces increasing competition from biosimilars and recombinant hCG products.

- Patent expiries and technological advances have exerted downward pressure on revenues, especially in developed markets.

- Growth opportunities exist in emerging markets, where biosimilar adoption is slower, and fertility treatments are expanding.

- Strategic diversification into biosimilar development and niche indications can mitigate revenue erosion.

- Stakeholders should closely monitor regulatory trends and manufacturing costs to maintain competitiveness.

FAQs

1. How does PREGNYL differ from recombinant hCG formulations?

PREGNYL is derived from human urine and purified, while recombinant hCG is produced via genetically engineered cell lines. Recombinant versions offer consistency, reduced contamination risk, and often lower production costs.

2. What impact has biosimilar competition had on PREGNYL’s market share?

Biosimilars have introduced price competition, leading to decreased margins and market share erosion in regions with approved biosimilar products.

3. Are there any new clinical indications for PREGNYL?

While primarily used in fertility treatments, off-label uses and niche indications exist, but expanding beyond traditional applications faces regulatory and clinical hurdles.

4. What regulatory challenges does PREGNYL face moving forward?

Regulatory bodies are increasingly emphasizing biosimilar approval pathways, traceability, and interchangeability criteria, affecting PREGNYL’s market exclusivity and post-patent strategies.

5. Can PREGNYL’s manufacturing process adapt to modern biotech standards?

Transitioning from urine-derived to recombinant manufacturing is complex. Companies may adopt hybrid approaches or develop biosimilar brands to remain competitive.

Sources

[1] European Society of Human Reproduction and Embryology (ESHRE). Fertility and Reproductive Health Statistics, 2021.

[2] U.S. Food and Drug Administration (FDA). Draft Guidance on Biosimilar Development, 2021.

[3] Eli Lilly Annual Report, 2022.