Share This Page

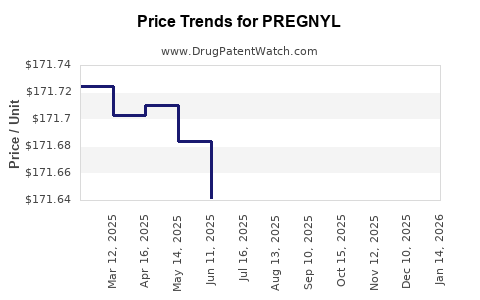

Drug Price Trends for PREGNYL

✉ Email this page to a colleague

Average Pharmacy Cost for PREGNYL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREGNYL 10,000 UNIT VIAL | 78206-0150-99 | 171.65471 | EACH | 2025-12-17 |

| PREGNYL 10,000 UNIT VIAL | 78206-0150-01 | 171.65471 | EACH | 2025-12-17 |

| PREGNYL 10,000 UNIT VIAL | 78206-0150-99 | 171.68776 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREGNYL

Introduction

PREGNYL, a formulation of human chorionic gonadotropin (hCG), is a pharmaceutical product primarily utilized in fertility treatments, ovarian stimulation, and certain hormonal deficiency therapies. Its patent status, manufacturing dynamics, competitive landscape, regulatory environment, and global demand influence its market trajectory and pricing strategies. As the market for fertility and reproductive health solutions expands due to demographic shifts and advancements in reproductive technologies, analyzing PREGNYL's market position and price evolution becomes essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Product and Therapeutic Uses

PREGNYL’s primary indication centers on stimulating ovulation in women undergoing infertility treatments, such as in vitro fertilization (IVF), and treating hypogonadotropic hypogonadism in men. Its utility in reproductive endocrinology positions it as a key product amidst burgeoning demand driven by delayed childbearing trends and increasing recognition of fertility issues globally.

Manufacturers and Patent Landscape

Several pharmaceutical entities produce PREGNYL, including Ferring Pharmaceuticals and other regional manufacturers, many of which operate under varying patent and regulatory statuses. Patent expirations, primarily in mature markets like the U.S. and EU, have historically led to the emergence of biosimilars and generics, intensifying market competition. Notably, patent cliffs have influenced the decline in prices and facilitated broader accessibility.

Regulatory Environment

Regulatory approvals in major markets (FDA in the U.S., EMA in Europe, and equivalents in Asia and other regions) significantly impact market presence. Post-patent expiration, biosimilars must demonstrate biosimilarity to originator products, following stringent regulatory pathways, which in turn influence pricing strategies and market share.

Global Market Dynamics

The global fertility market is projected to grow at a CAGR of approximately 9% through 2027, driven by demographic, social, and technological factors [1]. Developing countries exhibit rising demand due to increasing awareness and healthcare investments, whereas mature markets face competition from biosimilars and cost-containment measures.

Market Size and Trends

Current Market Valuation

The global human chorionic gonadotropin market, inclusive of PREGNYL and related products, was valued at approximately USD 300 million in 2022, with projections to reach USD 500 million by 2028, growing at a CAGR of 8-10% [2].

Key Growth Drivers

-

Rising Infertility Rates: Globally, infertility affects around 15% of couples, with many seeking fertility treatments that incorporate gonadotropins like PREGNYL [3].

-

Advancements in ART: Adoption of assisted reproductive technologies increases reliance on gonadotropins, bolstering demand.

-

Awareness and Accessibility: Increased awareness and healthcare reforms improving access contribute to growth in emerging markets.

Challenges

-

Pricing Pressures: Patent expirations facilitate biosimilar entry, leading to price reductions.

-

Cost Containment Policies: Reimbursement restrictions and healthcare budget constraints influence market penetration.

-

Regulatory Hurdles: Differing regional requirements complicate global expansion and product launch strategies.

Price Trends and Projection

Historical Price Trends

In mature markets, the average wholesale price of PREGNYL has declined from approximately USD 1,000–1,200 per vial pre-patent expiry to about USD 500–700 in recent years, attributable to biosimilar competition and market consolidation [4].

Future Price Projections

-

Short to Medium Term (Next 3–5 Years): Prices are expected to stabilize with minor fluctuations, primarily impacted by biosimilar market entries. The average unit price likely will range between USD 400–700 per vial, depending on regional dynamics and procurement channels.

-

Long-Term Outlook (Beyond 5 Years): With further biosimilar proliferation and possible market saturation, prices may decline by an additional 10–20%, possibly stabilizing around USD 350–600 per vial. Technological innovations or new indications could maintain or elevate pricing in niche segments.

Factors Influencing Future Pricing

-

Market Competition: Entry of biosimilars in key regions will exert downward pressure.

-

Regulatory Changes: Cost-effectiveness assessments and reimbursement policies may incentivize lower pricing.

-

Technological Developments: Improved manufacturing efficiencies could reduce production costs, enabling price adjustments.

-

Demand Elasticity: Growing infertility rates may sustain demand levels despite price fluctuations, especially in emerging markets.

Competitor and Biosimilar Landscape

The entry of biosimilars such as Ovitrelle (by Merck) and generic formulations in regions like Europe is significantly impacting PREGNYL’s market share. These products typically retail at 20-40% less than the originator, pressuring PREGNYL’s pricing strategies across healthcare systems.

Regional Market Variations

-

United States: Stringent regulatory pathways and high reimbursement standards make pricing sensitive to biosimilar competition. Prices are expected to decline by 10–15% over the next five years.

-

Europe: Fragmented market with early biosimilar adoption, leading to more aggressive price reductions. Standard prices may drop by 15–20%.

-

Emerging Markets: Less mature regulatory frameworks and lower drug costs foster higher price variability. Nonetheless, increasing demand raises price levels, with potential stabilization in the USD 300–500 range.

Strategic Recommendations

-

Product Differentiation: Emphasize clinical efficacy and safety to justify premium pricing in niche segments or for branded formulations.

-

Portfolio Diversification: Develop or acquire biosimilars to offset revenue declines from originator sales.

-

Regional Focus: Tailor pricing and market access strategies based on regulatory maturity and reimbursement landscape.

-

Cost Optimization: Invest in manufacturing efficiencies to sustain profitability amid declining prices.

Key Takeaways

-

The PREGNYL market is poised for steady growth, primarily driven by increased infertility treatment adoption and technological advances in assisted reproductive therapies.

-

Patent expirations and biosimilar competition are exerting downward pressure on prices, with projections indicating a 10-20% decline in unit prices over the next five years.

-

Geographic variability significantly influences pricing dynamics; mature markets experience sharper declines compared to emerging markets, which maintain higher price levels due to lower competition and different regulatory environments.

-

Strategic initiatives focusing on product differentiation, market segmentation, and biosimilar portfolio development are essential for maintaining profitability amid evolving market conditions.

-

Stakeholders should monitor regulatory updates and regional policy shifts, as these influence pricing strategies and market access.

FAQs

1. How will biosimilar entry affect PREGNYL’s pricing in the next five years?

Biosimilar adoption is expected to cause a 10–20% reduction in PREGNYL prices globally. Regions like Europe are more advanced in biosimilar penetration, resulting in more significant price declines.

2. Is PREGNYL still a viable high-margin product amidst increasing competition?

Yes. Differentiating through clinical efficacy and expanding into niche indications or new formulations can sustain margins. Strategic procurement and cost management further support profitability.

3. How does regional regulation influence PREGNYL price projections?

Regulatory policies impact approval timelines and reimbursement levels. Mature markets with stringent regulations tend to see faster biosimilar entry and price reductions, whereas emerging markets may sustain higher prices longer.

4. Are there upcoming innovations or new indications that could influence PREGNYL pricing?

Potential developments include novel delivery systems, combination therapies, or expanded indications in fertility and hormonal disorders, which could preserve or elevate pricing in specific segments.

5. What are the main risks to PREGNYL’s market outlook?

Main risks include regulatory delays, aggressive biosimilar competition, healthcare policy shifts favoring cost containment, and stagnation in fertility treatment uptake.

Sources

- MarketsandMarkets. "Fertility Treatment Market by Procedure, Product, and Region" (2022).

- Grand View Research. "Human Chorionic Gonadotropin Market Size & Trends" (2022).

- World Health Organization. "Infertility: A Tabulated Summary" (2021).

- IQVIA. "Pharmaceutical Pricing Trends and Market Access Data," (2022).

More… ↓